________________________________________________________________________________________________________

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION

APPLICATION FOR EXEMPTION FOR DISABLED VETERANS

Application be filed with the Supervisor of Assessments at the appropriate office; a list of offices is attached.

This form seeks information for the purpose of a disabled veteran’s exemption on the indicated property. Failure to provide this

information will result in denial of your application. However, some of this information would be considered a "personal record" as

defined in General Provisions Article, §4-501. Consequently,youhavethe statutory right to inspectyourfile and to file a written request to

correct or amend any information you believe to be inaccurate or incomplete. Additionally, personal information provided to the State

Department of Assessments and Taxation is not generally available for public review. However, this information is available to officers of the

State, county or municipality in their official capacity and to taxing officials of any State or the federal government, as provided by statute.

Full Name of Titled Property Owner(s): _________________________________________________________________________

Address of Property: _______________________________________________________________________________________

County Account Number: (Baltimore City)Ward____ Section ____ Block ____ Lot ______

Description of Property: ___________

I declare under the penalties of perjury, pursuant to Section 1-201, Tax Property Article, of the Annotated Code of Maryland, that

this return (including any accompanying schedules and statements) has been examined by me and to the best of my

knowledge and belief is a true, correct and complete return.

Signature of Veteran: Date: ___________________________

Printed Name: ____ Social Security Number:

____________________________

Mailing Address: ____

Daytime Phone: Email Address: _________

Check if transferring an exemption & provide an address: ___________________________________________

Check to apply for a refund of any property tax paid for which you may be eligible under Tax Property Article 7-208.

Please list all properties owned by veteran, use additional paper if needed:______________________

•

Attach a copy of the Veteran’s Honorable Discharge or a copy of DD-Form 214 as required by law. (Maryland Annotated Code, Tax-

Property Article, § 7-208)

•

Attach a copy of the veteran’s most recent rating notification packet by the U.S. Department of Veterans Affairs (V.A.). Document from

the V.A. must indicate that the veteran’s final service-connected disability rating is 100%permanent and total or 100% permanently

unemployable. This document must include the disability rating’s effective date and date of the V.A. rating’s decision.

•

Applicant must be a Maryland resident. Attach copy of a current Maryland driver’s license, voter’s registration or redacted previous

year Maryland income taxes as proof of residency. (If pending purchase, provide a contract of sale)

IF V.A RATING DOCUMENT IS NOT AVAILABLE, THIS SECTION MUST BE COMPLETED BY THE V.A.

The United States Veterans Administration (V.A.) hereby certifies that the above-named veteran has been declared by the V.A. to

have a service-connected disability, which was not incurred through misconduct; that the said disability is __ % disabling. Is

the disability permanent in character? . Is the disability reasonably certain to continue for the life of the veteran? _____

Is the veteran 100% permanently unemployable? . Is the said veteran receiving disability payments as allowed for reasons

of _________% disability, or __% unemployability.

The character of the disability is as follows: ______________________________________________________________________

Effective Date

of Disability Rating: Date of V.A. Rating Decision: ____________________________

Adjudication/Service Officer Name: ____ Date: ________________

Mailing Address: _________

Daytime Phone: Email: _____________________________________

THIS APPLICATION IS NOT OPEN FOR PUBLIC INSPECTION

FOR ASSESSMENT OFFICE USE ONLY

Comments ____________________________________________________________

Approved [ ] Re-Application [ ] Disapproved [ ] Effective Date: ________________

Supervisor’s Signature: ______ Date:

SDATRP_EX4B Rev July 204 http://dat.maryland.gov

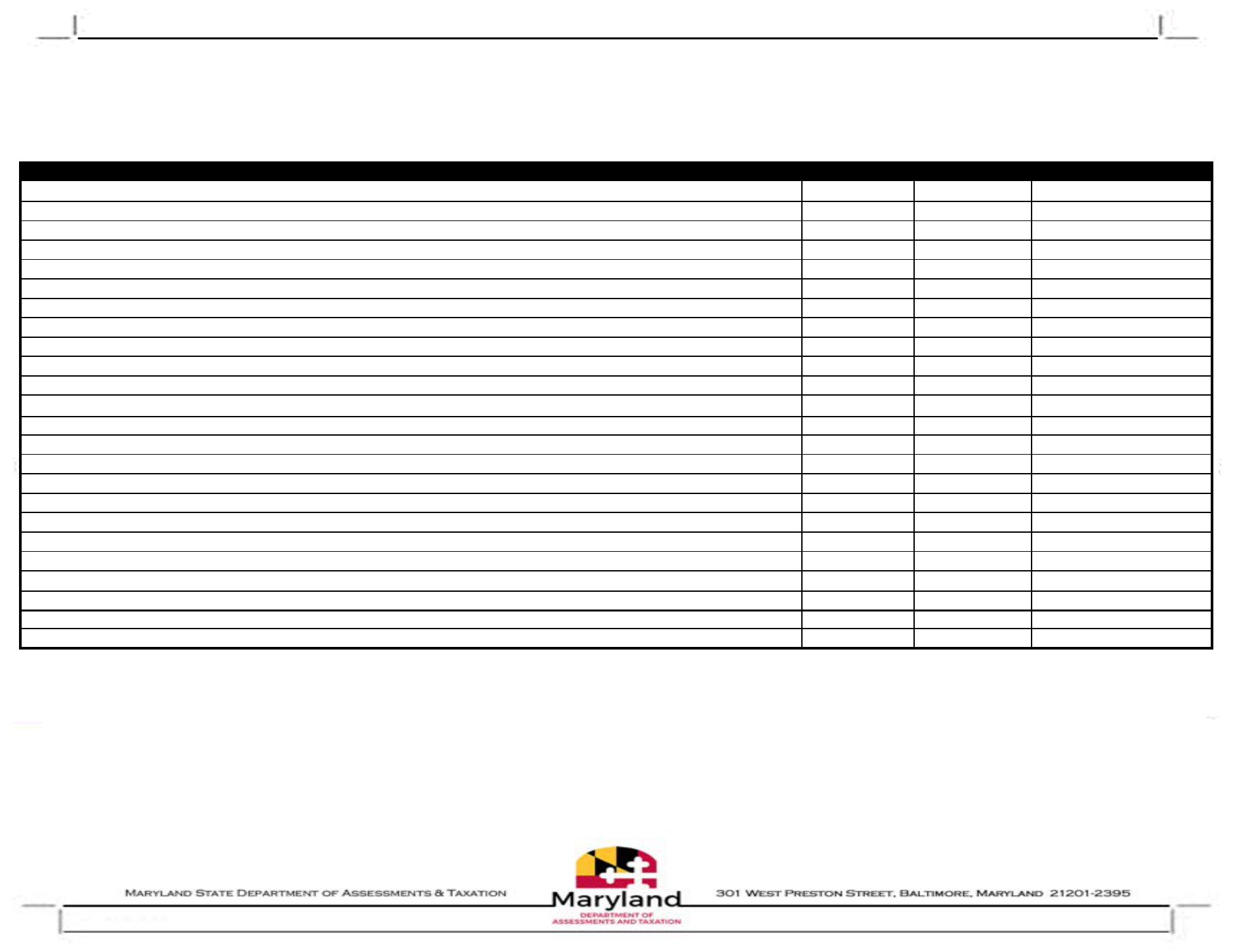

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION

REAL PROPERTY DIVISION

Listed below are the mailing addresses for local assessment offices

ASSESSMENT OFFICE MAILING ADDRESSES

PHONE FAX EMAIL

Allegany County Assessments 112 Baltimore Street, 3rd Floor, Cumberland, MD 21502

(301) 777-2108 (301) 777-2052 sdat.alle@maryland.gov

Anne Arundel County Assessments 45 Calvert St., 3rd Floor, Annapolis, MD 21401 (410) 974-5709 (410) 974-5738 sdat.aa@maryland.gov

Baltimore City Assessments Wm. Donald Schaefer Tower, 6 Saint Paul Street, 11th Floor, Baltimore, MD 21202 (410) 767-8250 (410) 333-4626 sdat.baltcity@maryland.gov

Baltimore County Assessments Hampton Plaza, 300 E Joppa Road, Suite 602, Towson, MD 21286

Calvert County Assessments State Office Bldg. 200 Duke Street, Room 1200, Prince Frederick, MD 20678

(443) 550-6840 (443) 550-6850 sdat.calv@maryland.gov

Caroline County Assessments Denton Multi-Service Center, 207 South 3rd St, Denton, MD 21629

Carroll County Assessments 15 E Main Street, Suite 229, Westminster, MD 21157 (410) 857-0600 (410) 857-0128 sdat.carl@maryland.gov

Cecil County Assessments District Court Multi-Service Center, 170 East Main Street, Elkton, MD 21921

Charles County Assessments Southern Maryland Trade Center, 101 Catalpa Drive Suite 101A, LaPlata, MD 20646

Dorchester County Assessments 501 Court Lane, PO Box 488, Cambridge, MD 21613

Frederick County Assessments 5310 Spectrum Dr, Suite E, Frederick, MD 21703 (301) 815-5350 (301) 663-8941 [email protected]

Garret County Assessments County Courthouse 317 East Alder St., Room 106, PO BOX 388, Oakland, MD 21550 (301) 334-1950 (301) 334-5018 sdat.gar@maryland.gov

Harford County Assessments Mary E.W. Risteau District Court Multi-Service Center, 2 South Bond Street, Suite 400, Belair, MD 21014

Howard County Assessments District Court Multi-Service Center, 3451 Court House Dr, Ellicott City, MD 21043

(410) 480-7940 (410) 480-7960 sdat.how@maryland.gov

Kent County Assessments 114-A Lynchburg Street, Chestertown, MD 21620 (410) 778-1410 (410) 778-1525 [email protected]ov

Montgomery County Assessments 30 W. Gude Drive, Suite 400, Rockville MD 20850

(240) 314-4510 (301)424-3864 [email protected]

Prince George's County Assessments 14735 Main Street, Suite 354B, Upper Marlboro, MD 20772

Queen Anne's County Assessments Carter M. Hickman District Court Multi-Service Center, 120 Broadway Suite 7, Centreville, MD 21617

St Mary's County Assessments Carter Building, 23110 Leonard Hall Drive, Room 2059, PO Box 1509 Leonardtown, MD 20650

(301) 880-2900 (301)475-4856 sdat.stm@maryland.gov

Somerset County Assessments 11545 Somerset Avenue, Princess Anne, MD 21853 (410) 651-0868 (410) 651-1995 sdat.som@maryland.gov

Talbot County Assessments 29466 Pintail Drive, Suite 12, Easton, MD 21601 (410) 819-5920 (410) 822-0048 sdat.talb@maryland.gov

Washington County Assessments 3 Public Square, Hagerstown, MD 21740

(301) 791-3050 (301) 791-2925 sdat.wash@maryland.gov

Wicomico County Assessments Salisbury District Court Multi-Service Center, 201 Baptist Street, Box 8 Salisbury, MD 21801

(410) 713-3560 (410) 713-3570 sdat.wic@maryland.gov

Worcester County Assessments One West Market Street, Rm. 1202, Snow Hill, MD 21863

(410) 632-1196 (410) 632-1366 sdat.wor@maryland.gov

ALL ASSESSMENT OFFICES ARE OPEN MONDAY - FRIDAY 8:00 AM – 4:30 PM,

EXCEPT BALTIMORE CITY WHICH IS OPEN 8:00 AM – 5:00 PM

For a complete list of office locations visit http://dat.maryland.gov/realproperty/Pages/Maryland-Assessment-Offices.aspx

Revised: 3/2023