1

Department of Defense

INSTRUCTION

NUMBER 1330.21

July 14, 2005

PDUSD(P&R)

SUBJECT: Armed Services Exchange Regulations

References: (a) DoD Instruction 1330.21 “Armed Services Exchange Regulations,”

February 4, 2003 (hereby canceled)

(b) DoD Directive 1330.9, "Armed Services Exchange Policy," November

27, 2002

(c) DoD Directive 1125.3, "Vending Facility Program for the Blind on

Federal Property," April 7, 1978

(d) DoD Directive 1015.14, "Establishment, Management, and Control of

Nonappropriated fund Instrumentalities and Financial Management of

Supporting Resources" July 16, 2003

(e) through (ab), see enclosure 1

1. PURPOSE

This Instruction reissues reference (a), implements reference (b), prescribes procedures,

and assigns responsibilities for operating Armed Services Exchanges.

2. APPLICABILITY AND SCOPE

This Instruction applies to:

2.1. The Office of the Secretary of Defense, the Military Departments, the Chairman

of the Joint Chiefs of Staff, the Combatant Commands, the Office of Inspector General of

the Department of Defense, the Defense Agencies, the DoD Field Activities, and all other

organizational entities in the Department of Defense (hereafter referred to collectively as

the "DoD Components").

2.2. The Commissioned Corps of the Public Health Service and the National Oceanic

and Atmospheric Administration (NOAA) under agreements with the Departments of

Health and Human Services and the Department of Commerce. The term "Armed

Services," as used herein, refers to the Army, the Navy, the Air Force, the Marine Corps,

and the Coast Guard.

DoDI 1330.21, July 14, 2005

2

3. DEFINITIONS

Terms used in this Instruction are defined in enclosure 2.

4. POLICY

DoD policy for the Armed Service Exchanges is contained in reference (b).

5. RESPONSIBILITIES

5.1. The Principal Deputy Under Secretary of Defense for Personnel and Readiness

(PDUSD (P&R)), under the Under Secretary of Defense for Personnel and Readiness

,

shall:

5.1.1. Serve as the principal point of contact for all Armed Services Exchange

policy matters in the Department of Defense.

5.1.2. Develop uniform DoD policy and guidance to ensure proper administration

and management of Armed Services Exchange programs and monitor compliance

thereof.

5.2. The Secretaries of the Military Departments

or their designees shall comply with

this Instruction.

6. PROCEDURES

6.1. Armed Service Exchange Programs

. Other Federal Departments, Agencies, and

instrumentalities shall obtain, in advance, written right of first refusal from the Armed

Services Exchange before beginning to operate or contract on military installations and

Government-owned or -leased military housing areas, for the programs designated for the

Armed Services exchanges listed at subparagraph E3.1.1.1. of enclosure 3. Exchanges

support forward deployments, ships at sea, emergency and disaster relief efforts,

international exercises, and contingency operations. Resale activities of blind vendors

are governed by DoD Directive 1125.3 (reference (c)).

6.2. Merchandise Restrictions

. The Armed Services Exchanges are authorized to sell

items of merchandise and offer retail services to provide a well-rounded program, except

as restricted in enclosure 4. Merchandise restrictions apply to direct sales, including by

special order catalog or e-commerce, and to indirect or concession activities.

DoDI 1330.21, July 14, 2005

3

6.3. Alcoholic Beverages Minimum Drinking Age

. The Secretary of the Military

Department concerned shall establish and enforce the minimum age for consumption and

purchase of alcoholic beverages established by the law of the State in which the military

installation is located. If a military installation is located in more than one State or a

State but within 50 miles of another State, Mexico or Canada, the Secretary concerned

may establish and enforce the lowest applicable age as the minimum drinking age on that

military installation. The Armed Service Exchanges shall follow the minimum drinking

age regulations for each military installation. Enclosure 5 establishes procedures for the

sale of package alcoholic beverages.

6.4. Sale of Tobacco

.

6.4.1. Military retail outlets shall not enter into any new merchandise display or

promotion agreements, or exercise any options in existing agreements, that provide for an

increase in total tobacco shelf-space. This provision does not prohibit couponing, or

incentives that allocate tobacco shelf-space among brands so long as total tobacco shelf-

space is not increased. Self-service promotional displays shall not be used outside of the

tobacco department. Incentives to increase the total number of tobacco displays shall not

be accepted, except to reallocate existing tobacco shelf-space among tobacco brands, if

the total amount of tobacco shelf-space is not increased. Promotional practices for

tobacco products shall reflect general commercial practices and shall not include

“military only” coupons or other promotions unique to the military or military resale

system.

6.4.2. Tobacco (including smokeless tobacco) shall not be sold to anyone less

than 18 years of age. A customer's ID shall be checked if his or her age is not known to

be over 18, and appears to be under 27.

6.4.3. Armed Service Exchanges shall endeavor to display tobacco cessation

products in areas that provide visibility and opportunity to customers who desire to

change their tobacco habits.

6.5. Authorized Patrons

. Only authorized patrons are entitled to exchange privileges

as prescribed in enclosure 6 of this Instruction, except when prohibited by treaty or other

international agreements in foreign countries. Patrons shall be identified under enclosure

7.

6.5.1. Sales of State Tax-Free Tobacco Products and Alcoholic Beverages

. State

tax-free tobacco products and alcoholic beverages shall be sold only to those individuals,

organizations, and activities entitled to unlimited exchange privileges. Common sense

must be used in determining that the quantities of state tax-free tobacco products and

alcoholic beverages sold are reasonable and for the use of authorized exchange patrons.

6.5.2. Sales to Appropriated Fund (APF) Activities Authorized

. Exchanges are

authorized to supply items within normal stock assortment to components, agencies,

DoDI 1330.21, July 14, 2005

4

instrumentalities and other activities or units within the Department of Defense and to

accept APF in payment, including the Government-wide purchase card. Such sales shall

be advantageous of the exchange and purchasing activity.

6.5.3. The Secretaries of the Military Departments may grant deviations with

regard to authorized patron privileges for individuals or classes/groups of persons at

specific installations. Delegation of this authority outside the Secretariat concerned is

prohibited. Deviations may be granted, when based on alleviating individual hardships.

Deviations granted by the Secretaries of the Military Departments shall be reviewed

annually as of June 30 and a report shall be submitted to the PDUSD (P&R) specifying

the exceptions and their justifications (Report Control Symbol DD-P&R(A)1096).

6.6. Purchase Restrictions

. By August 1

st

of each year, each Commander of a

Combatant Command, through the Chairman, Joint Chiefs of Staff, shall submit to the

PDUSD(P&R) an annual report describing changes to the host-nation laws and the treaty

obligations of the United States, and the conditions within host nations, that require the

use of new quantity or other restrictions on purchases in commissary and exchange stores

located outside the United States. Negative reports are required. If there are changes, the

PDUSD (P&R) shall notify Congress within 120 days of receipt of the reports.

6.7. Best Business Practices

. Exchange programs shall use best business practices to

fulfill customer needs, while maintaining a readiness capability to support wartime

missions and to meet quality, fiscal, health, and safety standards. The exchange

organizations shall ensure that short- and long-term plans are established and maintained.

6.8. Exchange Operations on Closed Installations

. Exchange operations on closed

installations shall follow the procedures in enclosure 8 of this Instruction.

6.9. Methods of Operation - Direct or by Concession

. Unless addressed specifically

by contract, a contractor or concessionaire of exchange services that sells or provides

authorized exchange service products or services is entitled to the same level of APF

support authorized for the applicable exchange service program in enclosure 9 of this

Instruction. The APF shall be used strictly on the exchange service program.

6.10. Resource Management

. Exchange program resource elements that are

authorized APF support are found in enclosure 9 and DoD Directive 1015.14 (reference

(d)).

6.10.1. Reporting of Violations

. The Department of Defense encourages the

reporting of suspected violations of rules, regulations, or law at the lowest organization

level possible. However, reports may be made to senior management, organizational

inspectors general, or to the DoD Hotline. The Commanders are responsible for prompt

detection, proper investigation, and appropriate corrective action. Individuals reporting

violations are protected from reprisal. Reference (e) is applicable to nonappropriated

DoDI 1330.21, July 14, 2005

5

fund (NAF) employees and employers and contains protections and responsibilities in

NAF whistleblower cases in accordance with reference (f).

6.10.2. Penalties for Violations

. The Commanders shall take appropriate action

against personnel responsible for violations of rules, regulations, or law. Where there is a

serious criminal infraction, commanders shall refer the matter to the appropriate Defense

criminal investigative organization for investigation and potential referral to judicial

authorities. Under Section 2783b of title 10, United States Code (U.S.C.) (reference (g)),

penalties for substantial violations of regulations governing the management and use of

NAF by civilian NAF employees shall be the same as provided by law for the misuse of

appropriations by civilian employees of the Department of Defense paid from APF.

Violations by personnel subject to the Uniform Code of Military Justice shall be subject

to appropriate disciplinary or administrative action.

6.11. Credit Programs

. A credit program shall be administered in accordance with

established business practices and industry standards. Credit limits shall be adjusted

periodically using standard industry practices. The exchange services shall include an

overview report that comments on the financial status of their credit programs as part of

their annual year-end certified financial audit. The exchange services shall also maintain

a Standard and Poor's rating. The exchange services shall initiate credit checks with

civilian credit bureaus on all new accounts and shall provide both good and bad credit

reports to the credit bureaus.

6.11.1. The Secretaries of the Military Departments may authorize the types of

merchandise or services for sale on a deferred payment basis for which no finance or

interest is charged within the following parameters:

6.11.1.1. Articles necessary for the health, comfort, or convenience of

recruits, officer candidates, re-enlistees, prisoners, or detained personnel. Payment shall

be made within 30 days.

6.11.1.2. Military Uniforms and Accessories

. The liability of any individual

shall not exceed the initial cost of the uniform requirement, to be paid in not more than 12

monthly installments.

6.11.1.3. Articles or services delivered or provided to private on-base

quarters, such as milk or bread deliveries. Billing and payment shall be monthly.

6.11.1.4. Sales to other authorized Government Agencies or

instrumentalities. Billing and payment shall be made on normal commercial terms of

trade.

6.11.1.5. The Secretaries of the Military Departments may authorize other

types of merchandise or services for sale for which no finance or interest is charged for a

period not to exceed 6 months.

DoDI 1330.21, July 14, 2005

6

6.11.2. Exchanges shall accept the Government-wide purchase card in activities

where personal credit cards or other purchase cards are accommodated. Exchanges shall

use the Government-wide purchase card or other commercial credit cards for goods and

services procured with NAF valued at or below $2,500 when appropriate and cost

effective.

6.11.3. A standard customer satisfaction index shall report customer satisfaction

levels for the individual exchanges and compare the three exchange services worldwide.

6.11.4. The exchanges shall jointly conduct an annual, standardized market-

basket price survey to measure customer savings by comparing the costs of like products

in the civilian sector in the United States.

6.12. Federal Retailers Excise Tax

. The Federal Retailers Excise Tax shall be

included in the sales price of all merchandise subject to this tax.

6.13. Pricing of Smoking Cessation Products

. The Military Departments shall

support the pricing of smoking cessation products below the local competitive price.

6.14. Merchandise Support.

Exchange merchandise categories for tobacco products

may be consigned and sold in commissary stores as exchange items.

6.15. Joint Construction.

Whenever practical, new commissaries and exchanges

shall be built as joint projects and collocated.

6.16. Advertising

. Armed Services Exchange advertising shall conform to enclosure

10 of this Instruction.

7. INFORMATION REQUIREMENTS

7.1. The annual "Military Exchange Deviation Report" required by subparagraph

6.5.3. has been assigned Report Control Symbol DD-P&R(A)1096 in accordance with

8910.1-M (reference (h)).

7.2. The annual "Overseas Commissaries and Exchange Stores-Access and Purchase

Restrictions Report" referred to at paragraph 6.6. has been assigned Report Control

Symbol DD-P&R(A&AR)2150 in accordance with reference (h).

7.3. Reporting of violations described in subparagraph 6.10.1. are exempt from

licensing in accordance with paragraph C4.4.2. of reference (h).

7.4 Inclusion of comments on the exchange services' credit programs referred to in

paragraph 6.11. is part of the "Morale, Welfare and Recreation (MWR) Activities

Financial Management Report." This annual report has been assigned Report Control

Symbol DD-P&R(A)1344 in accordance with reference (h).

DoDI 1330.21, July 14, 2005

7

7.5. The annual "DoD Commissary Operations Report" referred to in enclosure 8,

paragraph E8.1.6, has been assigned Report Control Symbol DD-P&R(A)1187 in

accordance with reference (h).

8. EFFECTIVE DATE.

This Instruction is effective immediately.

Enclosures - 10

E1. References, continued

E2. Definitions

E3. Exchange Resale Activities

E4. Merchandise Restrictions

E5. Alcoholic Beverages Operations

E6. Authorized Patrons

E7. Identification of Authorized Patrons

E8. Exchange Operations on Closed Installations

E9. Exchange Resource Elements Authorized Appropriated Fund (APF) Support

E10. Exchange Advertising Policy

DoDI 1330.21, July 14, 2005

8 ENCLOSURE 1

E1. ENCLOSURE 1

REFERENCES

, continued

(e) DoD Directive 1401.3, "Reprisal Protection for Nonappropriated Fund Instrumentality

Employees/Applicants," October 16, 2001

(f) DoD 7000.14-R, "DoD Financial Management Regulation," Volume 13, "Nonappropriated

Funds Policy and Procedures," August 2002

(g) Section 2783 of title 10, United States Code

(h) DoD 8910.1-M, “DoD Procedures for Management of Information Requirements," June 30,

1998

(i) DoD Directive 1015.2, "Military Morale, Welfare and Recreation (MWR)," June 14, 1995

(j) DoD Instruction 1015.15, “Procedures for Establishment, Management, and Control of

Nonappropriated Fund Instrumentalities and Financial Management of Supporting

Resources,” July 16, 2003

(k) Section 12301-12302 of title 10, United States Code

(l) Section 1101 of title 38, United States Code

(m) Section 1163a-1 of title 33, United States Code

(n) DoD Instruction 4105.70, "Sale or Rental of Sexually Explicit Material on DoD Property,"

June 29, 1998

(o) DoD Instruction 7700.18, "Commissary Surcharge, Nonappropriated Fund (NAF) and

Privately-Financed Construction Reporting Procedures," July 16, 2003

(p) Section 6374 of title 42, United States Code

(q) Section 7586 of title 42, United States Code

(r) Executive Order 13149, “Greening the Government through Federal Fleet and Transportation

Efficiency,” July 2000

(s) Section 548 of title 47, United States Code

(t) DoD Directive 1010.4, "Drug and Alcohol Abuse by DoD Personnel," September 3, 1997

(u) Section 213 of title 27, United States Code

(v) Section 2489 of title 10, United States Code

(w) Section 2482 of title 10, United States Code

(x) Section 1059 of title 10, United States Code

(y) DoD Instruction 1000.13, "Identification (ID) Cards for Members of the Uniformed

Services, Their Dependents, and Other Eligible Individuals," December 5, 1997

(z) Section 2490a of title 10, United States Code

(aa) DoD Directive 1330.17, "Military Commissaries," March 13, 1987

(ab) DoD Audit of Nonappropriated Fund Instrumentalities And Related Activities,”

January 16, 2004

(ac) DoD Instruction 5120.4, "Department of Defense Newspapers, Magazines, and Civilian

Enterprise Publications," June 16, 1997

DoDI 1330.21, July 14, 2005

9 ENCLOSURE 2

E2. ENCLOSURE 2

DEFINITIONS

E2.1.1. Alcoholic Beverages

. Beverages containing alcohol including wines, malt

beverages and distilled spirits.

E2.1.2. Appropriated Funds

(APF). See section 010103 of Volume 13, Chapter 1 of

reference (f).

E2.1.3. Authorized Family Member

. An individual whose relationship to the sponsor

leads to entitlement, benefits, or privileges administered by the Uniformed Services.

Family members include:

E2.1.3.1. Dependent Children 21 or Over

. Children, including adopted children,

stepchildren, and wards, who are 21 years of age or older, unmarried, and dependent

upon the sponsor for over half of their support and either:

E2.1.3.1.1. Incapable of self-support because of a mental or physical

handicap; or

E2.1.3.1.2. Have not passed their 23

rd

birthday and are enrolled in a full-time

course of study at an institution of higher education.

E2.1.3.2. Dependent Children Under 21

. Unmarried children under 21 years of

age, including pre-adoptive children, adopted children, stepchildren, foster children, and

wards dependent on the sponsor for over half of their support.

E2.1.3.3. Lawful Spouse

. If separated, a dependent spouse retains privileges

until a final divorce decree is issued.

E2.1.3.4. Orphans

. Surviving unmarried children of a deceased Uniformed

Service member or retired member of a Uniformed Service, who are either adopted or

natural born and under the age of 21, or who are over 21 and incapable of self-support; or

under 23 and enrolled in a full-time course of study. The surviving children must have

been dependents under the definitions in subparagraph E2.1.3. at the time of the death of

the parent or parents.

E2.1.3.5. Parents

. Father, mother, stepparent, parent by adoption, and parents-in-

law, who depend on the sponsor for over half of their support. The surviving dependent

parents of a member of the Armed Services who dies while on active duty are included.

E2.1.3.6. Surviving Family Member

. Children or parents of a sponsor who are

dependent on the surviving spouse for over half their support.

DoDI 1330.21, July 14, 2005

ENCLOSURE 2

10

E2.1.3.7. Surviving Spouse

. A widow or widower of a sponsor who has not

remarried or who, if remarried, has reverted through divorce, annulment, or the demise of

the spouse, to an unmarried status.

E2.1.3.8. Unmarried Children.

Unmarried children, including pre-adoptive

children, adopted children, stepchildren, foster children, and wards not having passed

their 23

rd

birthday and enrolled in a full-time course of study at an institution of higher

education and dependent on the sponsor for over half of their support.

E2.1.3.9. Unremarried Former Spouse

. An unremarried former spouse of a

member or former member of the Uniformed Services, who (on the date of the final

decree of divorce, dissolution, or annulment) had been married to the member or former

member for a period of at least 20 years during which period the member or former

member performed at least 20 years of service creditable for retired or retainer pay, or

equivalent pay.

E2.1.4. Continental United States

(CONUS). The 48 contiguous States and the

District of Columbia.

E2.1.5. Exchange Employees

. Civilian employees of the military exchange systems.

E2.1.6. Executive Control and Essential Command Supervision

(ECECS). Those

managerial staff functions and positions located above the direct program managerial and

operational level of individual Morale, Welfare and Recreation (MWR) programs that

support planning, organizing, directing, coordinating, and controlling the overall

operations of MWR programs. ECECS consists of program, fiscal, logistical, and other

managerial functions that are required to ensure oversight.

E2.1.7. Military Departments

. The Department of the Army, the Department of the

Navy, and the Department of the Air Force.

E2.1.8. Military Morale, Welfare, and Recreation (MWR Programs

. The military

programs defined in DoD Directive 1015.2 (reference (i)).

E2.1.9. Nonappropriated Funds

(NAF). See section E2.1. of DoD Instruction

1015.15 (reference (j)).

E2.1.10. Nonappropriated Fund Instrumentality

(NAFI). See section E2.1. of

reference (j).

E2.1.11. Outside the Continental United States

(OCONUS). Areas other than the 48

contiguous states and the District of Columbia. Includes Alaska, Hawaii, Puerto Rico,

Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. territories and

possessions.

DoDI 1330.21, July 14, 2005

ENCLOSURE 2

11

E2.1.12. Official DoD Web Site

. A DoD web site that is developed and maintained

by a command for which a DoD Component (a subordinate organization or an individual)

exercises editorial control over content. The content of official DoD web sites presents

the official position of the DoD Components. Content may include official news

releases, installation history, command position papers, etc. Official DoD Web sites are

prohibited from displaying sponsorships or commercial advertisements.

E2.1.13. Overseas

. Areas other than the 50 states and the District of Columbia.

E2.1.14. Reserve Components.

The Army National Guard and the Air National

Guard of the United States, the Army Reserve, the Naval Reserve, the Air Force Reserve,

the Marine Corps Reserve, the Coast Guard Reserve, and Reserve Officers of the Public

Health Service. The Ready Reserve is comprised of military members of the Reserve and

National Guard, organized in units, or as individuals, liable for recall to active duty to

augment the active components in times of war or national emergency under sections

12301(a) and 12302 of title 10 U.S.C. (reference (k)). The Ready Reserve consists of

three Reserve component subcategories: the Selected Reserve, the Individual Ready

Reserve, and the Inactive National Guard.

E2.1.15. Retired Personnel

. All personnel carried on the official retired lists (Active

and Reserve) of the Uniformed Services, who are retired with pay, granted retirement pay

for physical disability, or entitled to retirement pay whether or not such pay is waived, or

pending due to age requirement.

E2.1.15.1. Members of the Retired Reserve who are eligible for retired pay at age

60, but have not yet reached age 60.

E2.1.15.2. Personnel on the emergency officers' retired list of the Army, the

Navy, the Air Force, and the Marine Corps who retired under 38 U.S.C., (reference (l)).

E2.1.15.3. Officers, crews of vessels, light keepers, and depot keepers of the

former Lighthouse Service who retired under 33 U.S.C. (reference (m)).

E2.1.15.4. Retired noncommissioned ships' officers and crewmembers of the

NOAA and its predecessors, who either were on active duty as a vessel employee on July

19, 1963, and whose employment as such vessel employee was continuous from that date

until the date of retirement, or who had retired as a vessel employee on or before July 19,

1963.

E2.1.16. Sponsor

. An individual who is entitled to exchange benefits and privileges

and from whom others become entitled.

E2.1.17. Uniformed Personnel

. Members of the Armed Services, the Coast Guard;

cadets and midshipmen of the Armed Forces Service Academies, the Coast Guard

DoDI 1330.21, July 14, 2005

ENCLOSURE 2

12

Academy, Commissioned Corps of NOAA and its predecessors, Commissioned Corps of

the Public Health Service, and members of the Reserve components.

E2.1.18. Uniformed Services

. The Armed Services, the Commissioned Corps of the

National Oceanic and Atmospheric Administration, and the Commissioned Corps of the

Public Health Service.

E2.1.19. United States

. The 50 states and the District of Columbia.

E2.1.20. Unofficial DoD Web Site

. A DoD web site that is developed and

maintained with NAF. The content of unofficial DoD web sites is not endorsed as the

official position of the DoD Components. Content may, but does not usually, include

official news releases, installation history, command position papers, etc. Unofficial

DoD web sites may include commercial advertisements and may be used to advertise

products for sale, in accordance with the mission of the organization. In most cases,

unofficial DoD web sites are developed and maintained by NAFIs, including military

exchanges and MWR activities that use NAF.

DoDI 1330.21, July 14, 2005

13 ENCLOSURE 3

E3. ENCLOSURE 3

EXCHANGE RESALE ACTIVITIES

E3.1. GENERAL ACTIVITIES

E3.1.1. Exchanges are authorized to operate the following revenue generating

activities:

E3.1.1.1 Retail stores.

E3.1.1.2. Mail order, catalog, and ecommerce services.

E3.1.1.3. Automobile garages and service stations.

E3.1.1.4. Name brand fast food outlets (restaurants, cafeterias, and snack bars),

including nationally recognized franchises.

E3.1.1.5. Packaged beverage stores.

E3.1.1.6. Barber and beauty shops.

E3.1.1.7. Flower shops.

E3.1.1.8. Laundries, dry cleaning, and pressing.

E3.1.1.9. Tailor shops.

E3.1.1.10. Watch repair shops.

E3.1.1.11. Radio, television, computer, and electronic repair shops.

E3.1.1.12. Shoe repair shops.

E3.1.1.13. Photographic studios.

E3.1.1.14. Vending machines.

E3.1.1.15. Taxicab and bus services.

E3.1.1.16. Personal services.

E3.1.1.17. Newsstands.

E3.1.1.18. Pay telephone stations, telephone calling centers, and personal

telecommunication services.

DoDI 1330.21, July 14, 2005

ENCLOSURE 3

14

E3.1.1.19. Military Clothing Sales Operations.

E3.1.1.20. School Lunch Programs.

E3.1.1.21. Exchange Credit Programs.

E3.1.1.22. Tax Preparation Services.

E3.1.1.23. Exchange Marts.

E3.1.1.24. The Secretaries of the Military Departments may prescribe in their

regulations a selection of food and beverages, including malt beverages, wines, and other

alcoholic beverages. Food items shall supplement the primary full-line grocery service

provided by the commissary system.

E3.1.1.2. The Secretaries of the Military Departments may authorize the exchanges

to operate the following activities:

E3.1.1.2.1. Membership clubs (open messes), restaurants, cafeterias, and snack

bars.

E3.1.1.2.2. Lodging, including Permanent Change of Station (PCS), guest houses

and hostess houses.

E3.1.1.2.3. Amusement machines.

E3.1.1.2.4. Recreational, social, and family support activities.

E3.1.1.2.5. Pet Shops

E3.2. STOCKAGE AND SALE OF ITEMS

The Secretaries of the Military Departments shall determine items to be stocked or sold

OCONUS. Within the CONUS, the exchanges shall determine the items to be stocked or

sold, provided such items are not otherwise restricted.

E3.3. AUTHORIZED ACTIVITIES WITH SPECIAL REQUIREMENTS

E3.3.1. Fresh Meat and Produce Departments

. The Secretary of the Military

Department concerned may specifically authorize the sale of fresh meat, fresh poultry,

fresh seafood, fresh fruit, and produce when no commissary store is available on the

installation or when fresh meat and produce is not available within a reasonable distance

DoDI 1330.21, July 14, 2005

ENCLOSURE 3

15

at a reasonable price, or in satisfactory quality and quantity. Other necessary grocery

items may be sold without limitation in the number of items or container size.

E3.3.2. Mini-Storage Facilities

. Proposals for individual activities must be submitted

60 days in advance to the PDUSD(P&R) for Congressional notification prior to approval.

E3.3.3. Medical and Dental Services including Pharmacies

. Medical services

include, but are not limited to, dental, optometry, audiology, and pharmacy activities.

E3.3.3.1. Proposals for medical services at specific locations must be

submitted 60 days in advance to PDUSD(P&R) for

Congressional notification. The

PDUSD(P&R) must approve the offering of new medical and dental services and shall

notify Congress of such approval. Congressional notification and PDUSD(P&R)

approval must be obtained before exchanges initiate construction or contract action,

including entering into any license agreement with private practioners.

E3.3.3.2. Proposals shall include the installation’s name and location;

statements that solicitations shall include small businesses from the surrounding

communities and that no military doctors shall be used in the clinic; that the installation

commander and local military health care facility commander support the project; the

number of customers to be served; projected sales and financial return to the Department

of Defense and/or the exchange service; projected customer savings; a statement that

space available for the service meets DoD military medical space requirements; a detailed

site specific description of the contract award process, the contract requirements, the

length of the contract, the scope of services to be offered; and specific benefit to service

members. While there is no requirement that local business leaders agree with the new

service, the local business community and government officials shall be made aware of

the initiative and the proposal shall include their views.

E3.3.3.3. Re-notification is not required for renewal of a previously approved

specific medical concession at a specific location.

E3.3.4. Magazines and periodicals are authorized exchange sale items. DoD

Instruction 4105.70 (reference (n)) governs the sale or rental of sexually explicit material

on DoD property.

E3.3.5. Firearms and ammunition are authorized exchange sale items. Firearms shall

be sold in compliance with Federal laws and regulations. Overseas activities shall

conform to all applicable Status of Forces Agreements (SOFA) requirements, as well as

any requirements imposed by bilateral agreements between the United States and the host

nation.

E3.3.6. Name-Brand Fast-Food Operations

. When establishing name-brand

commercial fast-food operations, concession operations are preferred for military bases in

the United States, and exchange direct-run operations are the preferred method for bases

overseas. Both economic and non-economic factors shall be evaluated to decide on the

DoDI 1330.21, July 14, 2005

ENCLOSURE 3

16

method of operation that best meets the exchange mission for each location. In addition,

the following factors shall be considered in the aggregate: financial risk, customer

service, employment opportunities, management control, operational risk, and investment

opportunities. Primary consideration shall be given to the overall quality of life and

welfare of the active duty community. Notice of deviations from the preferred method

that result in major construction projects as defined in DoD Instruction 7700.18

(reference (o)) shall accompany the major construction program submitted to the

PDUSD(P&R) and l include the evaluation of economic and non-economic factors.

E3.3.7. Only Armed Services exchanges are permitted to sell, publicize, or display

new or factory certified cars or motorcycles on overseas DoD installations. Exchanges

may sell automobiles and motorcycles only to authorized patrons who are stationed or are

assigned overseas for 30 consecutive days or more. Orders may be taken for U.S.-made

automobiles, foreign name-plated vehicles with at least 75 percent U.S. or Canadian

content, and motorcycles. Sales may be made for stateside delivery or for in-country

delivery where permitted under the status of forces agreement.

E3.3.8. Alternative Fuels

Armed Services exchanges may sell alternative fuels to the

general public in compliance with 42 U.S.C. 6374, 42 U.S.C. 7586, and Executive Order

13149 (references (p) through (r)).

E3.3.9. Cable Television Services

. Armed Services exchanges may provide cable

television services in compliance with 47 U.S.C. 548 (reference (s)).

DoDI 1330.21, July 14, 2005

17 ENCLOSURE 4

E4. ENCLOSURE 4

MERCHANDISE RESTRICTIONS

E4.1.1. Exchanges in CONUS may not sell projection televisions and televisions

with a cost to the exchange of more than $3,500.

E4.1.2. Exchanges in CONUS may not sell diamond settings with individual stones

that exceed one carat.

E4.1.3. Exchanges in CONUS may not sell jewelry other than diamond jewelry with

a per-unit (piece) cost to the exchange in excess of the cost price of 2 ounces of gold.

E4.1.4. Exchanges in CONUS may not sell finished furniture with a per-unit (piece)

cost to the exchange in excess of $900.

E4.1.4.1. CONUS exchanges may not undertake new capital construction or

renovation of an exchange facility of any kind for the purpose, in whole or in part, of

providing additional space in which to sell finished furniture.

E4.1.4.2. At any new installation or location at which the exchange service

proposes to sell finished furniture, the exchange manager or installation commander shall

consult in advance with local furniture merchants and the exchange service shall advise

the Office of the PDUSD(P&R) of the proposal and any local merchant objections to

exchange sales of finished furniture. Such notice to the Office of the PDUSD (P&R)

shall be made 60 days before offering finished furniture at any new location so the Office

of the PDUSD (P&R) may notify the Congressional Committees on Armed Services in

advance. The PDUSD(P&R) must approve the offering of finished furniture at new

locations and shall notify Congress of such approval prior to offering finished furniture at

new locations.

E4.1.5. Exchanges in CONUS may not sell decorative housewares and furnishings

with a per-unit (piece) cost to the exchange in excess of $500.

E4.1.6. Exchanges in CONUS may not sell small appliances with a per unit (piece)

cost to the exchange in excess of $150 except that there is no cost limitation on floor

polishers, food processors, fans, coffee makers, humidifiers, dehumidifiers, air purifiers,

microwave ovens, refrigerators, rotisseries, roasters, broilers, and vacuum cleaners.

E4.1.7. Exchanges in CONUS may not sell recreational boats with a per unit (piece)

cost to the exchange in excess of $750.

DoDI 1330.21, July 14, 2005

ENCLOSURE 4

18

E4.1.8. Exchanges in CONUS may not sell sports equipment and supplies;

recreational, garden, and manual arts equipment and supplies; or photographic supplies

and film with a per-unit (piece) cost to the exchange in excess of $500. There is no cost

limitation on aquatic equipment, bicycles, cameras and projectors, camera and projector

accessories, fishing equipment, golf club sets, guns and gun accessories, physical fitness

exercise equipment, power tools, outdoor power equipment including lawn mowers,

edgers and snow blowers, ski equipment, surfboards, and tents.

DoDI 1330.21, July 14, 2005

19 ENCLOSURE 5

E5. ENCLOSURE 5

ALCOHOLIC BEVERAGES OPERATIONS

E5.1. APPLICABILITY AND AUTHORITY

This section applies to the sale of alcoholic beverages in the exchange systems.

E5.2. RESPONSIBLE USE OF ALCOHOL

The Military Departments shall establish programs, policies, and procedures consistent

with DoD Directive 1010.4 (reference (t)) to deglamorize the use of alcohol and to

discourage and treat its irresponsible use.

E5.3. ALCOHOLIC BEVERAGE LABELING

The provisions of the Alcoholic Beverage Labeling Act of 1988, 27 U.S.C 213 (reference

(u)) shall apply to all alcoholic beverages sold in exchange activities in CONUS and

OCONUS . This includes the requirement that alcoholic beverages purchased offshore

carry labels as required of U.S.-procured products.

E5.4. ESTABLISHMENT AND CONTINUATION OF EXCHANGE PACKAGE

STORES IN THE UNITED STATES

In the United States and Puerto Rico, the Secretary concerned may approve the sale of

packaged alcoholic beverages with an alcohol content of more than 7 percent by volume.

E5.4.1. Establishment

. Before authorizing the establishment of a package store, the

Military Department Secretary shall review the following pertinent factors:

E5.4.1.1. Estimated number of authorized patrons per outlet if granted.

E5.4.1.2. Importance of estimated contributions of package store profits to

providing, maintaining, and operating military MWR activities.

E5.4.1.3. Availability of wholesome family social clubs to military personnel in

the local civilian community.

E5.4.1.4. If on a National Guard installation, coordination with the State Adjutant

General concerned.

E5.4.1.5. Geographical inconveniences.

DoDI 1330.21, July 14, 2005

ENCLOSURE 5

20

E5.4.1.6. Limitations of nonmilitary sources.

E5.4.1.7. Disciplinary and control problems due to restrictions imposed by local

law and regulations.

E5.4.1.8. Highway safety

.

E5.4.1.9. Location and distance of nearest military package store and reasons that

the use of this facility is not feasible.

E5.4.1.10. A digest of the attitudes of community authorities or civic

organizations toward establishment of a package sales outlet. This digest should consist

of a summary of the community authorities and civic organizations, including the means

of contact, the date contact occurred, and any written comments received from

individuals and agents such as local mayors, heads of prominent civic groups or

Chambers of Commerce, State legislators, Members of Congress, or other government

officials. Speculative assessments of prospective community attitudes shall not satisfy

this requirement. The use of available command channels is encouraged.

E5.4.2. An information copy of the Military Department review shall be submitted to

the PDUSD(P&R) for each action approving the establishment of sales outlets for

packaged alcoholic beverages, including the determinations and findings made in

accordance with the criteria as stated above. The review shall be submitted to the

PDUSD(P&R) 60 days prior to the establishment to provide for advance notification to

Congress.

E5.4.3. Triennial Review

. The Secretary concerned shall conduct a triennial review

of each package store in the United States to determine the need for its continued

operation. The evaluation shall consider the factors required to establish a package store,

except subparagraph E5.4.1.10., above.

E5.5. ESTABLISHMENT OF EXCHANGE PACKAGE STORES OVERSEAS

Outside the United States, the sale of packaged alcoholic beverages with an alcoholic

content of more than 7 percent by volume may be approved by the exchange service

Commander/Chief Executive Officer provided such sales do not contradict treaties,

SOFA, and local governmental agreements.

DoDI 1330.21, July 14, 2005

ENCLOSURE 5

21

E5.6. NONALCOHOLIC AND ALCOHOLIC-TYPE BEVERAGES

The sale of packaged nonalcoholic, alcoholic beverage substitutes shall be carried out

only in exchange facilities. Due to the disparity in State laws on the classification of

"nonalcoholic," these products shall be sold only to those customers authorized to

purchase alcoholic beverages.

E5.7. PACKAGE STORE OPERATIONS

Where a package store operation is authorized for an installation, exchange systems may

operate in an independent facility, or, merge the alcoholic beverage operations with other

exchange activities provided the installation commander concurs, the stock and displays

are segregated, and all inventory controls, ration controls, signage required for alcoholic

beverages are in effect.

E5.8. PURCHASE OF ALCOHOLIC BEVERAGES FOR RESALE

Alcoholic beverage shall be purchased by the exchange service for resale from the most

competitive source and distributed in the most economical manner, price, and all other

matters considered. The most economical method of distributing distilled spirits to stores

shall be found by considering all components of distribution costs incurred in distributing

beverages to the stores including all management, logistics, administration, depreciation,

utilities, inventory carrying, handling, and distribution costs. In Alaska and Hawaii,

alcoholic beverages shall be purchased from and delivered by a source within the State in

which the military installation is located.

E5.8.1. Malt beverages and wine shall be purchased from and delivered by a source

within the State in which the military installation is located. If an installation is located

in more than one State, then the source may be in any State in which the installation is

located.

E5.8.2. State and Local Government

. DoD resale activities are not subject to State

and local laws, regulations, control, or taxation. It is DoD policy to cooperate with State

and local officials to the degree that their duties relate to the provisions of this

Instruction. The factors to be considered in sections E5.4., and E5.9. of this enclosure,

shall not be construed as meaning any submission to State control, nor shall cooperation

be construed or represented as an admission of any legal obligation to submit to State

control, pay State or local taxes, or purchase distilled spirits within geographical

boundaries, from suppliers or at prices prescribed by any State.

DoDI 1330.21, July 14, 2005

ENCLOSURE 5

22

E5.9. POSSESSION

Packaged alcoholic beverage sales outlets are operated solely for the benefit of authorized

customers. Authorized purchasers shall not sell, exchange, or otherwise divert packaged

alcoholic beverages to unauthorized personnel.

E5.10. OVERSEAS WINE SALES

In accordance with 10 U.S.C. 2489 (reference (v)) Armed Services exchanges outside the

United States engaged principally in selling alcoholic beverages will, in general, give

equitable treatment to American produced wines, in terms of selection, distribution, and

price, when compared with wines produced by the host nation. The exchange service

shall:

E5.10.1. Work with U.S. wine producers to assist and facilitate the supply and

marketing of U.S.-produced wines in package stores outside the United States. Each

package store shall separately and/or prominently identify or display U.S.-produced

wines.

E5.10.2. Carry a representative number of American wines in each category and

price level that compares with the selection of host-nation wines.

E5.10.3. Ensure that the percentage of markup on host-country wines shall be equal

to or more than the percentage of markup on American-produced wines.

E5.10.4. If there is conflict between this policy and a SOFA or other country-to-

country agreements, the latter shall prevail.

E5.11. IN-HOUSE PROMOTIONS OF ALCOHOLIC BEVERAGE SALES

Coupons, bag stuffers, free samples, or any other media used to promote or advertise the

sale or consumption of specific brands of alcoholic beverage are prohibited. Examples

include, but are not limited to, cents-off coupons, chit books, courtesy cards, slips,

coupons books, and product samples designed to reduce the normal retail sales price

charged by package beverage stores as established above. This does not prevent

conducting on-premise beverage tasting.

DoDI 1330.21, July 14, 2005

ENCLOSURE 5

23

E5.12. COMMERCIAL PROMOTIONS OF ALCOHOLIC BEVERAGE SALES

Exchange systems are not authorized to participate in any type of alcoholic beverage

promotion sponsored by commercial enterprises that is directed or targeted primarily or

exclusively at the military community (uniformed or retired personnel, either on active

duty or serving in any category of a Reserve component, and their dependents).

Examples of promotions include, but are not limited to, sweepstakes, lucky number

events, bottle-top redemption, premiums, discount coupons, or providing sample

products. This does not prevent conducting on-premise beverage tasting. Package

beverage stores may participate in promotions available to the general public at large.

DoDI 1330.21, July 14, 2005

24 ENCLOSURE 6

E6. ENCLOSURE 6

AUTHORIZED PATRONS

E6.1.1. Unlimited Exchange Privileges in the United States, and all

Commonwealths, Possessions, and Territories of the United States (except as noted). The

following table lists the individuals, organizations, and activities entitled to unlimited

exchange service benefits:

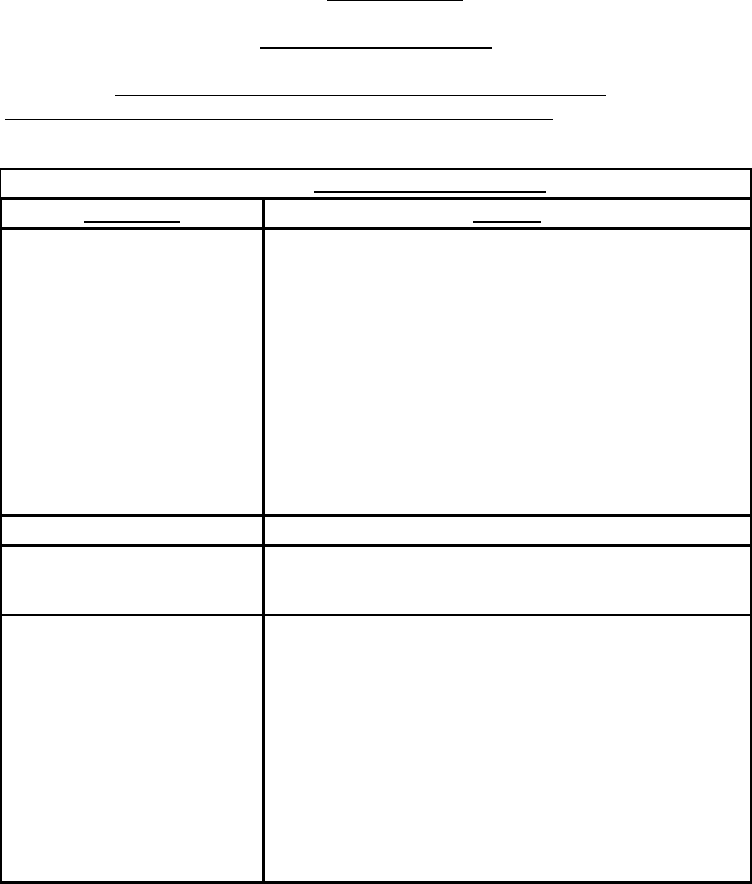

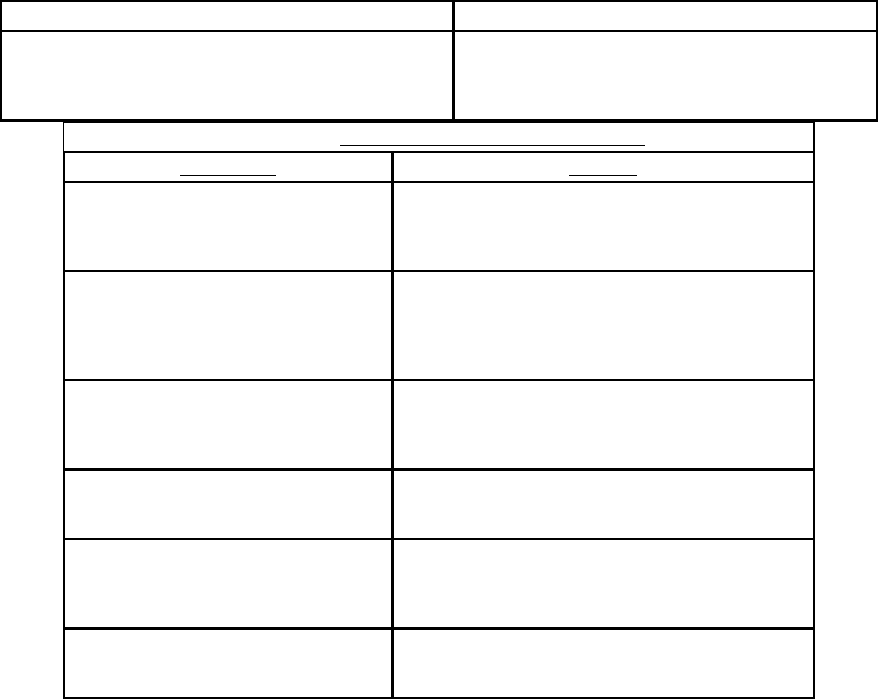

Table E6.T1. Unlimited Exchange Privileges

CATEGORY STATUS

1. Uniformed or Retired

Uniformed Personnel, either on

Active Duty or serving in any

category of the Reserve

Component

• All members of the Army, the Air Force, the Navy, the

Marines, the Coast Guard, commissioned officers of the

National Oceanic and Atmospheric Administration (NOAA) and

its predecessors, and commissioned officers of the Public

Health Service.

• Former members of the Lighthouse Services; personnel of

the Emergency Officers’ Retired List of the Army, the Navy,

the Air Force, and the Marine Corps; and members or former

members of Reserve components who, but for age, would be

eligible for retired pay.

• Enlisted personnel transferred to the Fleet Reserve of the

Navy and Fleet Marine Corps Reserve after 16 or more years

of active military service. (These personnel are equivalent to

Army and Air Force retired enlisted personnel.)

2. Medal of Honor Recipients • All.

3. Honorably Discharged

Veterans

• When: (a) classified by the Veterans’ Administration as

being 100-percent disabled or (c) when hospitalized where

exchange facilities are available.

4. Military Members of Foreign

Nations

• Active duty officers and enlisted personnel of foreign nations

when on duty with the U.S. Armed Services under orders

issued by the U.S. Army, Navy, Air Force, or Marine Corps.

Service regulations shall govern the sale of uniform items.

• Excluded are officers and enlisted personnel of foreign

nations, retired or on leave in the United States, or when

attending U.S. schools, but not under orders issued by the

U.S. Army, Navy, Air Force, or Marine Corps.

• Overseas, when decided by the major overseas commander

that granting such privileges is in the best interest of the

United States and that such persons are connected with, or

their activities are related to, the performance of functions of

the U.S. Military Establishment.

DoDI 1330.21, July 14, 2005

ENCLOSURE 6

25

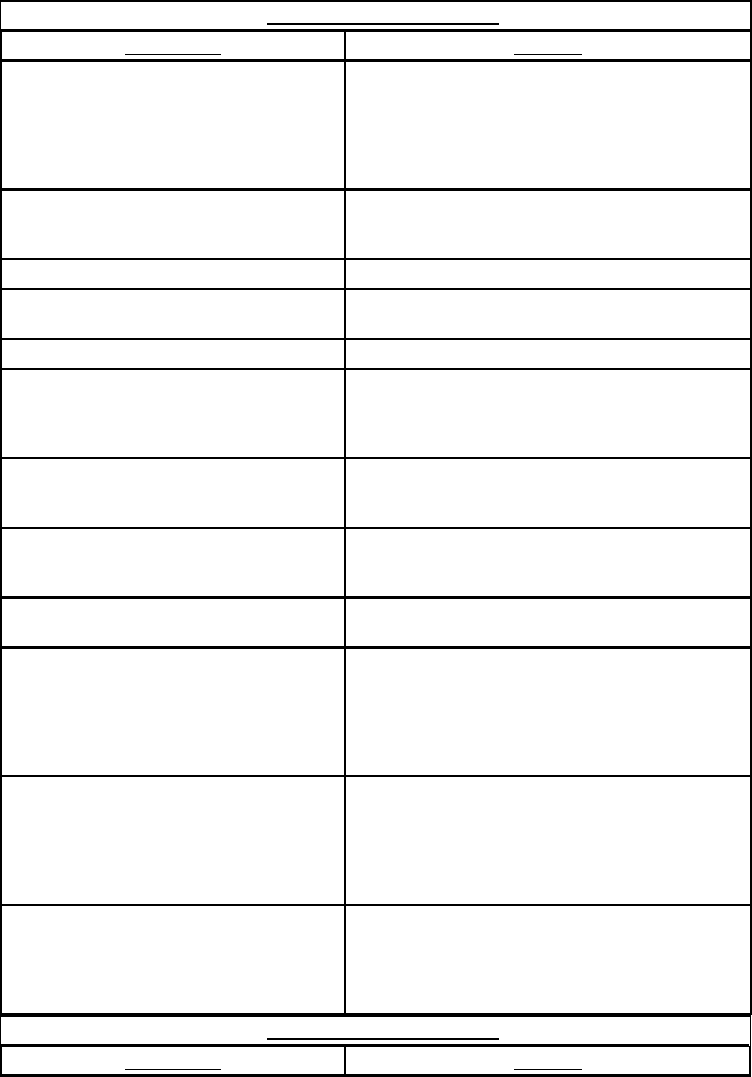

Table E6.T1. Unlimited Exchange Privileges - Continued

CATEGORY STATUS

5. National Guard Members not in Federal

service

• Members not in Federal service, when called or

ordered to duty in response to a federally declared

disaster or National Emergency shall be permitted

to use exchange facilities during the period of such

duty, on the same basis as active duty members of

the Armed Forces.

6. Red Cross Personnel • Personnel who are U.S. citizens and assigned to

duty outside of the United States and Puerto Rico

with an activity of the Military Service.

7. U.S. Civilian DoD Employees • When stationed outside of the United States.

8. U.S. Citizen Employees of Firms under

Contract to the Department of Defense

• When employed outside of the United States.

9. Wage marine personnel, including

noncommissioned ships' officers and crew

members of the NOAA

• All

10. Retired wage marine personnel,

including noncommissioned ships’ officers

and crew members of NOAA

• All

11. Authorized Family Members of

Personnel in Categories 1 through 10,

above

• As defined in enclosure 2.

12. Contract Surgeons • During the period of their contract with the

Surgeon General.

13. Official DoD Activities (for activity

purchases and use only; not for individual

purchases or use)

• All purchases authorized for Government-wide

purchase card use.

• All other purchases based on sole-source

justification.

• All purchases authorized by 10 U.S.C. 2482

(reference (w))

14. Non-DoD Federal

Departments/Agencies (for Federal

Department/Agencies purchases and use

only; not for individual purchases or use)

• When it is determined by the local commanding

officer that the desired supplies or services may not

be conveniently obtained elsewhere and may be

furnished without unduly impairing service to

exchange patrons.

• All purchases authorized by reference (w).

15. Dependents of members of the Armed

Forces, Commissioned Officers of the

Public Health Service, and Commissioned

Officers of the NOAA, separated for

Dependent Abuse

• A dependent or former dependent entitled to

transition compensation under 10 U.S.C. 1059

(reference (x)), if not eligible under another

provision of law, while receiving payments for

transition compensation.

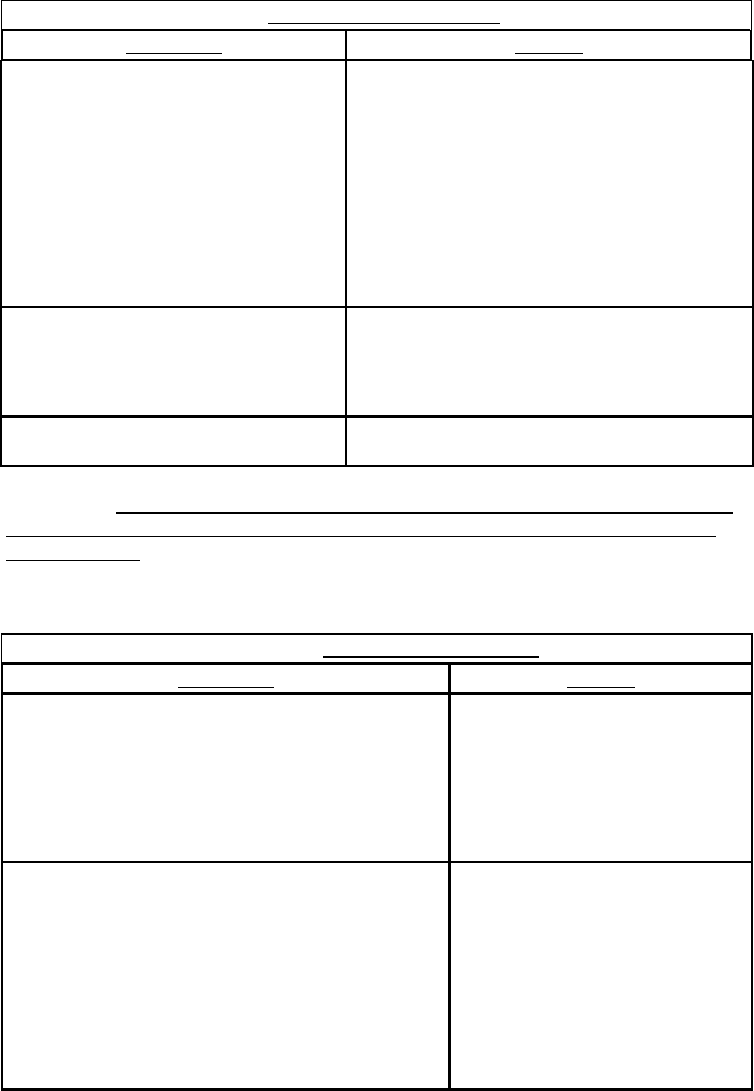

Table E6.T1. Unlimited Exchange Privileges - Continued

CATEGORY STATUS

DoDI 1330.21, July 14, 2005

ENCLOSURE 6

26

Table E6.T1. Unlimited Exchange Privileges - Continued

CATEGORY STATUS

16. United Service Organizations (USO) • USO clubs and agencies may purchase

subsistence supplies for use in club snack bars that

support active duty military members and their

families.

• USO personnel stationed outside the United

States.

• In overseas areas, installation Commanders may

extend privileges to USO area executives,

executive directors, and assistant executive

directors who are U.S. citizens when it is in the

capability of the exchanges and does not impair the

military mission.

17. Agents • Persons authorized in writing by the base

commanding officer to shop for an authorized

patron or an official organization or activity entitled

to unlimited privileges.

• Agents are not authorized to shop for themselves.

18. Delayed Entry Program Participants • Authorized to use exchange facilities during

interim period before entering active duty.

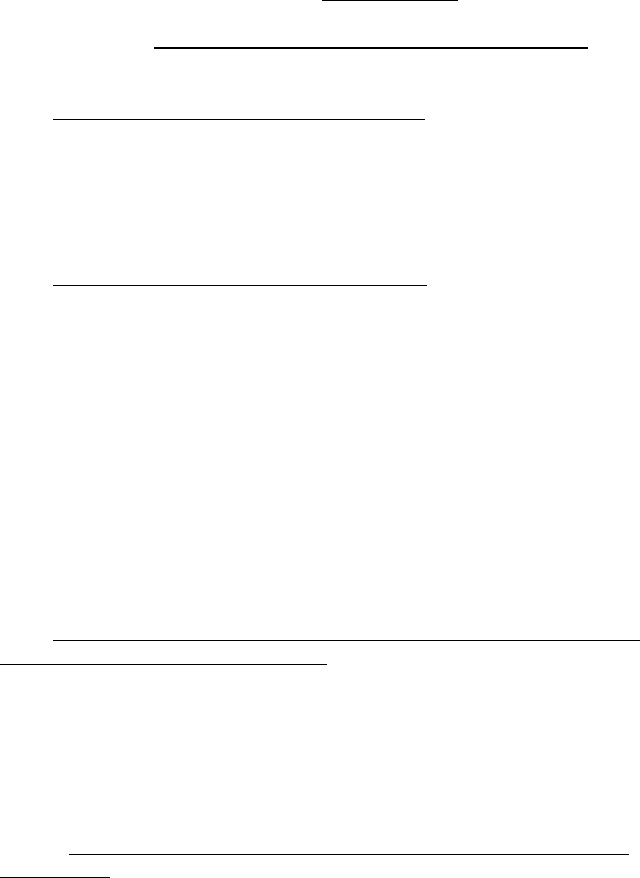

E6.1.2. Limited Exchange Privileges in the United States and all Commonwealths,

Possessions, and Territories of the United States (except as noted in section 2. of table

E26.T2., below). The following table lists the individuals, organizations, and activities

entitled to limited exchange service benefits. Limited exchange privileges generally

exclude tobacco products, alcoholic beverages, and military uniforms.

Table E6.T2. Limited Exchange Privileges

CATEGORY STATUS

1. U.S Government Civilian Employees and Full-Time

Paid Staff of the Red Cross

• Who reside on military installations

within the United States and Puerto

Rico.

• No uniform items.

• No State tax-free tobacco items.

• Tax-free alcoholic beverages may

be purchased, but not removed from

the installation.

2. Armed Forces Exchange Employees • Current employees, retired

employees with 20 or more years of

service, and employees on 100-

percent disability retirement from the

Armed Services exchanges are

entitled to all privileges of the

exchange system where they are

employed.

• No uniform items.

• No State tax-free tobacco items.

DoDI 1330.21, July 14, 2005

ENCLOSURE 6

27

• No tax-free alcoholic beverages.

• Unlimited privileges overseas,

except for uniform items.

• Overseas sales to exchange

employees must not violate SOFA or

international agreements.

3. DoD Civilian Employees on Evacuation Orders • Employees who are directly affected

by an emergency evacuation are

authorized to use the Armed Services

exchange services at their safe-haven

location as determined by the

pertinent installation commander in

the United States during the

evacuation period.

4. Authorized Family Members of Personnel in

Categories 1 through 3, above

• As defined in enclosure 2.

5. DoD Civilian Employees in Temporary Duty (TDY)

status

• In the United States, when occupying Government

quarters on military installations, and identified by

copies of their TDY orders and on-base billeting

authorization.

• Outside of the United States when identified by

copies of their TDY orders.

• No uniform items.

• No State tax-free tobacco items.

• No tax-free alcoholic beverages.

6. Civilian Employees of the U.S. Government working

on, but residing off of, Military Installations

• All food and beverages sold at any exchange food

activity, if consumed on post.

7. Uniformed and Non-uniformed Personnel working in

recognized welfare service organization offices within an

Activity of the Military Service

• All food and beverages sold at any exchange food

activity, if consumed on post.

8. Visitors to Military Installations • All food and beverages sold at any exchange food

activity, if consumed on post.

9. Contract Technical Services Personnel in travel status;

Army, Navy, and Air Force Academy Applicants

• When occupying Government quarters on a military

installation.

• No uniform items.

• No State tax-free tobacco items.

• No tax-free alcoholic beverages.

10. Foreign National Active Duty Officers and Enlisted

Members, when visiting U.S. Military Installations on

unofficial business

• Entitled to all exchange privileges, except that

merchandise sold to such personnel shall be

restricted to quantities required for their personal use.

• Service regulations shall govern the sale of uniform

items.

11. Service Members of the Civil Air Patrol in a travel

status and occupying Government quarters on a DoD

Installation

• For purchases other than uniforms, they shall be

identified by their current membership card, their

travel authorization, and evidence they are occupying

Government quarters on the installation.

• Purchases of uniforms, when Civil Air Patrol

membership card is shown.

• No State tax-free tobacco items.

DoDI 1330.21, July 14, 2005

ENCLOSURE 6

28

• No tax-free alcoholic beverages.

12. Civil Air Patrol Cadets • Purchases of uniforms, when Civil Air Patrol

membership card is shown.

• All food and beverage sold at any exchange food

activity, if consumed on post.

Table E6.T2. Limited Exchange Privileges - continued

CATEGORY STATUS

13. Members of the Reserve Officers

Training Corps and Junior Reserve

Officers Training Corps

• When visiting installations under orders as part of a

Service orientation program.

• No State tax-free tobacco items.

• No tax-free alcoholic beverages.

14. Members of the Naval Sea Cadet

Corps

• On 2-week summer training duty, if occupying

Government quarters on a military installation.

• No distinctive uniform items.

• No State tax-free tobacco items.

• No tax-free alcoholic beverages.

15. Coast Guard Auxiliary Members • When identified by the Coast Guard Auxiliary ID

Card, CG-2650.

• Uniform articles and accessories authorized by

Coast Guard auxiliary directives.

16. Civilian Students and Faculty

Members at Service Schools

• Books, supplies, and materials related to the

educational process, only at exchange facilities that

support the school.

17. Persons Suffering from Hardship • Exchange employees may sell to otherwise

unauthorized persons "stranded on an installation,"

small quantities of gasoline, oil, other automotive

items, or items necessary for an individual's health.

18. DoD Civilian Employees using

Government-authorized vehicles for

official business

• Gasoline for use in vehicles, upon presentation of

military travel orders that authorize the leasing or use

of the Government vehicle.

DoDI 1330.21, July 14, 2005

29 ENCLOSURE 7

E7. ENCLOSURE 7

IDENTIFICATION OF AUTHORIZED PATRONS

E7.1. POSITIVE IDENTIFICATION REQUIRED

Any individual seeking to make a purchase from an exchange shall be positively

identified as an authorized patron before completing a sale. Sales shall be made only to

authorized patrons.

E7.2. TYPES OF IDENTIFICATION REQUIRED

Authorized patrons of exchanges shall be identified by the complete regulation U.S.

military uniform, by an official Uniformed Services Identification Card (DD Form 2, DD

Form 1173, DD Form 1173-1, DD Form 2750, DD Form 2764, DD Form 2765, and the

DoD Common Access Card), by the Armed Forces Exchange Service Identification and

Privilege Card (DD Form 2574), by an official identification card issued by the Military

Service of which the patron is affiliated, or by official DoD issuances (DD Form 4, DD

Form 1610, and DD Form 1618). Specific information regarding the Armed Services

Identification Card (DD Form 2, DD Form 1173, DD Form 1173-1, DD Form 2750, DD

Form 2764, DD Form 2765, and DoD Common Access Card) is contained in DoD

Instruction 1000.13 (reference (y)). The Defense Enrollment Eligibility Reporting

System may be used to verify authorized Armed Services exchange catalog customers.

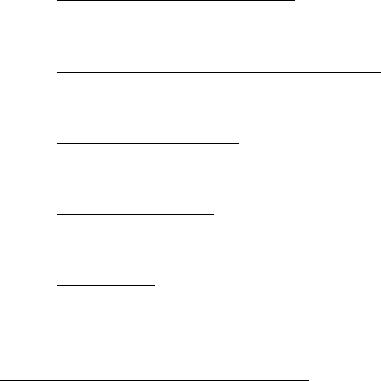

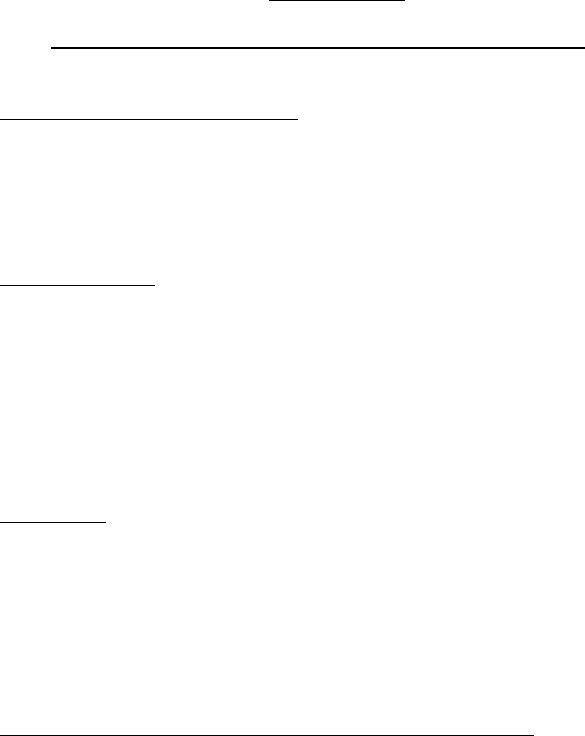

E7.3. ARMED FORCES EXCHANGE SERVICE IDENTIFICATION AND

PRIVILEGE CARD (DD FORM 2574)

The Armed Forces Exchange Service Identification and Privilege Card DD Form 2574

(See figure E7.F1., below) may only be issued to authorized patrons of exchanges who do

not otherwise require the Armed Service Identification Card for benefit or identification

purposes.

E7.1.4. PATRONS OF FOUNTAIN, SNACK BAR, AND RESTAURANT

FACILITIES

Identification cards are not required of personnel listed in subsections E6.T2.6, E6.T2.7.,

and E6.T2.8., who are authorized only to patronize fountain, snack bar, and restaurant

facilities.

DoDI 1330.21, July 14, 2005

ENCLOSURE 7

30

Figure E7.F1. Armed Forces Exchange Identification and Privilege Card, DD Form 2574

A000087

20050518 20090517

Geor

g

e P. Giles

,

NF-01

19550702 123-45-6789

BR BR 6’ 2” 185

Mae B. Br

y

ant

,

NF-03

Fort Myer, Arlington, VA

DoDI 1330.21, July 14, 2005

31 ENCLOSURE 8

E8. ENCLOSURE 8

EXCHANGE OPERATIONS ON CLOSED INSTALLATIONS

E8.1. REALIGNMENT AND CLOSURE

Where military realignment and installation closure costs adversely impact exchange

earnings, affected exchanges are authorized to receive APF. Where permitted by law,

this includes all Base Realignment and Closure (BRAC) accounts.

E8.2. BRAC FUNDING

Exchange programs may receive BRAC funding for expenses affecting personnel

(civilian severance pay, civilian PCS, outplacement, transportation of things, etc.) to the

extent authorized by reference (f). When NAF facilities are transferred in connection

with the closure or realignment of a military installation, exchanges may also receive

funding from the Reserve Account up to the depreciated value of the investment. Use of

funds from the Reserve Account is specified in reference (j).

E8.3. PROPERTY

Exchange service NAF personal property is not Government APF property. At BRAC

locations, this NAF property may be removed or sold to the local redevelopment

authority for fair market value at the exchange service's discretion. Every effort should

be made to ensure that the local redevelopment authority is aware of the difference

between NAF and APF property.

E8.4. EXCHANGE OPERATIONS ON CLOSED INSTALLATIONS

Exchange operations may be provided to patrons in the immediate area of closed

installations in the United States, its territories and possessions under specific criteria.

E8.4.1. Exchange operations are authorized on closed installations based on either

Reserve component or active duty patron bases remaining on the closed installation, or in

the immediate vicinity.

E8.4.2. Main exchange and other major exchange operations on closed installations

shall be endorsed by the Secretary of the Military Department concerned and approved

by the PDUSD(P&R). The exchange Service Commander shall approve troop stores,

concessions, food, and shoppette-type operations on closed installations after a final

decision from the Military Department.

DoDI 1330.21, July 14, 2005

ENCLOSURE 8

32

E8.4.3. The general criteria for continuation of exchange operations on closed

installations in the United States are:

E8.4.3.1. The needs and welfare of the remaining active duty military community

shall be given primary consideration.

E8.4.3.2. The installation no longer has a full-time active duty mission, but active

duty Uniformed Service personnel remain on the former installation or in the immediate

area. This includes the actual installation and Government-owned or contracted housing.

E8.4.3.3. The Military Department shall confirm the number of active duty

personnel who shall be stationed on and in the immediate area of the closed installation

after the installation is closed. Active duty personnel are Uniformed Service personnel

with DD Form 2 (Active) identification cards.

E8.4.3.4. Where possible, as determined by the Military Department, the

exchange operations shall complement the local community reuse plan and have written

community support from the local government(s) in the immediate area surrounding the

closed installation.

E8.4.3.5. The closed installation shall be over 20 miles from another active

installation or a Government-owned or contracted housing area that is authorized

exchange support. If the active installation is fewer than 20 miles from the closed

installation, the active installation's exchange shall be able to accommodate the additional

patron migration.

E8.4.3.6. Requirements for facilities and programs shall consider that all

authorized patrons (including Reserve components and retirees) may continue to use the

exchange programs.

E8.4.3.7. New construction or expansion of an existing facility on a closed

installation should not be required. This does not preclude renovations, maintenance and

repair, and minor construction on existing facilities when justified. Exceptions to allow

major construction shall be approved by the PDUSD(P&R) and forwarded to Congress

for approval, as required.

E8.4.4. In addition to the foregoing criteria, the PDUSD(P&R) shall approve main

exchanges and other exchange operations for closed and realigned installations with a

predominant Reserve Force, based on the following specific criteria, if the exchange

operations:

E8.4.4.1. Provide an otherwise unavailable benefit to a substantial number of

authorized patrons remaining in the area.

DoDI 1330.21, July 14, 2005

ENCLOSURE 8

33

E8.4.4.2. Require no APF. Exchanges are authorized to receive support for

common services normally provided, such as police and fire protection.

E8.4.4.3. Complement the local community reuse plan and have local community

support.

E8.4.4.4. Require a Reserve Force as part of the patron complement, based on the

Reserves' entitlement to full exchange privileges.

E8.4.4.5. Do not require new construction or expansion of an existing building.

Renovations and minor construction on existing buildings are allowable, when justified.

E8.4.5. All exchange operations on closed installations shall undergo a 1-year test

period to establish profitability. For operations that are not profitable, the exchange

service shall take action to achieve profitability. Any operation with a loss for any 2

consecutive years or with a loss for 2 out of 3 years shall close.

E8.5. COMBINED COMMISSARY AND EXCHANGE STORES ON CLOSED

INSTALLATIONS

Before evaluating a combined store, the Secretary of the Military Department concerned

shall decide if a "limited commissary benefit" shall be supported at the location. A

"limited commissary benefit" is defined as grocery (edible) food items sold at cost plus 5

percent to authorized exchange patrons. Where the Military Department(s) supports a

"limited commissary benefit" (including the associated APF costs) and an exchange and

commissary already operate at the location, an exchange-operated combined commissary

and exchange store shall be evaluated by the Armed Service exchange that operates at the

location.

E8.5.1. A recommendation to create a combined store shall be based on the

following criteria, which apply to all models of combined stores operated by the Military

Department, except those specifically excluded by or under an agreement in effect before

the enactment of 10 U.S.C. 2490a (reference (z)):

E8.5.1.1. Active duty personnel remain on the installation or within a 20 mile

radius of an installation.

E8.5.1.2. The closest installation with an active duty mission, or a Federal

Government-owned or contracted housing area that has commissary and exchange

support is a one-way distance of at least 20 miles away. If the one-way distance is fewer

than 20 miles, and the commissary and exchange are able to accommodate the additional

patron migration, a combined store shall not be considered.

E8.5.1.3. In the case of a closed installation:

DoDI 1330.21, July 14, 2005

ENCLOSURE 8

34

E8.5.1.3.1. Where possible, as determined by the Secretary concerned, the

combined store must complement the local reuse plan and have written support from the

local government(s) immediately surrounding the closed installation.

E8.5.1.3.2. Space must be available in an existing facility. New construction

or expansion of an existing facility on a closed installation shall not be required.

Renovations, maintenance and repair, and minor construction on existing facilities are

allowable, when justified. Exceptions to allow major construction shall be approved by

the PDUSD(P&R).

E8.5.1.3.3. Requirements for facilities and programs shall consider that all

authorized patrons (including Reservists and retirees) may continue to use MWR and

resale programs.

E8.5.1.4. The number of combined stores in the United States shall not exceed

ten.

E8.5.1.5. Only an Armed Service Exchange may operate a combined store.

E8.5.1.6. Edible groceries shall be sold at cost plus 5 percent. Other items may be

priced in conformance with paragraph 4.10. of reference (b).

E8.5.1.7. The combined store shall be economically viable and shall not

negatively impact MWR dividends, after authorized APF is provided, as discussed below.

E8.5.1.7.1. The cost for the combined grocery store operation must yield at

least a 10 percent annual savings compared to the cost for the Defense Commissary

Agency (DeCA) to operate a downscaled commissary. All operating costs, including

facility, equipment and manpower, both one-time and recurring, that are required shall be

considered when making this comparison.

E8.5.1.7.2. DeCA and the Military Department(s) shall provide APF to the

Armed Service Exchange for the combined store only if the grocery operation suffers a

net loss during the Federal fiscal year, provided that there is an annual loss from all

exchange-operated activities at the installation. The annual APF support shall be limited

to 25 percent of the last full fiscal year of DeCA's cost to operate the commissary store at

that location. Within the limitations, the amount shall be based on a pro rata share of:

E8.5.1.7.2.1. Store-specific costs determined by the percentage of store

sales associated with edible grocery items; plus,

E8.5.1.7.2.2. "Above the store level" overhead (exclusive of MWR

dividends) that shall not exceed 2.5 percent of edible grocery item sales.

DoDI 1330.21, July 14, 2005

ENCLOSURE 8

35

E8.5.2. The combined store operation shall be reviewed annually by the Military

Departments and the Commissary Operating Board (COB) to ensure that criteria are still

met. A combined store operation with a loss for two consecutive years or with a loss for

2 out of 3 years shall close. If the location is closed as a combined store operation, the

exchange may reestablish the operation as a stand alone independent exchange selling all

merchandise including food at regular exchange mark-ups provided it conforms to

section E8.4. and paragraphs E8.5.4. and E3.3.1. If an operation reopened as an

independent exchange continues to post a loss, the exchange and the host military Service

shall determine the continuance of the operation.

E8.5.3. Based on the above analysis, the Director of DeCA, following coordination

with the Military Department(s) and the Armed Service Exchange concerned, shall

provide a recommendation to the COB regarding the need to close or to create a

combined store. The COB shall forward its recommendation to the PDUSD(P&R). A

decision to close or create a combined store must be approved by the PDUSD(P&R).

The PDUSD(P&R) shall notify the Congress 90 days before action is taken.

E8.5.4. If a "limited commissary benefit" is not warranted at the location, then the

Armed Service Exchange may elect to sell edible food items at the location, but APF

support designated for commissaries shall not be provided to offset the exchange cost of

selling edible groceries

E8.6. REPORTING REQUIREMENTS

The Military Departments, DeCA, and the COB shall submit their recommendations,

along with the "DoD Commissary Operations Report" (Report Control Symbol DD-

FM&P(A)1187) required by DoD Directive 1330.17 (reference (aa)), to the

PDUSD(P&R) by April 1

st

of each year.

DoDI 1330.21, July 14, 2005

ENCLOSURE 9

36

E9. ENCLOSURE 9

EXCHANGE RESOURCE ELEMENTS AUTHORIZED APPROPRIATED FUND

(APF) SUPPORT

E9.1. MILITARY PERSONNEL

Active duty military personnel performing ECECS in sufficient numbers for military

exchanges to provide a trained cadre to meet wartime and deployment requirements and

to perform managerial functions.

E9.2. HUMAN RESOURCES OFFICE ASSISTANCE OR ADMINISTRATION

The human resources office (appropriated) may provide technical advice and counsel,

and day-to-day personnel administration when no additional incremental APF costs are

incurred.

E9.3. TRAVEL OF PERSONNEL

E9.3.1. PCS relocation of military and APF civilian personnel assigned on a full-time

basis.

E9.3.2. Temporary Duty (TDY and/or TAD) travel for military and APF civilian

personnel, and for exchange employees when directed by the Department of Defense.

E9.3.3. Use of Government vehicles (owned, leased, or contracted) to assist in

ECECS.

E9.4. TRANSPORTATION OF THINGS

E9.4.1. APF purchased goods.

E9.4.2. NAF purchased goods:

E9.4.2.1. Transoceanic movement of goods to and from overseas and aerial ports

of debarkation to first destination OCONUS.

E9.4.2.2. Movement of U.S. and foreign goods within foreign areas when

commercial transportation is not available, in combat zones, or otherwise on a

reimbursable basis only.

DoDI 1330.21, July 14, 2005

ENCLOSURE 9

37

E9.4.2.3. Movement of U.S. goods between DoD installations because of base

closures, or to safeguard goods under emergency conditions, such as the threat of hostile

force or natural disaster.

E9.4.2.4. Household goods of military personnel and APF civilian personnel.

E9.4.2.5. Household goods of NAF personnel on a reimbursable basis. Initial

APF funding is authorized for NAF personnel only when NAF shall reimburse (except at

BRAC locations that are authorized APF).

E9.5. UTILITIES

(including fuel)

E9.5.1. Buildings on military installations used for exchange activities.

E9.5.2. Other exchange activities for members of the Armed Forces.

E9.6. COMMUNICATIONS

E9.6.1. Electronic communications in support of command management functions,

statistical data gathering, and communications with other DoD and Government

Agencies.

E9.6.2. Electronic communication in support of exchange activities OCONUS.

E9.6.3. Postal services for official communications within and between Government

Agencies, persons, and private commercial agencies not related to the sale of goods and

services.

E9.6.4. Printing and reproduction services excluding those services directly relating

to the sale of merchandise or services, or to the internal operation of the exchanges.

E9.7. EQUIPMENT

Equipment required for ECECS, and surplus/excess Government equipment.

E9.8. EQUIPMENT MAINTENANCE

Equipment acquired with NAF, but authorized for purchase with APF where the title

transfers to the Government.

DoDI 1330.21, July 14, 2005

ENCLOSURE 9

38

E9.9. OTHER SERVICES

E9.9.1. Education and training of military and APF personnel. APF may be used to

fund NAF employee courses for DoD Component-approved training that is not job

unique; examples include, but are not limited to, courses on management and/or leader