NOTIFICATION

to the

BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM

by

CAPITAL ONE FINANCIAL CORPORATION

in connection with the acquisition of

DISCOVER FINANCIAL SERVICES AND ITS NONBANKING SUBSIDIARIES

pursuant to Sections 4(c)(8) and 4(j)

of the Bank Holding Company Act of 1956, as amended

and Section 225.24 of Regulation Y

March 20, 2024

Board of Governors of the Federal Reserve System

Notification by a Bank Holding Company to Acquire a

Nonbank Company and/or Engage in Nonbanking Activities

Capital One Financial Corporation

Corporate Title of Notificant

1680 Capital One Drive

Street

McLean

City

Virginia

State

22102

Zip Code

Hereby provides the Board with a notice pursuant to:

(1) Section 4(c)(8) and 4(j) of the Bank Holding Company Act of 1956, as amended (“BHC Act”— 12 U.S.C. 1843), under

the “Expedited action for certain nonbanking proposals by well-run bank holding companies” as described in section

225.23 of Regulation Y; or

(2) Section 4(c)(8) and 4(j) of the BHC Act, under the “Procedures for other nonbanking proposals” as described in section

225.24 of Regulation Y;

for prior approval to engage directly or indirectly in certain nonbanking activities, de novo, through acquisition of the assets of a

going concern, or through direct or indirect ownership, control, or power to vote at least 100% of the voting shares of:

DFS Services LLC (primarily engaged in financial data processing, including payments, lending and related servicing)

Corporate Title of Company to be Acquired and/or Description of Nonbanking Activity

2500 Lake Cook Road

Street

Riverwoods Illinois 60015

City State Zip Code

Discover Financial Services (Canada), Inc. (primarily engaged in financial data processing, including payments)

Corporate Title of Company to be Acquired and/or Description of Nonbanking Activity

Three Bentall Center, 595 Burrard St., Suite 2600

Street

Vancouver British Columbia, Canada V7X1L3

City State Zip Code

PULSE Network LLC

(engaged i

n

financial data processing, including payments)

Corporate Title of Company to

be

Acquired

and/or Description

of Nonbanking

Activity

1301 McKinn

ey, Suite 600

Street

Houston Texas 77010

City State Zip Code

Diners Club

International Ltd.

(p

rimarily engaged in

financial data processing, including

payments, lending and related servicing)

Corporate Title of Company to

be

Acquired

and/or Description

of Nonbanking

Activity

2500 Lake C

ook Road

Street

Riverwoods Illinois 60015

City State Zip Code

Diners Club Services Private Ltd.– India (primarily engaged in financial data processing, including payments)

Corporate Title of Company to be Acquired and/or Description of Nonbanking Activity

Level 1, First International Financial Centre, Plot No C-54 and C-55 G Block

Street

Mumbai India 400051

City State Zip Code

Diners Club Services Taiwan Ltd. (engaged in

financial

data

processing, including payments)

Corporate Title of Company to

be

Acquired

and/or Description

of Nonbanking

Activity

15-2, No. 1

68, Sec. 3, Nanjing E. Rd

Street

Taipei Taiwan

N

/A

City State Zip Code

Does Notificant request confidential treatment for any portion of this submission?

Yes

As required by the General Instructions, a letter justifying the request for confidential treatment is included.

The information for which confidential treatment is being sought is separately bound and labeled “CONFIDENTIAL.”

No

Public Reporting Burden for this collection of information is estimated to average 0.5

hours for a post-consummation notification, 5 hours for an expedited notification, and

12 hours for a complete notification, including the time to gather and maintain data in

the required form, to review instructions, and to complete the information collection.

Send comments regarding this burden estimate or any other aspect of this collection of

information, including suggestions for reducing this burden to: Secretary, Board of

Governors of the Federal Reserve System, 20th and C Streets, N.W., Washington,

D.C. 20551; and to the Office of Management and Budget, Paperwork Reduction

Project (7100-0121), Washington, D.C. 20503. The Federal Reserve may not

conduct or sponsor, and an organization or a person is not required to respond to a

collection of information unless it displays a currently valid OMB control number.

Name, title, address, telephone number and facsimile number of person(s) to whom inquiries concerning this notification may be directed:

Rosemary Spaziani, Esq.

Wachtell, Lipton, Rosen & Katz, 51 W. 52

nd

Street, New York, NY 10019

(212) 403-1342, (212) 403-2354 (fax)

with a copy to:

Richard K. Kim, Esq.

Wachtell, Lipton, Rosen & Katz, 51 W. 52

nd

Street, New York, NY 10019

(212) 403-1354, (212) 403-2354 (fax)

Certification

I certify that the information contained in this notification has been

examined carefully by me and is true, correct, and complete, and is current

as of the date of this submission to the best of my knowledge and belief.

I acknowledge that any misrepresentation or omission of a material fact

constitutes fraud in the inducement and may subject me to legal sanctions

provided by 18 USC 1001 and 1007.

I also certify, with respect to any information pertaining to an individual

and submitted to the Board in (or in connection with) this notification, that

the notificant has the authority, on behalf of the individual, to provide such

information to the Board and to consent or to object to public release of

such information. I certify that the notificant and the involved individual

consent to public release of any such information, except to the extent set

forth in a written request by the notificant or the individual, submitted in

accordance with the Instructions to this form and the Board’s Rules

Regarding Availability of Instructions to this form

and the Board’s Rules Regarding Availability of Information (12 CFR

Part 261), requesting confidential treatment for the information.

I acknowledge that approval of this notification is in the discretion of

the Board of Governors of the Federal Reserve System (the “Federal

Reserve”). Actions or communications, whether oral, written, or

electronic, by the Federal Reserve or its employees in connection with

this filing, including approval if granted, do not constitute a contract,

either express or implied, or any other obligation binding upon the

agency, the United States or any other entity of the United States, or

any officer or employee of the United States. Such actions or

communications will not affect the ability of the Federal Reserve to

exercise its supervisory, regulatory, or examination powers under

applicable laws and regulations. I further acknowledge that the

foregoing may not be waived or modified by any employee or agency

of the Federal Reserve or of the United States.

Signed this ____ _______ day of _March_______________, _2024_.

20th

Signature of Chief Executive Officer or Designee

Typed Name and Title

Matthew Cooper, General Counsel & Corporate Secretary

TABLE OF CONTENTS

Page

Introductory Statement.....................................................................................................................2

Overview of the Proposed Transaction

Permissibility of the Discover Nonbanking Companies Acquisition under the BHC

......................................................................................3

Required Approvals ...................................................................................................................3

Act ........................................................................................................................................4

Financial and Managerial Resources .........................................................................................5

Management ...............................................................................................................................9

Impact on Competition ............................................................................................................23

Public Benefits of the Acquisition ...........................................................................................24

Conclusion .....................................................................................................................................25

Information Required by Section 225.23 of Regulation Y............................................................26

Exhibits ..........................................................................................................................................28

Confidential Exhibits .....................................................................................................................28

-i-

Request for Confidential Treatment

Confidential treatment is being requested under the federal Freedom of Information Act,

5 U.S.C. § 552 (the “FOIA”), and the implementing regulations of the Board of Governors of the

Federal Reserve System (the “Federal Reserve”), for the information contained in the

Confidential Exhibits Volume to this application (the “Confidential Materials”). The

Confidential Materials include, for example, nonpublic pro forma financial information and

information regarding the business strategies and plans of (1) Capital One Financial Corporation

(“COFC”), Vega Merger Sub, Inc. (“Merger Sub”) and Capital One, National Association

(“CONA”) and (2) Discover Financial Services (“Discover”) and Discover Bank (“Discover

Bank”), and other information regarding additional matters of a similar nature, which is

commercial or financial information that is both customarily and actually treated as private by

COFC, Merger Sub, CONA, Discover and Discover Bank and provided to the government under

an assurance of privacy. Certain information in the Confidential Materials also includes

“confidential supervisory information” as defined in the Federal Reserve’s regulations at 12 CFR

§ 261.2, which is protected from disclosure. None of this information is the type of information

that would otherwise be made available to the public under any circumstances. All such

information, if made public, could result in substantial and irreparable harm to COFC, Merger

Sub, CONA, Discover and Discover Bank. Other exemptions from disclosure under the FOIA

may also apply. In addition, investors and potential investors could be influenced or misled by

such information, which is not reported in any documents filed or to be filed in accordance with

the disclosure requirements of applicable securities laws, as a result of which COFC, Merger

Sub, CONA, Discover and Discover Bank could be exposed to potential inadvertent violations of

law or exposure to legal claims. Accordingly, confidential treatment is respectfully requested for

the Confidential Materials under the FOIA and the Federal Reserve’s implementing regulations.

Please contact Rosemary Spaziani (212-403-1342) or Richard K. Kim (212-403-1354)

before any public release of any of this information pursuant to a request under the FOIA or a

request or demand for disclosure by any governmental agency, congressional office or

committee, court or grand jury. Such prior notice is necessary so that COFC, Merger Sub,

CONA, Discover and Discover Bank may take appropriate steps to protect such information

from disclosure.

-1-

Introductory Statement

This Notification to the Board of Governors of the Federal Reserve System (the “Federal

Reserve”), pursuant to Section 4(c)(8) and 4(j) of the Bank Holding Company Act of 1956, as

amended

1

(the “BHC Act”), relates to the acquisition by Capital One Financial Corporation,

McLean, Virginia (“COFC”, together with its subsidiaries, “Capital One” or the “Company”) of

Discover Financial Services (“Discover”) and its subsidiaries (excluding Discover Bank and

Discover Bank’s subsidiaries) (the “Discover Nonbanking Companies”) via a merger of

Discover with and into COFC with a multi-step transaction (the “Proposed Transaction”).

The organizational chart provided in Exhibit 1 sets forth the entities that Capital One is

acquiring pursuant to the Proposed Transaction and highlights those Discover Nonbanking

Companies, which are related to this Notification. As detailed in Exhibit 2, Discover

Nonbanking Companies engage in permissible payment activities permissible under Section

4(c)(8) of the BHC Act and Subpart C of Regulation Y, as having been determined to be so

closely related to banking as to be a proper incident thereto. Capital One is requesting prior

Board approval under Section 4(c)(8) of the BHC Act to acquire the Discover Nonbanking

Companies.

The Discover Nonbanking Companies operate the Discover Network, the PULSE

network (“PULSE”) and Diners Club International (“Diners Club”), collectively known as the

“Discover Global Network.” The Discover Network processes transactions for Discover-

branded credit and debit cards and provides payment processing and settlement services. PULSE

operates an electronic funds transfer network, providing financial institutions issuing debit cards

on the PULSE network with access to ATMs domestically and internationally, as well as

merchant acceptance throughout the United States for debit card transactions. Diners Club is a

global payments network of licensees, which are generally financial institutions, that issue

Diners Club branded charge cards and/or provide card acceptance services. Discover provides

Diners Club licensees with payment processing and settlement services for transactions, as well

as a centralized service center and technological services.

With the acquisition of the Discover Nonbanking Companies, Capital One will scale and

leverage the benefits its eleven-year technology transformation across the Discover payments

network to provide customers and merchants expanded products and services within Capital

One’s robust risk management framework.

For the reasons discussed in this Notification, Capital One respectfully submits that the

acquisition of the Discover Nonbanking Companies fully satisfies the statutory factors that the

Federal Reserve is required to consider under the BHC Act and that the acquisition of the

Discover Nonbanking Companies merits the Board’s approval.

1

12 U.S.C. § 1843(c)(8).

-2-

Overview of the Proposed Transaction

COFC, Merger Sub and Discover entered into the Agreement and Plan of Merger on

February 19, 2024 (the “Agreement”), for COFC to acquire Discover through a merger and,

thereby indirectly acquire Discover Bank. Each outstanding share of Discover’s common stock

(“Discover Common Stock”) will be converted into the right to receive 1.0192 shares (the

“Exchange Ratio”) of COFC common stock (the “COFC Common Stock”). Each outstanding

share of Discover preferred stock will be converted into the right to receive one share of a newly

created series of COFC preferred stock having materially the same terms as the applicable series

of Discover preferred stock.

In the Proposed Transaction, there will be three mergers, all part of a single, integrated

transaction. First, Merger Sub will merge with and into Discover, with Discover continuing as

the surviving corporation to effectuate the “First Step Merger.” Immediately following the First

Step Merger, the “Second Step Merger” will occur in which Discover will merge with and into

COFC, with COFC continuing as the surviving corporation and, following the Second Step

Merger, the separate corporate existence of Discover will cease. Immediately following the

Second Step Merger, the Bank Merger will take place in which Discover Bank will merge with

and into CONA, with CONA continuing as the surviving entity and the separate corporate

existence of Discover Bank will cease to exist.

See the summary of terms of the Proposed Transaction provided in Exhibit 3.

On consummation of the Proposed Transaction, the subsidiaries of Discover Bank will

become subsidiaries of CONA and the other direct and indirect subsidiaries of Discover will

become direct or indirect subsidiaries of COFC. In Exhibit 1, please find the current

organizational chart of Discover, which sets forth the entities to be acquired by Capital One,

including the Discover Nonbanking Companies described in Exhibit 2. In Confidential Exhibit

A, please find a pro forma organizational chart of COFC.

The Proposed Transaction will substantially enhance Capital One’s ability to distribute its

broad suite of consumer and business banking products and services, and better position the

combined organization to compete with the largest banking organizations in the United States.

Required Approvals

An application to the Federal Reserve by COFC and Merger Sub, requesting approval

to acquire Discover and thereby Discover Bank, pursuant to sections 3(a)(3) and (5)

of the BHC Act, and section 225.15 of Regulation Y (the “FRB Application”);

An application to the OCC for prior approval for Discover Bank to merge with and

into CONA, with CONA as the surviving institution, pursuant to the Bank Merger

Act and to operate Discover Bank’s branch as a licensed branch of CONA pursuant to

-3-

the Bank Merger Act, section 36(d) of the National Bank Act and the OCC’s

implementing regulations (the “OCC Application”);

2

and

An application to the Delaware State Bank Commissioner for prior approval to

acquire control of Discover Bank immediately prior to the Bank Merger, pursuant to

Title 5 Del. C. § 843, and for a waiver of the 30% state deposit concentration limit

pursuant to Title 5 Del. C. § 795H.

Permissibility of the Discover Nonbanking Companies Acquisition under the BHC Act

Section 4(c)(8) of the BHC Act permits a bank holding company to acquire “shares of

any company the activities of which had been determined by the Board by regulation or order

under this paragraph as of the day before November 12, 1999, to be so closely related to banking

as to be a proper incident thereto (subject to such terms and conditions contained in such

regulation or order, unless modified by the Board).”

3

Section 225.28(b) of the Board’s

Regulation Y sets forth a list of activities that the Board has previously determined to be

permissible under Section 4(c)(8). Among the permissible activities are those engaged in by the

Discover Nonbanking Subsidiaries, namely:

Payments and data processing, permissible under 12 CFR § 225.28(b)(14); and

Extensions of credit, loan servicing and other activities related thereto, permissible

under 12 CFR § 225.28(b)(1)-(2).

Certain of the Discover Nonbanking Companies are also engaged in providing services to

affiliates, as permissible under 12 CFR § 225.22(b). Based on the diligence it has conducted to

date, Capital One understands that the activities and investments of the Discover Nonbanking

Companies are permissible for bank holding companies. Please refer to Exhibit 2 for additional

information on which activities are conducted in each of the Discover Nonbanking Subsidiaries.

In considering a proposal by a bank holding company to acquire a nonbank company, the

Board is required under Section 4(j)(2)(A) of the BHC Act to consider whether the proposal “can

reasonably be expected to produce benefits to the public that outweigh possible adverse effects,

such as undue concentration of resources, decreased or unfair competition, conflicts of interest,

unsound banking practices or risk to the stability of the United States banking or financial

system.”

4

As part of its consideration of these factors, the Board also reviews the financial and

managerial resources of the companies involved, the effect of the proposal on competition in the

relevant markets and the public benefits of the proposal. As discussed below, Capital One

submits that the proposed acquisition by Capital One of the Discover Nonbanking Companies

satisfies all of the factors that the Board is required to consider under the BHC Act.

2

12 U.S.C. §§ 24, 36(d), 1828(c) and 1831u; 12 CFR §§ 5.33 and 5.34. This OCC Application will also cover the

operating subsidiaries of the Bank Merger.

3

12 U.S.C. § 1843(c)(8).

4

12 U.S.C. § 1843(j)(2)(A) (as amended by Section 604(e) of the Dodd Franke Act, effective July 21, 2011).

-4-

Financial and Managerial Resources

The Proposed Transaction will introduce the Discover Global Network to Capital One.

Currently, Discover processes approximately 5% of total debit purchase volume and 4% of total

credit purchase volume in the United States. Capital One expects to utilize its strong credit card

issuance platform to drive increased volume to the Discover Global Network, which, coupled

with expected additional investments in the Discover Global Network, position the Discover

Global Network to compete more effectively with Visa, Mastercard, and Amex.

Capital One has strong financial, capital, liquidity and managerial resources, including a

robust risk management framework (“RMF”), that will enable it to consummate the Proposed

Transaction, successfully integrate the operations of Discover into Capital One and Discover

Bank into CONA, and ensure the continued safe and sound operation of Capital One, including

the Discover Nonbanking Companies, going forward.

Senior management of Capital One will continue to take steps to ensure that COFC

maintains suitable capital planning, liquidity management, managerial resources, corporate

governance, enterprise risk management programs, compliance and technological infrastructure

commensurate with its size, complexity, risk profile, and scope of operations and otherwise meet

the Federal Reserve’s and OCC’s supervisory expectations. As a Category III organization

under the Federal Reserve’s prudential standards for large bank holding companies (Regulation

YY, 12 CFR part 252), COFC has already been subject to enhanced prudential supervisory

standards, including the Supplementary Leverage Ratio, Countercyclical Capital Buffer

requirements of the banking agencies’ regulatory capital rules, company-run capital stress testing

and single counterparty credit limits, as well as the liquidity coverage ratio requirement (the

“LCR”) and net stable funding requirement (the “NSFR”) and resolution planning requirements.

5

COFC has satisfactorily met all these requirements and standards and will continue to have the

governance, infrastructure and systems to meet all the relevant regulatory requirements and

supervisory expectations for a Category III banking organization. Furthermore, the Proposed

Transaction will have the effect of bringing the assets, liabilities and operations of the Discover

organization under the heightened requirements applicable to Category III organizations,

described above.

A. Financial, Capital and Liquidity Strength

Since January 1, 2020, the federal banking agencies’ capital and liquidity rules classify

all banking organizations with $100 billion or more in total consolidated assets into one of four

categories (Category I, II, III or IV), based on the banking organization’s asset size and risk

profile, with the most stringent capital and liquidity requirements applicable to Category I firms

and the least restrictive requirements applying to Category IV firms. Based on this regulatory

framework, COFC currently qualifies as a Category III organization. Following the Proposed

Transaction, COFC will have approximately $646 billion in total consolidated assets and will

remain well under $75 billion in cross-jurisdictional activity. Capital One would become subject

5

See Prudential Standards for Large Bank Holding Companies, Savings and Loan Holding Companies, and Foreign

Banking Organizations, 84 Fed. Reg. 59032 (Nov. 1, 2019).

-5-

to Category II standards if it has $700 billion or more in total consolidated assets or $75 billion

or more in cross-jurisdictional activity, each as measured based on the average for the four most

recent calendar quarters.

6

Accordingly, upon consummation of the Proposed Transaction, the

combined organization will continue to be a Category III firm. Capital One understands the

additional regulatory requirements applicable to Category II firms and will be prepared to meet

such additional requirements to the extent future growth results in Capital One exceeding the

applicable thresholds for classification as a Category II firm.

Capital. Capital One employs comprehensive and rigorous capital planning and capital

stress testing programs, and the acquired operations of Discover will be covered by these

effective programs. The respective capital and leverage ratios of COFC, CONA, Discover and

Discover Bank exceed the minimum ratios necessary for “well capitalized” status and, on

consummation of the Proposed Transaction, the capital ratios and leverage ratios of COFC and

CONA are projected to exceed the required minimum levels necessary for “well capitalized”

status and meet supervisory expectations. The Proposed Transaction is expected to result in a

holding company and bank with stronger financial and operating metrics, and increased

profitability and scale that will permit the combined organization to better compete against the

largest banking organizations and larger regional banking organizations in the United States.

Liquidity. COFC and CONA are subject to the LCR as implemented by the Federal

Reserve and OCC (the “LCR Rule”).

7

The LCR Rule requires each of COFC and CONA to hold

an amount of eligible high quality liquid assets that equals or exceeds 100% of its respective

projected adjusted net cash outflows over a 30-day period, each as calculated in accordance with

the LCR Rule. As a Category III institution with less than $75 billion in weighted average short-

term wholesale funding, COFC’s and CONA’s total net cash outflows are subject to an outflow

adjustment percentage of 85%. The LCR Rule requires each of COFC and CONA to calculate

its respective LCR daily.

The NSFR requires COFC and CONA to maintain an amount of available stable funding,

which is a weighted measure of a company’s funding sources over a one-year time horizon,

calculated by applying standardized weightings to equity and liabilities based on their expected

stability, that is no less than a specified percentage of its required stable funding, which is

calculated by applying standardized weightings to assets, derivatives exposures and certain other

items based on their liquidity characteristics. As a Category III institution, COFC and CONA

are each required to maintain available stable funding in an amount at least equal to 85% of its

required stable funding.

Capital One maintains a robust liquidity risk management program and manages liquidity

risk at the consolidated company level to help ensure that it (1) can obtain cost-effective funding

to meet current and future obligations under both normal “business as usual” and stressful

circumstances, and (2) maintains an appropriate level of contingent liquidity. Management

monitors liquidity through a series of early warning indicators that may indicate a potential

market or Capital One-specific liquidity stress event, performs liquidity stress tests over multiple

6

12 CFR §§ 252.2 and 252.5.

7

12 CFR § 50 (OCC) and 12 CFR § 249 (Federal Reserve).

-6-

time horizons with varying levels of severity, and maintains a contingency funding plan to

address a potential liquidity stress event. Capital One’s liquidity guidelines and liquidity-related

risk limits are established at an enterprise level, as well as managed and monitored at various

entity levels, including CONA. Capital One’s liquidity risk management program will cover the

acquired operations of Discover and Discover Bank on consummation of the Proposed

Transaction. Substantial focus has been placed by regulators, the markets and, the banks

themselves on a bank’s level of insured deposits in absolute terms and relative to total deposits.

CONA’s insured deposits would be approximately 79% of its total deposits, which is expected to

be the highest insured deposit percentage amongst the 10 largest U.S. banks.

Resolution Planning. COFC is a Category III organization for purposes of the Federal

Reserve’s resolution planning requirements

8

and CONA is an insured depository institution with

more than $50 billion in total assets that is subject to the FDIC’s resolution planning

requirements.

9

Following consummation of the Proposed Transaction, COFC will continue to be

a Category III organization, subject to the Federal Reserve’s resolution planning rules, and

CONA will continue to be subject to the FDIC’s resolution planning rules.

Capital One does not expect that the Proposed Transaction will make COFC or CONA

materially more difficult to resolve if they fail or experience financial distress. The Proposed

Transaction does not involve the acquisition or assumption of complex assets or liabilities.

Although Capital One will have a larger asset base after consummation of the Proposed

Transaction, approximately 99% of the combined organization’s total assets will be held by or

through CONA. The introduction of the new operations, legal entities, and activities related to

the Discover Global Network is not expected to increase the relatively low level of complexity of

Capital One’s operations from a resolution standpoint especially given that the Discover Global

Network could be viewed as a standalone and marketable asset.

Capital One anticipates that its existing resolution planning processes and governance

framework, including ongoing enhancements designed to address regulatory rules and

expectations, are appropriate to incorporate Discover, including the Discover Global Network,

into Capital One’s resolution and recovery planning strategy. Discover’s most significant

business lines and the significant majority of its assets and liabilities consist of activities at

Discover Bank, namely credit card lending and direct banking. Capital One has extensive

existing operations, expertise and experience, including extensive resolution planning experience

with respect to those activities. The services provided by the Discover Global Network to

CONA’s material entities and core business lines will be appropriately mapped and evaluated as

part of Capital One’s resolution strategy. Capital One is currently evaluating the impact of the

Proposed Transaction on its resolution plans and resolution strategy, and expects to submit

interim updates to its resolution plans within a reasonable timeframe following the

consummation of the Proposed Transaction.

8

See Regulation QQ, 12 CFR part 243.

9

See 12 CFR § 360.10.

-7-

B. Managerial Resources

COFC has a diverse, highly accomplished and experienced Board of Directors and senior

executive management team, which provide it with outstanding managerial resources to ensure

its safe and sound operation.

Boards of Directors

COFC. The COFC Board of Directors and management will evaluate the proposed

composition of the Board of COFC following the Proposed Transaction, considering the

appropriate size, skill sets, geographic representation, diversity as well as other governance

considerations. The Board of COFC will add three members of the Discover Board of Directors

and expand from 12 to 15 directors. These individuals will be named at a later date.

The independent directors of the COFC Board (the “Independent Directors”), each year in

conjunction with the Board of Directors’ self-assessment, evaluate the continued effectiveness of

its leadership structure in the context of Capital One’s specific circumstances, culture, strategic

objectives, and challenges.

The Board of Directors has determined that the existing leadership structure with a

combined Chairman/CEO and a Lead Independent Director provides the most effective

governance framework and allows Capital One to benefit from Mr. Fairbank’s talent, knowledge,

and leadership as the founder of Capital One and allows him to use the in-depth focus and

perspective gained in running Capital One to effectively and efficiently lead the Board. As CEO,

Mr. Fairbank oversees Capital One’s day-to-day operations and strategic planning, and as

Chairman of the Board he leads the Board in its oversight role, including with respect to strategic

matters and risk management.

COFC and the Board of Directors also benefit from an active and empowered Lead

Independent Director who provides strong, independent leadership for the Board. Recognizing

the importance of independent perspectives to the Board to balance the combined Chairman and

CEO roles, Capital One appropriately maintains strong independent and effective oversight of its

business and affairs through its Lead Independent Director; fully-independent Board committees

with independent chairs that oversee Capital One’s operations, risks, performance, compliance

and business strategy; experienced and committed directors; and regular executive sessions.

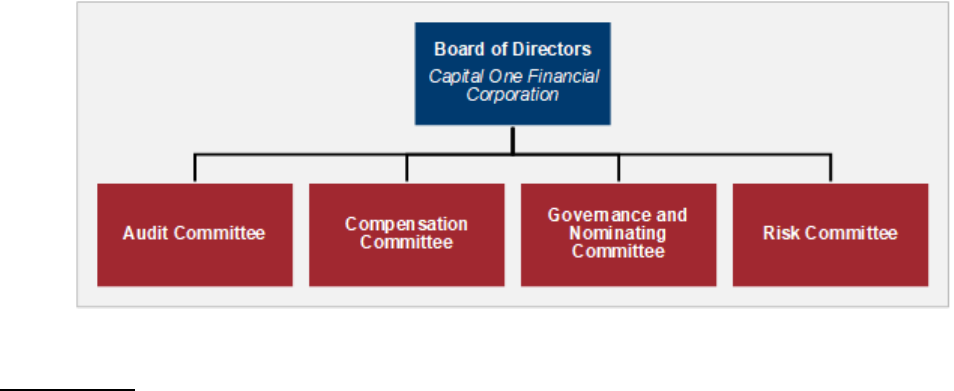

The COFC Board of Directors currently has four standing committees: (i) Audit

Committee, (ii) Risk Committee, (iii) Governance and Nominating Committee, and (iv)

Compensation Committee. Each committee chair provides recurring reports to the Board

regarding its discussions and activities.

-8-

COFC Board Committee Structure

Board

of

Directors

Capital

One

Financial

Corporation

Audit Committee

Compensation

Committe

e

Governance

and

Nominating

Committee

Risk Committee

Management

Capital One does not anticipate material changes to the management structure and team.

Mr. Fairbank will remain Chairman and Chief Executive Officer of COFC and Chairman,

President and Chief Executive Officer of CONA. As part of the integration planning, the

management structure and team will be reviewed for any appropriate changes.

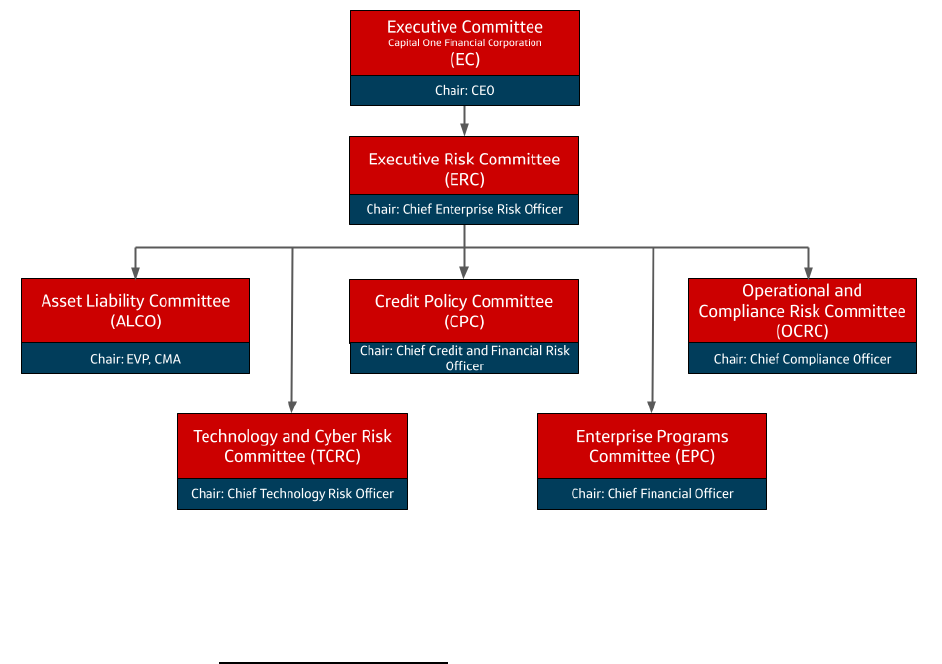

As part of its management structure, Capital One has senior management committees,

which are governance forums established to advise and assist the CEO and other accountable

executives, as subject matter expert advisory panels, in the management of Capital One’s

strategy, financial results, business operations, compliance with laws and regulations (including

those pertaining to consumer protection), and enterprise risk matters, including the Company’s

performance against risk appetites and limits. The senior management committee structure is an

important part of Capital One’s broader governance framework.

-9-

Senior Management Committee Structure

Executive Committee

Capital One Financial Corporation

(EC)

Chair: CEO

Executive Risk Committee

(ERC)

Chair: Chief Enterprise Risk Officer

Asset Liability Committee

(ALCO)

Chair: EVP, CMA

Technology and Cyber Risk

Committee (TCRC)

Chair: Chief Technology Risk Officer

Credit Policy Committee

(CPC)

Chair: Chief Credit and Financial Risk

Officer

Enterprise Programs

Committee (EPC)

Chair: Chief Financial Officer

Operational and

Compliance Risk Committee

(OCRC)

Chair: Chief Compliance Officer

3. Governance Structure

Capital One is dedicated to strong and effective corporate governance that provides the

appropriate framework for the COFC Board of Directors to engage with and oversee the

management of the organization. Robust and dynamic corporate governance policies and

practices are the foundation of an effective and well-functioning Board, and are vital to

preserving the trust Capital One has built with its stakeholders, including customers,

stockholders, regulators, suppliers, associates, communities, and the general public.

The COFC Board of Directors and its committees are accountable for oversight of

Capital One’s business affairs and operations. In carrying out this responsibility, among other

things, the Board and its committees oversee management’s development and implementation of

the Company’s (i) corporate culture; (ii) corporate strategy; (iii) financial performance and

associated risks; (iv) the enterprise-wide RMF, including cybersecurity and technology risk; (v)

succession planning for the Company’s CEO and other key executives; (vi) compensation

policies and practices; and (vii) policies, programs, and strategies related to Environmental,

Social, and Governance matters.

The COFC Board of Directors and its committees regularly review and approve key

governance policies and plans. The Corporate Governance Guidelines adopted by the COFC

Board of Directors formalize Capital One’s key corporate governance practices and facilitate

efficient and effective Board oversight. The Guidelines enable the COFC Board of Directors to

-10-

engage in responsible decision-making, work with management to pursue Capital One’s strategic

objectives and promote the long-term interests of its stockholders. The Corporate Governance

Guidelines embody many of Capital One’s long-standing practices, policies, and procedures,

which collectively form a corporate governance framework that promotes the long-term interests

of its stockholders, promotes responsible decision-making and accountability, and fosters a

culture that allows the COFC Board of Directors and management to pursue Capital One’s

strategic objectives.

To maintain and enhance independent oversight, the COFC Board of Directors regularly

reviews and refreshes its governance policies and practices as changes in corporate strategy, the

regulatory environment and financial market conditions occur, and in response to stakeholder

feedback and engagement.

Capital One’s governance structure is designed to ensure that its business is conducted in

compliance with all legal and regulatory requirements. As part of the integration process,

Capital One will maintain its governance framework in order to continue providing strong and

effective oversight of the combined operations.

4. Risk Management

Capital One dedicates significant resources to Risk Management and maintains a robust

RMF, including coverage of liquidity and funding, credit, market, operational (including data

and technology), strategic, reputational, and compliance risks. The RMF is rooted in the Risk

Appetite Statement for Capital One, which is established by the COFC and CONA Boards of

Directors and sets forth the high-level principles that govern risk taking at Capital One. The

Risk Appetite Statement defines the Boards of Directors’ tolerance for certain risk outcomes at

an enterprise level and enables senior management to manage and report within these

boundaries. This Risk Appetite Statement is also supported by specific risk appetite statements

for each risk category as well as metrics and qualitative factors and, where appropriate, Board

Limits and Board Notification Thresholds. Capital One’s Risk Appetite Statement and

associated metrics will be reviewed with the COFC and CONA Boards of Directors and

adjusted to reflect necessary changes, upon integration of Discover’s businesses (e.g., Card

Concentration).

The RMF is codified in the Enterprise Risk Management Policy, which is reviewed and

approved at least annually by the Board of Directors. Capital One maintains a robust structure

of policies and supporting documents, which collectively establish clear and specific risk

management requirements, commensurate with Capital One’s complexity, size, and risk profile.

Risk Officer Structure

Capital One utilizes a dual Chief Risk Officer (“CRO”) structure. The Chief Enterprise

Risk Officer (“CERO”) oversees Compliance Risk, Operational Risk, Reputation Risk, and

Strategic Risk, and leads the Enterprise Risk Management function. The Chief Credit and

Financial Risk Officer (“CCFRO”), oversees Credit Risk, Liquidity Risk, and Market Risk and

leads the Model Risk Management function.

-11-

Each CRO reports directly to the CEO and Risk Committee Chair, has unrestricted access

to the Board and its committees, is responsible for Risk Committee planning and debriefing

interactions with the Chair, and holds membership in all Senior Management Committees. In

addition, the CCFRO provides administrative oversight to the Credit Review function, which

independently reports to the Risk Committee of the Board.

Lines of Defense

The RMF sets consistent expectations for Capital One’s “Three Lines of Defense”

model, which defines the roles, responsibilities and accountabilities for taking and managing

risk across Capital One. Accountability for overseeing an effective RMF resides with COFC’s

Board of Directors either directly or through its committees. CONA has adopted COFC’s RMF

as permitted by the OCC’s Heightened Standards.

First Line Second Line Third Line

Identifies and Owns Risk Advises & Challenges

First Line

Provides Independent

Assurance

Key Responsibilities

Identify, assess, measure,

monitor, control, and

report the risks associated

with their business.

Independent Risk

Management (“IRM”):

Independently oversees,

challenges, and assesses

risk taking activities for

the First Line.

Provides independent and

objective assurance to the

Board of Directors and

senior management that the

systems and governance

processes are designed and

working as intended and that

the RMF is appropriate for

the size, complexity, and

risk profile of Capital One.

The First Line consists of any line of business or function that is accountable for risk-

taking and is responsible for: (1) engaging in activities designed to generate revenue or reduce

expenses; (2) providing operational support or servicing to any business function for the delivery

of products or services to customers; or (3) providing technology services in direct support of

first line business areas. Each Capital One line of business or First Line function must manage

the risks associated with their activities, including identifying, assessing, measuring, monitoring,

controlling, and reporting the risks within its business activities consistent with the RMF.

The Second Line consists of two types of functions: IRM and support functions that are

centers of specialized experts (“Support Functions”). IRM oversees risk-taking activities and

assesses risks and issues independent of the First Line. IRM functions play a central role in

defining the risk management standards that guide the risk taking activities of the First Line, in

addition to providing effective challenge to first line risk taking activities. IRM is responsible

for designing and updating the RMF; setting policies and standards for risk identification,

assessment, measurement, monitoring, control, and reporting by the First Line; identifying and

assessing material aggregate risks consistent with Capital One’s risk appetite; establishing and

adhering to enterprise risk policies that include concentration risk limits; and monitoring the risk

-12-

profile relative to the approved risk appetite. No First Line executive may oversee an IRM unit.

IRM functions provide effective challenge across the relevant risk categories to the first line of

defense and, when appropriate, certain activities conducted by support functions. Support

Functions include Human Resources, Accounting and Legal, which leverage their skills and

expertise to advise Capital One across all lines of defense in performing their respective

activities or in identifying, assessing, measuring, monitoring, controlling, and reporting the risks

associated with business activities owned by the First Line.

The Third Line is comprised of Capital One’s Internal Audit and Credit Review

functions. The third line provides independent and objective assurance to senior management

and the Board that the first and second lines of defense have systems and governance processes

which are well designed and working as intended and that the RMF is appropriate for the size,

complexity, and risk profile of Capital One. Additionally, in carrying out its responsibilities, the

third line maintains a complete and current inventory of Capital One’s material processes,

product lines, services, and functions, and assesses the risks, including emerging risks, associated

with each, which collectively provide a basis for the audit plan. No First Line executive may

oversee any Internal Audit or Credit Review units. Third Line functions provide effective

challenge and determine how and when effective challenge is conducted, including the

evidentiary requirements.

Elements of the RMF

The RMF consists of the following nine elements:

● Governance and Accountability. The RMF sets the foundation for the methods for

governing risk taking and the interactions within and among the three lines of

defense. Capital One’s risk governance structure and culture of accountability is a

core focus to effectively and consistently oversee the management of risks across the

Company. The Board of Directors, CEO, and management team establish the tone at

the top regarding the culture of the Company, including management of risk, which is

reinforced throughout the various levels of the organization. Senior Management

Committees are governance forums established to assist the CEO and other

management team accountable executives in the management of the strategy,

financial results, business operations, and enterprise risk management for Capital

One.

● Strategy and Risk Alignment. Capital One’s strategy is informed by and aligned with

its risk appetite, from development to execution, including how initiatives may

impact Capital One’s overall risk profile. The strategy is developed with input from

teams in the First, Second, and Third Lines, as well as the Board of Directors.

● Risk Identification. The First Line is responsible for identifying risks, including

concentration and emerging risks, across the relevant risk categories associated with

their current and proposed business activities and objectives. IRM and certain

Support Functions, where appropriate, provide effective challenge in the risk

identification process. IRM is also responsible for identifying material aggregate

risks on an ongoing basis.

-13-

● Assessment, Measurement and Response. Risks are assessed to understand their

severity and likelihood of occurrence under both normal and stressful conditions.

Risk severity is measured through modeling and other quantitative estimation

approaches, as well as qualitative approaches, based on management judgment. As

part of the risk assessment process, the First Line also evaluates the effectiveness of

the existing control environment and mitigation strategies. Management determines

the appropriate risk response, which may include implementing new controls,

enhancing existing controls, developing additional mitigation strategies to reduce the

impact of the risk, and/or monitoring the risk. These risk assessments and mitigation

strategies are challenged by the Second Line.

● Monitoring and Testing. Management monitors risks to ensure alignment with

Capital One’s risk appetite and to evaluate how the risk is affecting Capital One’s

strategy, business objectives and resilience. The First Line is required to evaluate the

effectiveness of risk management practices and controls through testing and other

activities. IRM and Support Functions, as appropriate, assess the First Line’s

evaluation of risk management, which may include providing effective challenge,

performing independent monitoring, or conducting risk or control validations.

● Aggregation, Reporting and Escalation. Capital One’s risk aggregation processes

aggregate risk information from lower levels of the business hierarchy to higher

levels to determine material risk themes across the Enterprise and provide a

comprehensive view of performance against risk appetite. Material risks are reported

to the Risk Committee of the Board of Directors and the appropriate senior

management committees no less than quarterly.

● Capital and Liquidity Management (including stress testing). Capital One’s risk

management practices inform key aspects of Capital One’s capital planning,

including the development of stress scenarios, the assessment of the adequacy of

post-stress capital levels, and the appropriateness of potential capital actions. In

assessing its capital adequacy at both COFC and CONA, Capital One identifies how

and where its material risks are accounted for within the capital planning process.

Monitoring and escalation processes exist for key capital thresholds and metrics to

continuously monitor capital adequacy. Prudent balance sheet management is a

critical component of Capital One’s overall business strategy as it enables

management to manage risk and allows Capital One to achieve its long-term financial

objectives. Capital One identifies and manages funding and liquidity risks that could

affect its earnings, balance sheet strength, and investor confidence. Capital One also

manages its liquidity position to satisfy regulatory requirements.

● Risk Data and Enabling Technology. Risk data and technology are utilized for risk

reporting and to monitor changes to Capital One’s risk profile. Core governance and

risk systems are used as the systems of record to monitor risks, controls, issues, and

events and support the analysis, aggregation, and reporting capabilities across the risk

categories.

● Culture and Talent Management. The RMF relies on the culture, talent, and skills of

Capital One’s employees. Every associate at the Company is responsible for risk

-14-

management; however, associates with specific risk management skills and expertise

within the first, second, and third lines of defense are critical to execute appropriate

risk management across the enterprise.

Enterprise Risk Management and Categories of Risk

Enterprise Risk Management

Capital One devotes significant resources to maintaining and continuously improving the

company’s Risk Management Capabilities. A key component of its Risk Management system is

the Enterprise Risk Management function and the role it plays in developing, implementing,

maintaining, and monitoring adherence to the RMF and the supporting Enterprise Risk

Management Policy.

Capital One’s Enterprise Risk Management function is led by the Head of Enterprise

Risk Management and reports directly to the CERO as well as maintains a seat on the senior

leadership team of the Credit and Financial Risk Management organization. The Enterprise Risk

Management function is responsible for the following:

Setting enterprise guidelines and frameworks to support the identification,

assessment, measurement, monitoring, controlling, and reporting of risks including

concentrations of risk.

Establishing enterprise risk management governance and strategy; providing advice

to the three lines of defense, as the advice relates to enterprise risk management; and

communicating significant risk management trends and insights from the enterprise

level.

Conducting oversight, including review and challenge by providing effective

challenge; independently monitoring enterprise risk management activities; and

independently escalating enterprise risk management gaps and issues.

Driving risk aggregation, including maintaining a complete and current inventory of

material risks; and analyzing and independently assessing the Enterprise Risk Profile

across all categories.

Driving holistic reporting of risk to senior management and the Board through the

Enterprise Risk Profile report and other reporting.

Administering, monitoring, and supporting enterprise-wide communication of the

Risk Appetite Program.

The Enterprise Risk Management function fulfills these responsibilities through the

establishment of processes and capabilities which support the Enterprise Risk Management

framework.

-15-

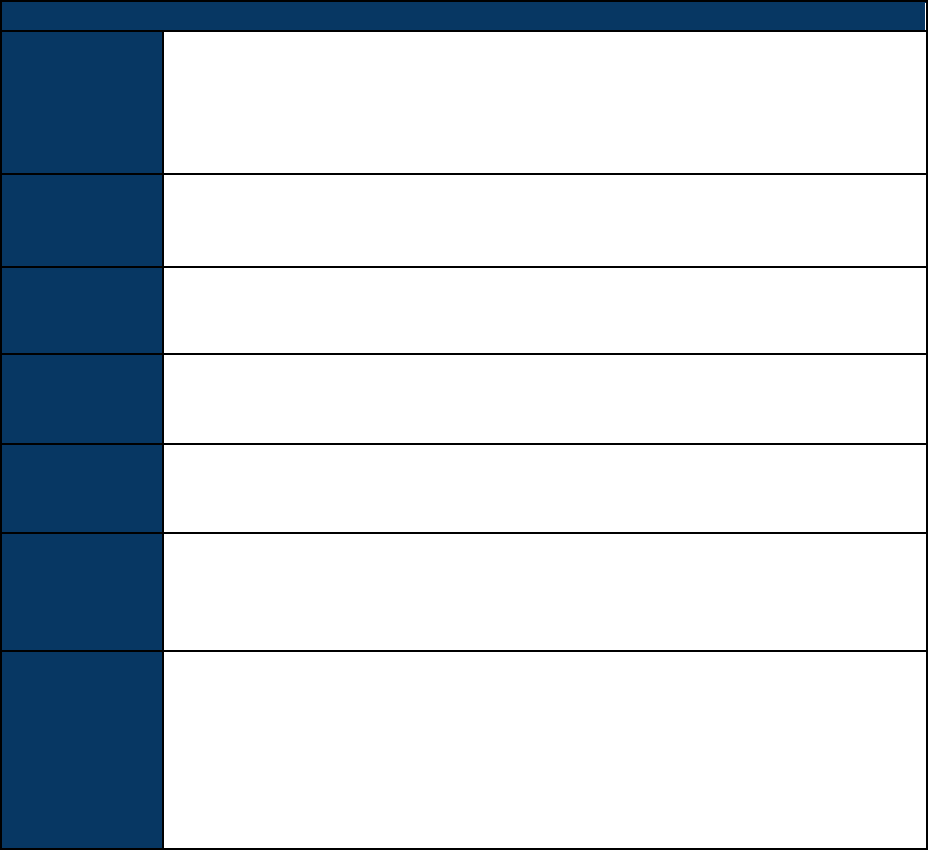

Capital One applies its RMF to protect itself from the major categories of risk that it is

exposed to through its business activities. Capital One has seven major categories for the

management of risk, as described below.

Categories of Risk

Compliance The risk to current or anticipated earnings or capital arising from violations of

laws, rules or regulations. Compliance risk can also arise from

nonconformance with prescribed practices, internal policies and procedures,

contractual obligations or ethical standards that reinforce those laws, rules or

regulations

Credit The risk to current or projected financial condition and resilience arising from

an obligor’s failure to meet the terms of any contract with the Company or

otherwise perform as agreed

Liquidity The risk that the Company will not be able to meet its future financial

obligations as they come due, or invest in future asset growth because of an

inability to obtain funds at a reasonable price within a reasonable time

Market The risk that an institution’s earnings or the economic value of equity could

be adversely impacted by changes in interest rates, foreign exchange rates or

other market factors

Operational The risk of loss, capital impairment, adverse customer experience or

reputational impact resulting from failure to comply with policies and

procedures, failed internal processes or systems, or from external events

Reputation The risk to market value, recruitment and retention of talented associates and

maintenance of a loyal customer base due to the negative perceptions of

internal and external constituents regarding the Company’s business

strategies and activities

Strategic The risk of a material impact on current or anticipated earnings, capital,

franchise or enterprise value arising from the Company’s competitive and

market position and evolving forces in the industry that can affect that

position; lack of responsiveness to these conditions; strategic decisions to

change the Company’s scale, market position or operating model; or, failure

to appropriately consider implementation risks inherent in the Company’s

strategy

Compliance Risk Management

Capital One recognizes that compliance requirements for financial institutions are

increasingly complex and that there are heightened expectations from financial services

regulators and customers. In response, Capital One continuously evaluates the regulatory

environment and proactively adjusts its compliance program to fully address these requirements

and expectations.

Capital One’s Compliance Management Program establishes expectations for

determining compliance requirements, assessing the risk of new product offerings, creating

appropriate controls and training to address requirements, monitoring for control performance,

-16-

and independently testing for adherence to compliance requirements. The program also

establishes regular compliance reporting to senior business leaders, the executive committee and

the Board of Directors.

The Chief Compliance and Ethics Officer is responsible for establishing and overseeing

Capital One’s Compliance Management Program. Business areas incorporate compliance

requirements and controls into their business policies, standards, processes and procedures.

They regularly monitor and report on the efficacy of their compliance controls and Compliance

periodically independently tests to validate the effectiveness of business controls. The Chief

Compliance and Ethics Officer also oversees the company’s Ethics Office, which administers the

Code of Conduct and provides training and guidance to ensure the company meets its high

expectations for ethical behavior and business practices.

Credit Risk Management

Capital One recognizes that it is exposed to changes in credit quality driven by economic

cycles, market pressures and other factors. Consequently, the Company follows robust risk

management practices designed to ensure its credit portfolio is resilient to economic downturns

and other drivers of changing credit performance. The tools Capital One relies on in this

endeavor include customer selection, underwriting, monitoring, remediation, and portfolio

management. In unsecured consumer loan underwriting, Capital One generally ensures lending

decisions are resilient to higher credit losses than those prevailing at the time of the underwriting.

In commercial underwriting, Capital One generally requires strong cash flow, collateral,

covenants, and guarantees. In addition to sound underwriting, Capital One continually monitors

its portfolio and takes steps to collect or work out distressed loans.

The CCFRO, in conjunction with the Chief Credit Officers for each line of business, is

responsible for establishing credit risk policies and procedures, including underwriting and hold

guidelines and credit approval authority, and monitoring credit exposure and performance of

Capital One’s lending related transactions. The Chief Credit Officers are responsible for

evaluating the risk implications of credit strategy and the oversight of credit for both the existing

portfolio and any new credit investments.

Capital One’s credit policies establish standards in five areas: customer selection,

underwriting, monitoring, remediation and portfolio management. The standards in each area

provide a framework comprising specific objectives and control processes. These standards are

supported by detailed policies and procedures for each component of the credit process. Starting

with customer selection, Capital One’s goal is to generally provide credit on terms that generate

above hurdle returns. Capital One uses a number of quantitative and qualitative factors to

manage credit risk, including setting credit risk limits and guidelines for each of its lines of

business. Capital One monitors performance relative to these guidelines and reports results and

any required mitigating actions to appropriate senior management committees and its Board of

Directors.

Liquidity Risk Management

Capital One recognizes that liquidity risk is embedded within its day-to-day and strategic

decisions. Liquidity is essential for banks to meet customer withdrawals, account for balance

-17-

sheet changes, and provide funding for growth. Capital One has acquired and built deposit

gathering businesses and actively monitors its funding concentration. Capital One manages

liquidity risk, which is driven by both internal and external factors, centrally and establishes

quantitative risk limits to continually assess liquidity adequacy.

The CCFRO, in conjunction with the Head of Liquidity, Market and Capital Risk

Oversight, is responsible for the establishment of liquidity risk management policies and

standards for governance and monitoring of liquidity risk at a corporate level. Capital One

assesses liquidity strength by evaluating several different balance sheet metrics under severe

stress scenarios to ensure it can withstand significant funding degradation. Results are reported

to the Asset Liability Committee monthly and to the Risk Committee no less than quarterly.

Capital One also continuously monitors market and economic conditions to evaluate emerging

stress conditions and to develop appropriate action plans in accordance with its Contingency

Funding Plan and Recovery Plan.

Capital One uses internal and regulatory stress testing and the evaluation of other balance

sheet metrics within its Liquidity Framework to confirm that the firm maintains a fortified

balance sheet. Capital One relies on a combination of stable and diversified funding sources,

along with a stockpile of liquidity reserves, to effectively manage liquidity risk. Capital One

maintains a sizable liquidity reserve of cash and cash equivalents, high-quality unencumbered

securities and investment securities and certain loans that are either readily marketable or

pledgeable. Capital One also continues to maintain access to secured and unsecured debt

markets through regular issuance.

Market Risk Management

Capital One recognizes that interest rate and foreign exchange risk are present in its

business due to the nature of its assets and liabilities. Market risk is inherent from the financial

instruments associated with Capital One’s business operations and activities including loans,

deposits, securities, short-term borrowings, long-term debt and derivatives. Capital One

manages market risk exposure, which is principally driven by balance sheet interest rate risk,

centrally and establishes quantitative risk limits to monitor and control its exposure.

The CCFRO, in conjunction with the Head of Liquidity, Market, and Capital Risk

Oversight, is responsible for the establishment of market risk management policies and standards

for the governance and monitoring of market risk at a corporate level. The market risk position

is calculated and analyzed against pre-established limits. Capital One uses industry accepted

techniques to analyze and measure interest rate and foreign exchange risk and performs

sensitivity analysis to identify its risk exposures under a broad range of scenarios. Results are

reported to the Asset Liability Committee monthly and to the Risk Committee no less than

quarterly.

Management is authorized to utilize financial instruments as outlined in Capital One’s

policy to actively manage market risk exposure. Investment securities and derivatives are the

main levers for the management of interest rate risk. In addition, Capital One also uses

derivatives to manage foreign exchange risk.

-18-

Operational Risk Management

Capital One recognizes the criticality of managing operational risk on both a strategic and

day-to-day basis and that there are heightened expectations from its regulators and customers.

Capital One has implemented appropriate operational risk management policies, standards,

processes and controls to enable the delivery of high quality and consistent customer experiences

and to achieve business objectives in a controlled manner.

The Chief Operational Risk Officer (“CORO”), in collaboration with the Chief

Technology Risk Officer (“CTRO”), is responsible for establishing and overseeing Capital One’s

Operational Risk Management Program. Both the CORO and CTRO report to the CERO. The

program establishes practices for assessing the operational risk profile and executing key control

processes for operational risks. These risks include topics such as internal and external fraud,

cyber and technology risk, data management, model risk, third-party risk management, country

risk, payments risk, and business continuity. Operational Risk Management and Technology

Risk Management enforce these practices and deliver reporting of operational risk results to

senior business leaders, the executive committee and the Board of Directors.

Reputation Risk Management

Capital One recognizes that reputation risk is of particular concern for financial

institutions and, increasingly, technology companies, in the current environment. Areas of

concern have expanded to include company policies, practices and values and, with the growing

use of social and digital platforms, public corporations face a new level of scrutiny and channels

for activism and advocacy. The heightened expectations of internal and external stakeholders

have made corporate culture, values and conduct pressure points for individuals and advocates

voicing concerns or seeking change. Capital One manages both strategic and tactical reputation

issues and builds relationships with government officials, media, community and consumer

advocates, customers and other constituencies to help strengthen the reputations of both Capital

One and the industry. Capital One’s actions include implementing pro-customer practices in its

business and serving low- to- moderate- income communities in its market area consistent with a

quality bank and an innovative technology leader. The Executive Vice President, Head of

External Affairs, is responsible for managing Capital One’s overall reputation risk program.

Day-to-day activities are controlled by the frameworks set forth in the Reputation Risk

Management Policy and other risk management policies.

Strategic Risk Management

Capital One recognizes that strategic risk is present within its business and strategy.

Capital One monitors risks for the impact on current or future earnings, capital growth or

enterprise value arising from changes to the Company’s competitive and market positions,

including as a result of evolving forces in the industry. Additionally, Capital One monitors

timely and effective responsiveness to these conditions, strategic decisions that impact the

Company’s scale, market position or operating model and failure to appropriately consider

implementation risks in the Company’s strategy. Potential areas of opportunity or risk inform

the Company’s strategy, which is led by the Chief Executive Officer and other senior executives.

-19-

The CERO, in consultation with the CCFRO, oversees the identification and assessment of risks

associated with the Company’s strategy and the monitoring of these risks throughout the year.

Capital One’s Strategic Risk Management Policy, processes and controls encompass an

ongoing assessment of risks associated with corporate or line of business specific strategies.

These risks are managed through periodic reviews, along with regular updates to senior

management and the Board.

Integration of Discover into the Capital One RMF

Immediately upon closing, Capital One will begin to apply its RMF to Discover’s

businesses and risk management functions. In parallel, Capital One will start a process to

integrate Discover’s existing risk management functions directly into their counterparts or

equivalents at Capital One. In those instances where Capital One does not currently have an

equivalent risk management function (e.g., for the Discover Global Network, discussed below),

Capital One will establish such a function with appropriate executive oversight and merge the

relevant Discover risk management function into it upon the consummation of the Proposed

Transaction.

Capital One expects that this integration will occur in phases and result in one, cohesive

and comprehensive Risk Management system for the combined entity operating under uniform

Capital One policies, standards and expectations. During the integration period, Capital One

will mitigate the risks related to the transition to a single risk management framework through

the implementation of a comprehensive integration plan. The integration plan will seek to

prioritize the highest risk areas first as well as provide a means for monitoring, reporting and

escalating progress against the plan.

With respect to the Discover Global Network, Capital One’s risk management strengths

provide a strong foundation for integration. Capital One recognizes that conducting full risk

oversight related to the Discover Global Network will require Capital One to expand its risk

management capabilities. In particular, Capital One intends to establish, prior to integration,

dedicated teams that will oversee the Discover Global Network’s risk management upon

consummation of the Proposed Transaction. These teams will include dedicated staff with

relevant industry experience and expertise across operational risk management, technology risk

management compliance and other Second Line teams.

As a part of the integration activities, Capital One will evaluate Discover’s current risk

management approach to the Discover Global Network, ensuring continuity of oversight during

the transition while developing plans to elevate risk management practices where necessary.

This evaluation will include an assessment of the talent and skill sets in all three Lines of

Defense to oversee and manage these risks consistent with Capital One’s Enterprise Risk

Management framework, across applicable risk management categories, and risk appetite.

Additionally, Capital One will conduct detailed risk assessments of Discover Global Network,

including critical processes, infrastructure, and products. These risk assessments will result in

risk mitigation activities where appropriate, and will inform Capital One’s enterprise-level

assessments of material risk and risk appetite performance.

-20-

5. Compliance

Capital One manages compliance risk through its Compliance Management Program

(“CMP”), as established by its Compliance Management Policy (“Compliance Policy”). The

CMP, as outlined in the Policy, provides an enterprise-wide approach to compliance risk

management and oversight that creates and supports a culture of compliance throughout the

Company. Capital One’s CMP is designed to ensure that Capital One appropriately identifies,

manages, and oversees all compliance risk – including consumer compliance, fair lending, and

AML risk – through sound governance, rigorous controls and transaction testing, advice and

effective challenge to the First Line and staff functions, and timely risk escalation. The program

also establishes regular compliance reporting to senior business leaders, the executive

committee, and the Board of Directors.

The Chief Compliance and Ethics Officer is responsible for establishing and overseeing

the CMP and leads the Compliance & Ethics (“C&E”) department. C&E is staffed by

compliance leaders and professionals with expertise in regulatory risk management, testing,

investigations, ethics, and data. The C&E organization fulfills IRM risk activities as a Second

Line function that advises and effectively challenges the First Line and staff operations under

Capital One’s Enterprise Risk Management Framework.

The First Line and staff operations are accountable for complying with laws and

regulations and incorporating compliance requirements and controls into their business policies,

standards, processes, and procedures. They regularly monitor and report on the efficacy of their

compliance controls; as a second line IRM function, C&E independently tests to validate the

effectiveness of first line business controls. Additionally, C&E advises the first line on

applicable regulatory requirements, compliance risks related to new and changed products, and

the assessment and remediation of issues and events. C&E both advises and effectively

challenges the first line in their development and enhancement of products, processes and

procedures to ensure they maintain effective control oversight and support adherence to

compliance requirements.

Culture of Compliance

Capital One’s culture is built on two core values: Excellence and Do the Right Thing.

To promote these values, Capital One’s Code of Conduct (“Code”) memorializes a commitment

to comply with applicable laws, regulations and internal policies governing conduct and

operations. Following these policies helps to ensure that honesty, fair dealing, and integrity are

hallmarks of Capital One’s business dealings. By adhering to the Code, associates live Capital

One’s values and ensure that Capital One is recognized for modeling the highest standards of

business conduct in everything it does. The Code is more than just a set of “do’s and don’ts.” It

provides guidance, practical information, and resources that help enhance Capital One’s

relationships with its customers, each other, and all of the people that play a role in Capital One’s

success.

The Board of Directors reviews and approves the Code. The Ethics Office, which is

managed by the Chief Compliance and Ethics Officer, has day-to-day responsibility for

administering the Code and managing Capital One’s Ethics program. In addition, the Ethics

-21-

Office is responsible for managing the Ethics Line, which is a confidential reporting tool

operated by an independent third party. Reports may be submitted to the Ethics Line online or

through a call center that operates 24 hours a day, seven days a week. Ethics Line complaints

may be submitted anonymously, and phone calls are not recorded.

All newly hired associates receive the Code with their employment offer and, within their

first 30 days, must complete a 30-minute interactive computer-based training course where they

agree to comply with the Code and demonstrate their understanding of its content. Thereafter,

all associates are required to complete the Code training annually and agree to comply with the

Code and all related policies, standards, and procedures.

Doing the right thing includes speaking up. Capital One expects all associates to

immediately report any suspected or potential violations of law, the Code, the company’s

policies, or other actions inconsistent with Capital One’s values. Associates may report concerns

to their manager, the Associate Relations team in Human Resources, the Ethics Line, or to the

Ethics Office. Raising concerns within Capital One does not prevent associates from reporting

the same concerns to law enforcement or the relevant government entity if there is a suspected or

potential violation of law. Further, Capital One prohibits retaliation against any individual for

making good faith claims regarding possible violations of law, the Code or other Company

policies. Capital One also prohibits retaliation against any individual for participating in or

cooperating with any investigation.

In addition, as discussed in Risk Management above, Capital One expects the integration

to require a substantial amount of investment in the Risk Management team and related

infrastructure to ensure a successful transition.

Oversight, Escalation and Reporting

Compliance risk reporting is foundational in supporting Capital One’s Board of Directors

and senior management committee members in executing their compliance risk oversight

responsibilities. The Compliance Policy and Compliance Risk Reporting Standard outline the

process for compliance reporting. Through the CMP, C&E supports the enterprise’s adherence

to Capital One’s compliance risk appetite by tracking and producing data that corresponds to

Compliance Risk Appetite Metrics (as well as informational metrics) that are reported to senior

management and the Risk Committee of the Board of Directors. In addition, the charter of the

Audit Committee requires the Chief Compliance and Ethics Officer to discuss the annual