Intellix

®

Payments

Reference Guide

Table of Contents

Overview 3

Accessing Payment Functionality 3

About this Guide and Additional Training 3

Using List Functionality in Intellix Payments 4

Overview 4

Standard Conventions in Intellix Payments 4

Filtering a List (Standard) 5

Filtering a List (Advanced) 7

Sorting Data in a List 8

Adding and Rearranging Columns in a List 8

Managing Views 10

Exporting a List 11

Printing a List 11

Working with Payments and Templates 13

Payment Statuses, Workflows and Release 13

Modifying a Payment or Template 15

Deleting a Payment or Template 16

Creating a Payment Template Group 17

Modifying a Payment Template Group 18

Using Quick Entry 19

Approving Payments and Templates 21

Approving a Payment or a Template 21

Rejecting a Payment or Template 23

Unapproving an Approved Payment 25

Alert Settings 26

Payment Reports 28

Viewing a Report 28

Report Definitions 28

Viewing Additional Detail Within a Report 32

Filtering a Report 32

Printing a Report 34

Exporting a Report 35

Capital One Intellix

®

Payments | 2

Capital One Intellix

®

Payments Overview | 3

Overview

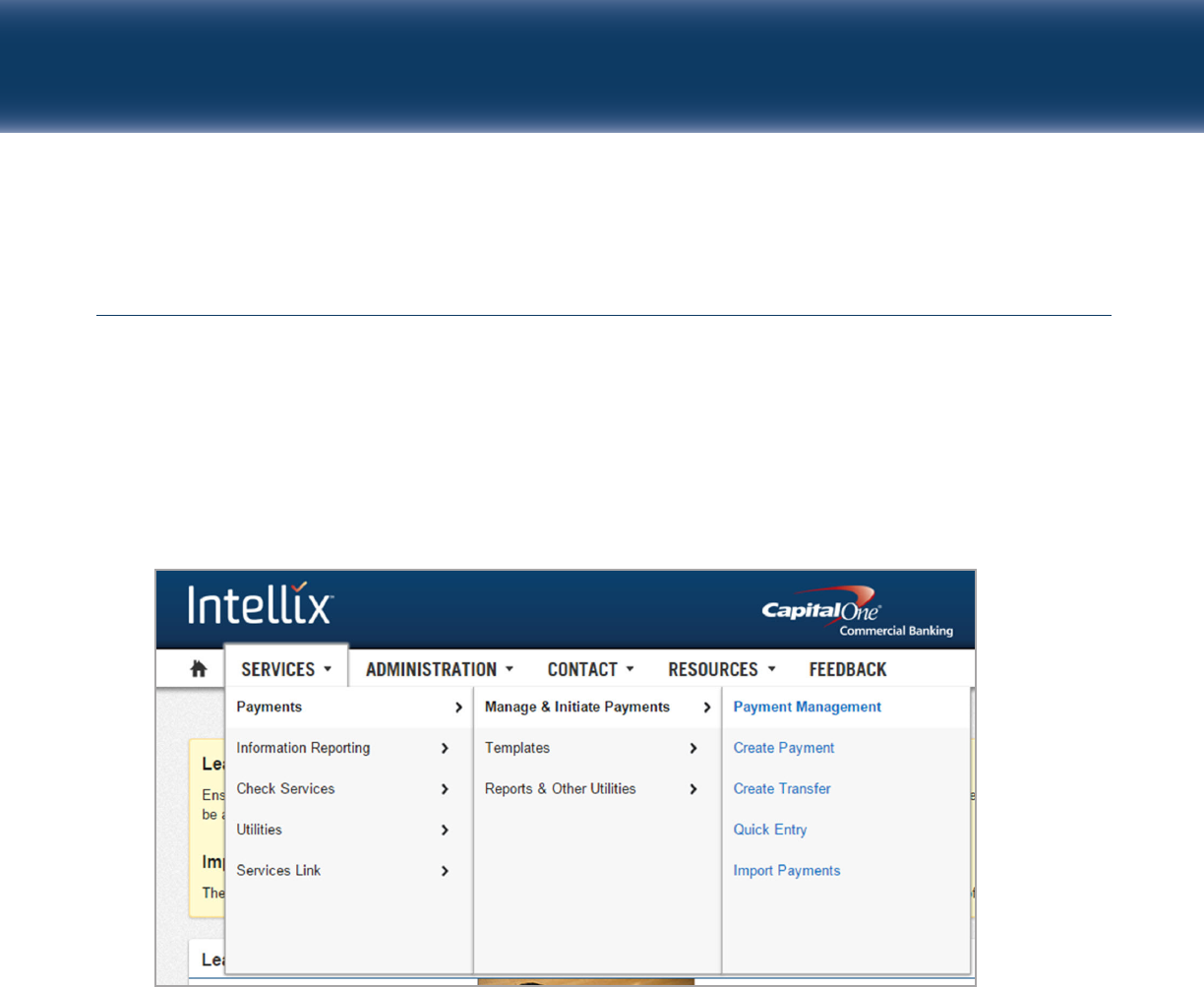

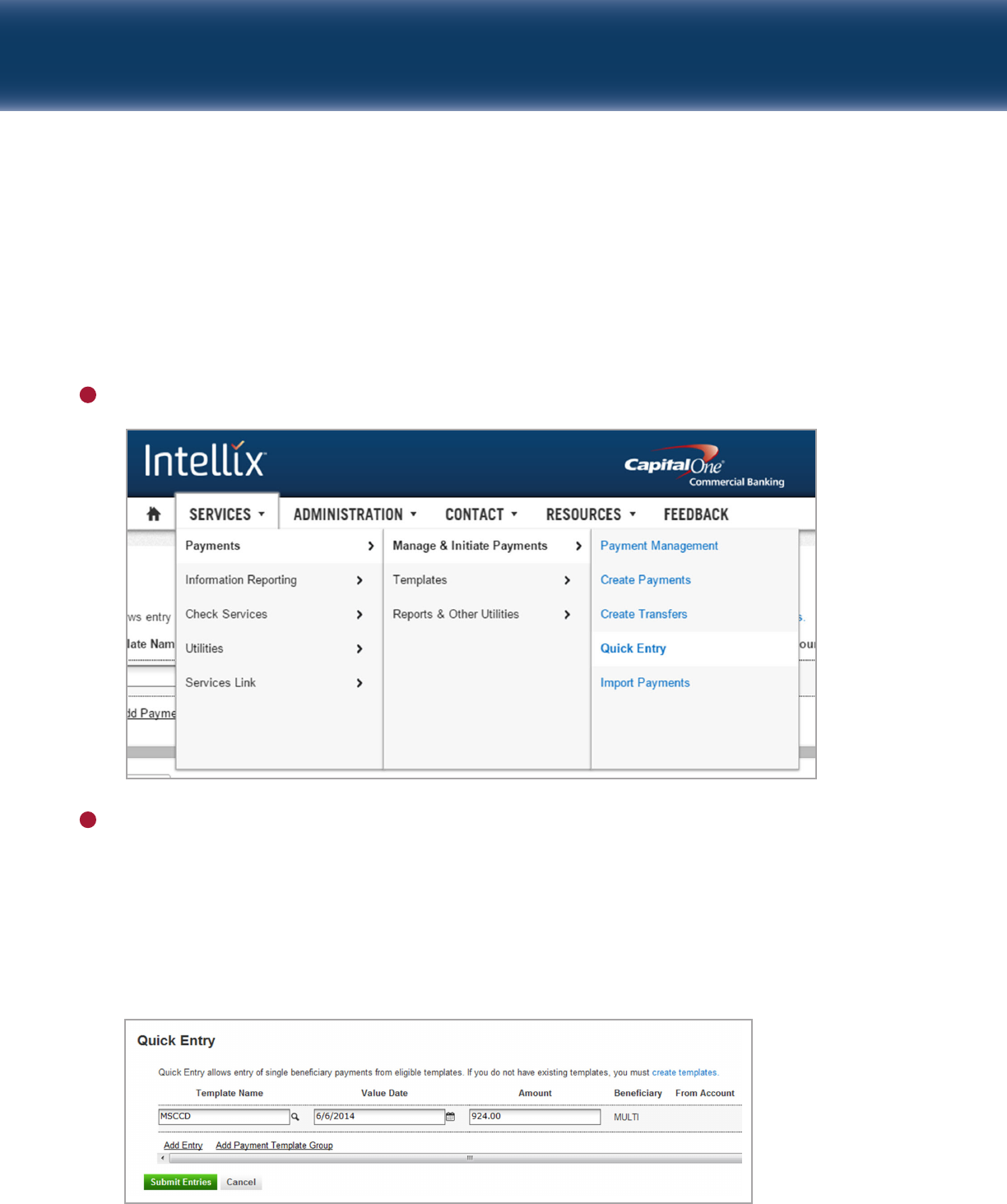

ACCESSING PAYMENT FUNCTIONALITY

Transaction types such as ACH (Payroll, Corporate Collections, etc.), Wire Transfers, and internal account

transfers are referred to as Payments in Intellix. Payment functions can be accessed through the Services g

Payments menu in Intellix. Your access to different options and information within Payments is based on the

entitlements for your organization and your permissions. As a result you may not have access to some of the

functions and information outlined in this guide.

ABOUT THIS GUIDE AND ADDITIONAL TRAINING

This guide provides an overview of functionality common to all types of Payments. Additional training and

reference materials are also available on the Resources tab. These materials include specific reference

guides for each type of payment (ACH, Domestic Wires, International Wires and Book Transfers), Quick

Start Guides and several eLearning videos that demonstrate how to work with the various functions within

Intellix Payments. Please refer to these materials for further information and to help you to use all of the

functions of Intellix Payments.

Capital One Intellix

®

Payments Using List Functionality in Intellix Payments | 4

Using List Functionality in Intellix Payments

OVERVIEW

Payment screens display information in a list

within Intellix. The Payment Management screen is shown;

however other services will have different buttons, menus and commands.

This view presents records in a spreadsheet-style format, with each record on a new row, and various

columns of detail displayed for each item.

• The view may be customized to display only the records you wish to see, through Filtering, Sorting,

and

Managing Views

.

• The data shown for each record may be customized by adding and rearranging columns.

See detail on each of these options below.

STANDARD CONVENTIONS IN INTELLIX PAYMENTS

The following are used throughout Intellix Payments:

Type Ahead and Search

Fields followed by a magnifying glass (see right) may be filled in

one of two ways; you may begin typing in the field, which will

filter your choices to match the information typed, or you may

click on the magnifying glass icon and perform a search for the

appropriate selection.

Required Fields

These fields will be identified with either a

red asterisk (*) or a red exclamation point (!).

Capital One Intellix

®

Payments Using List Functionality in Intellix Payments | 5

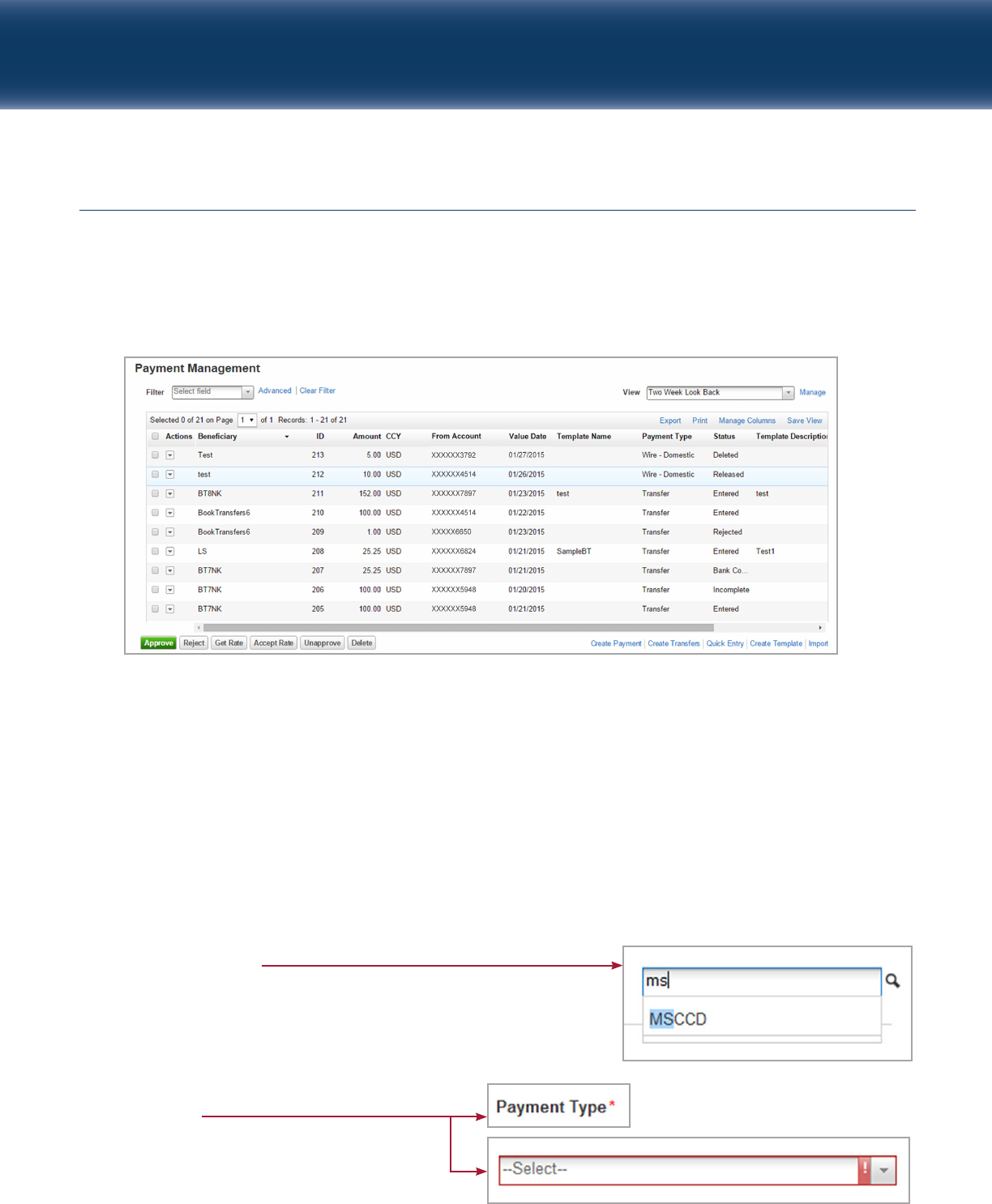

FILTERING A LIST (STANDARD)

A list may be filtered to display only the information you want to see. You can create a filter using any of

the data fields, even if that column is not currently displayed in the list. The basic filter displays at the top

of every list as shown. To create a basic filter:

Click on the Filter drop-down menu at the top of the list and select the field you wish to filter.

1

Capital One Intellix

®

Payments Using List Functionality in Intellix Payments | 6

Select an operator if necessary (is greater than, contains, etc.).

2

Select or enter criteria for the filter.

Click Go.

Results will display based on the criteria specified in your filter.

If you create another filter, it will filter within the current filtered results. Click Clear Filter to return to

the original view of the list.

3

4

5

Capital One Intellix

®

Payments Using List Functionality in Intellix Payments | 7

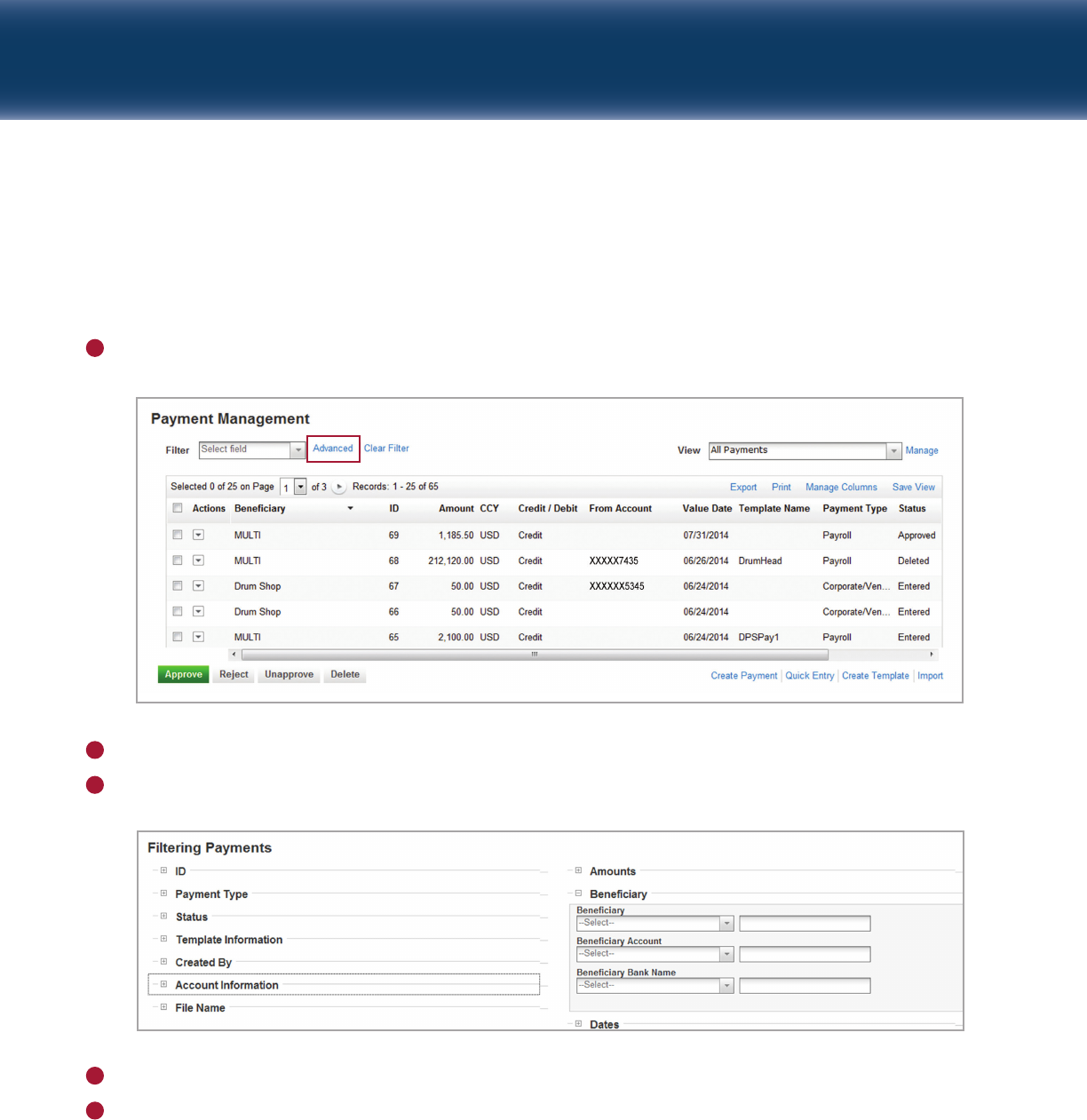

FILTERING A LIST (ADVANCED)

An Advanced Filter allows you to filter on multiple data fields at one time. The link to create an advanced

filter displays at the top of every list. To create an advanced filter:

Click on Advanced next to the filter box at the top of the list, as shown.

1

Select the category(ies) you wish to use in your filter (e.g., Beneficiary).

Select the field and value combinations as appropriate.

2

3

Click the View Results button in the lower left corner of the screen to show the results of your filter.

If you use the Advanced Filter again, it will search all of the items of the original list, not the filtered list.

Click Clear Filter to return to the original view of the list.

4

5

Capital One Intellix

®

Payments Using List Functionality in Intellix Payments | 8

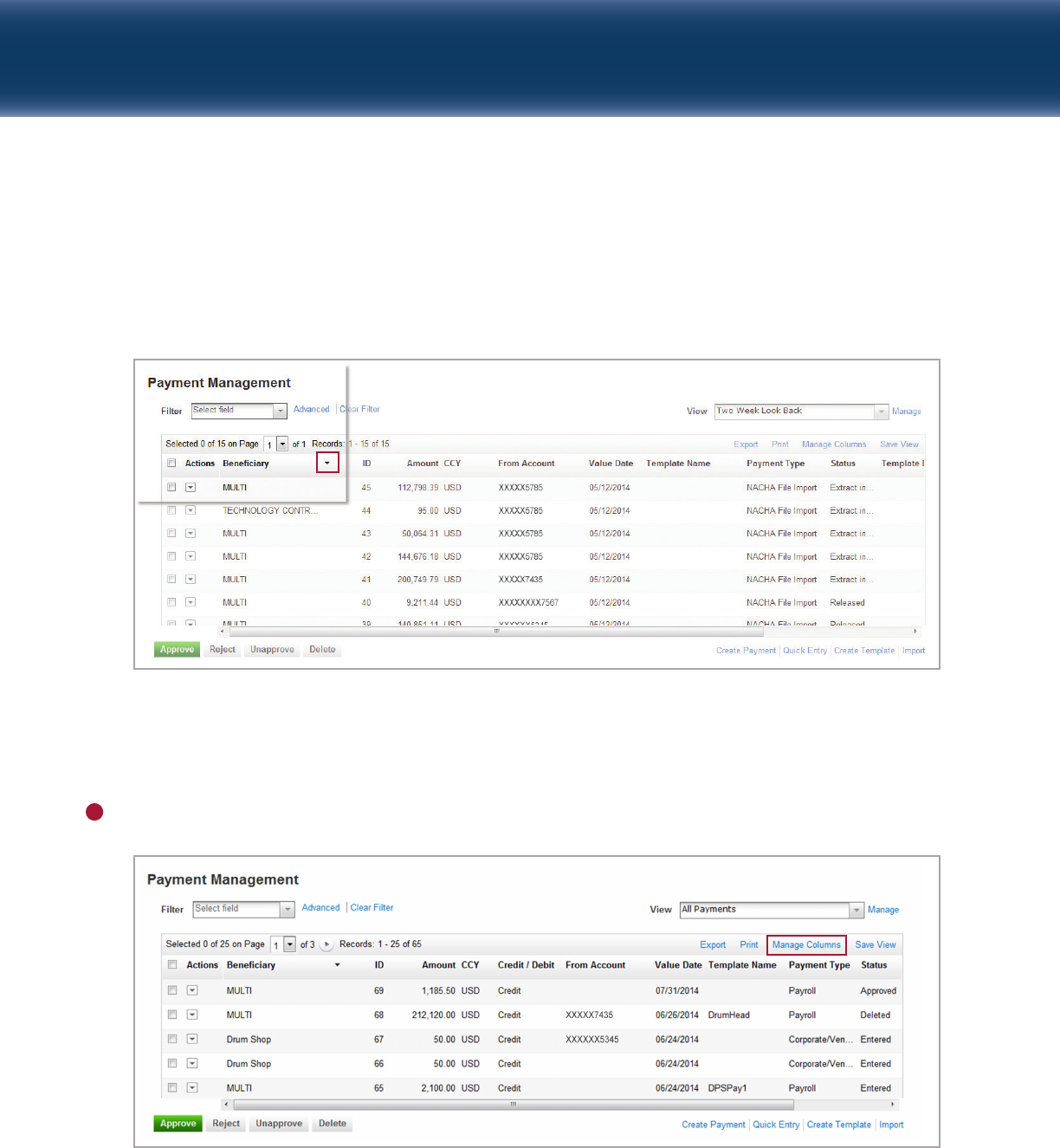

SORTING DATA IN A LIST

To sort the data in a column click the column header. An arrow t will display, which will show the sort

order of the data. Click the column header again to reverse the sort order.

ADDING AND REARRANGING COLUMNS IN A LIST

The List View allows you to add, remove and rearrange which columns are shown in your list.

To manage these columns:

Click the Manage Columns link at the top right of the list view (as shown below).

1

Capital One Intellix

®

Payments Using List Functionality in Intellix Payments | 9

Click Save to save these columns to your view.

3

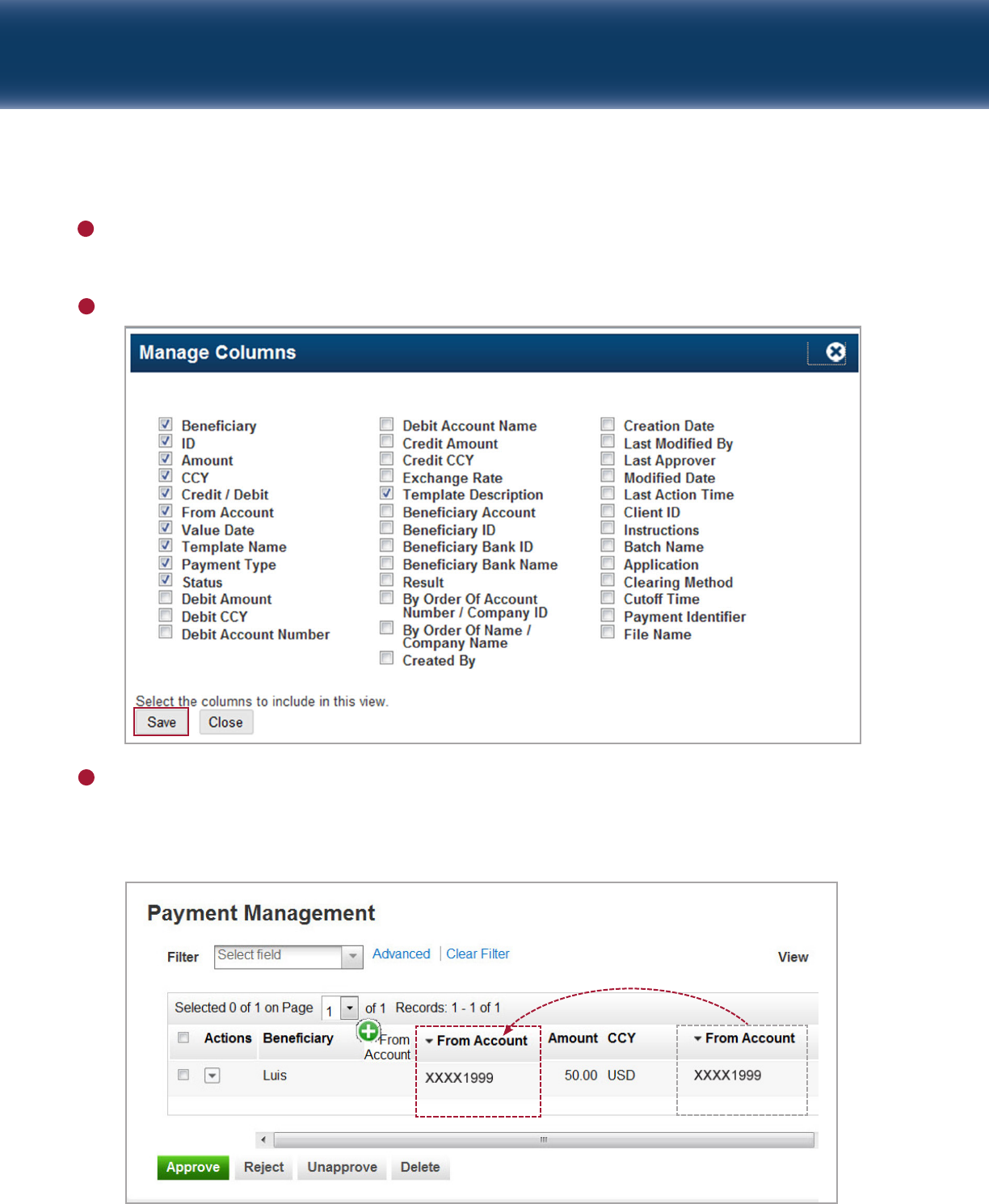

You may rearrange the order of the columns by clicking and dragging them within the list.

A. Click and drag a column header to the desired position.

B. When the column is in a valid position, a green button with a plus sign “+” displays.

C. “Drop” the column by releasing your mouse button.

4

Select or deselect the columns as desired.

NOTE: The Payment Management column choices are shown here. Each list will display the columns

appropriate for that list.

2

Capital One Intellix

®

Payments Using List Functionality in Intellix Payments | 10

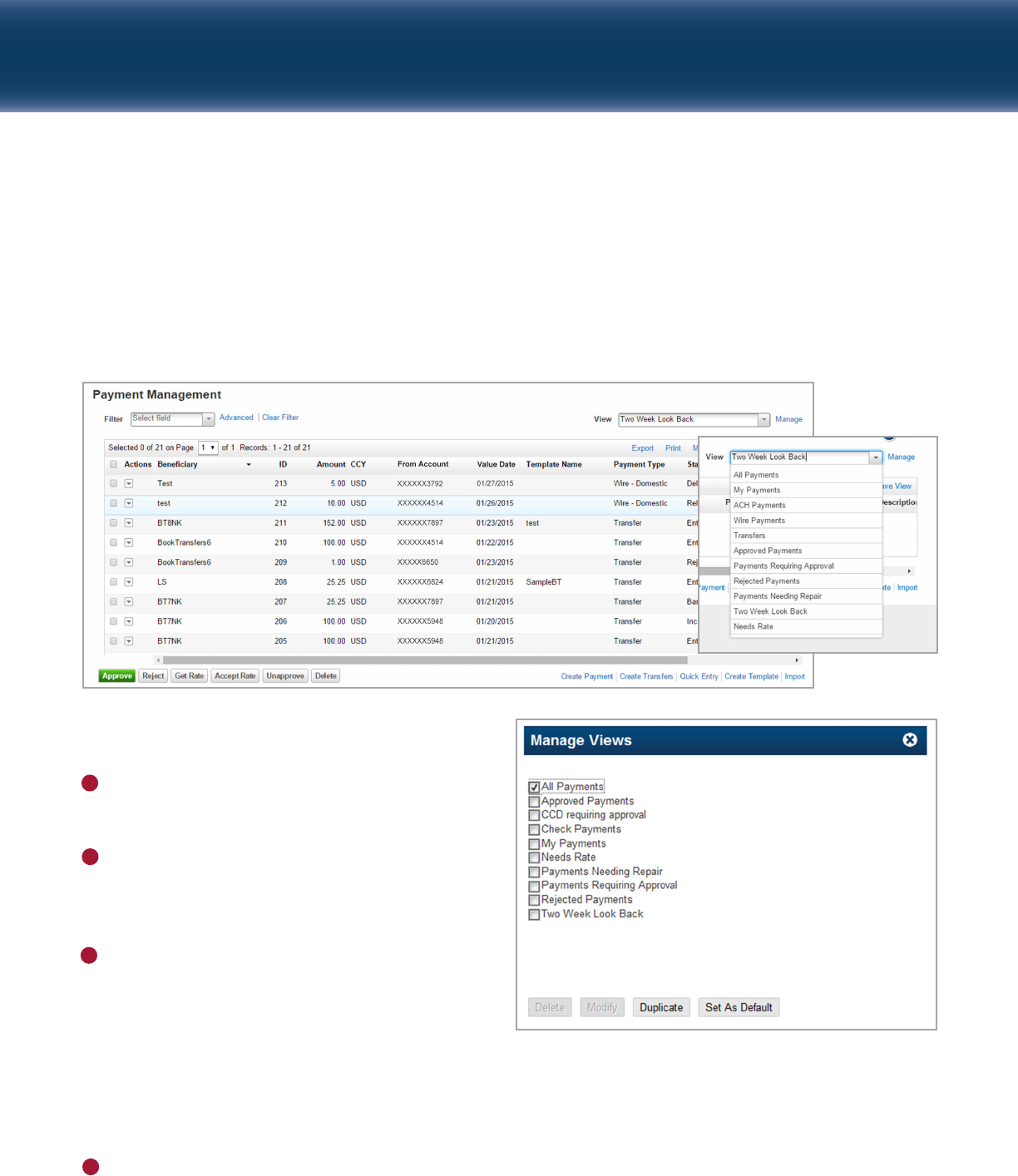

MANAGING VIEWS

Views are pre-defined filters; when selecting a view, a filter is applied and only the items that meet the

criteria are displayed. Some views are provided by default, but you can save your own settings as a new

view, or set one as your default view including columns that have been added or removed. The default view

is shown every time you access that screen or page. You may select an existing view from the drop-down

menu as shown:

To create a new view, modify an existing view, or set

one as default:

Click Manage to the right of the View drop-down

menu (shown above). The Manage Views window

displays.

Select a view from the list. If the selected view is

a system standard, such as All Payments, you may

not delete or modify it but may duplicate it and

modify the copy.

Select one of the following options:

A. Delete: Removes the custom view from the list.

B. Modify: Opens the advanced filters page and

allows you to modify the settings associated

with the view.

C. Duplicate: Creates a copy of the selected view and opens the advanced filters page. You may then

modify the filters and save your settings under a new view name.

D. Set as Default: Saves the selected view as the default.

If you choose Modify or Duplicate, make appropriate changes to the filters, then click Save to save your

changes or Cancel to exit without making changes. If you choose Set as Default, you will see a window

confirming your default setting. Click the “X” to close this window.

2

1

3

4

Capital One Intellix

®

Payments Using List Functionality in Intellix Payments | 11

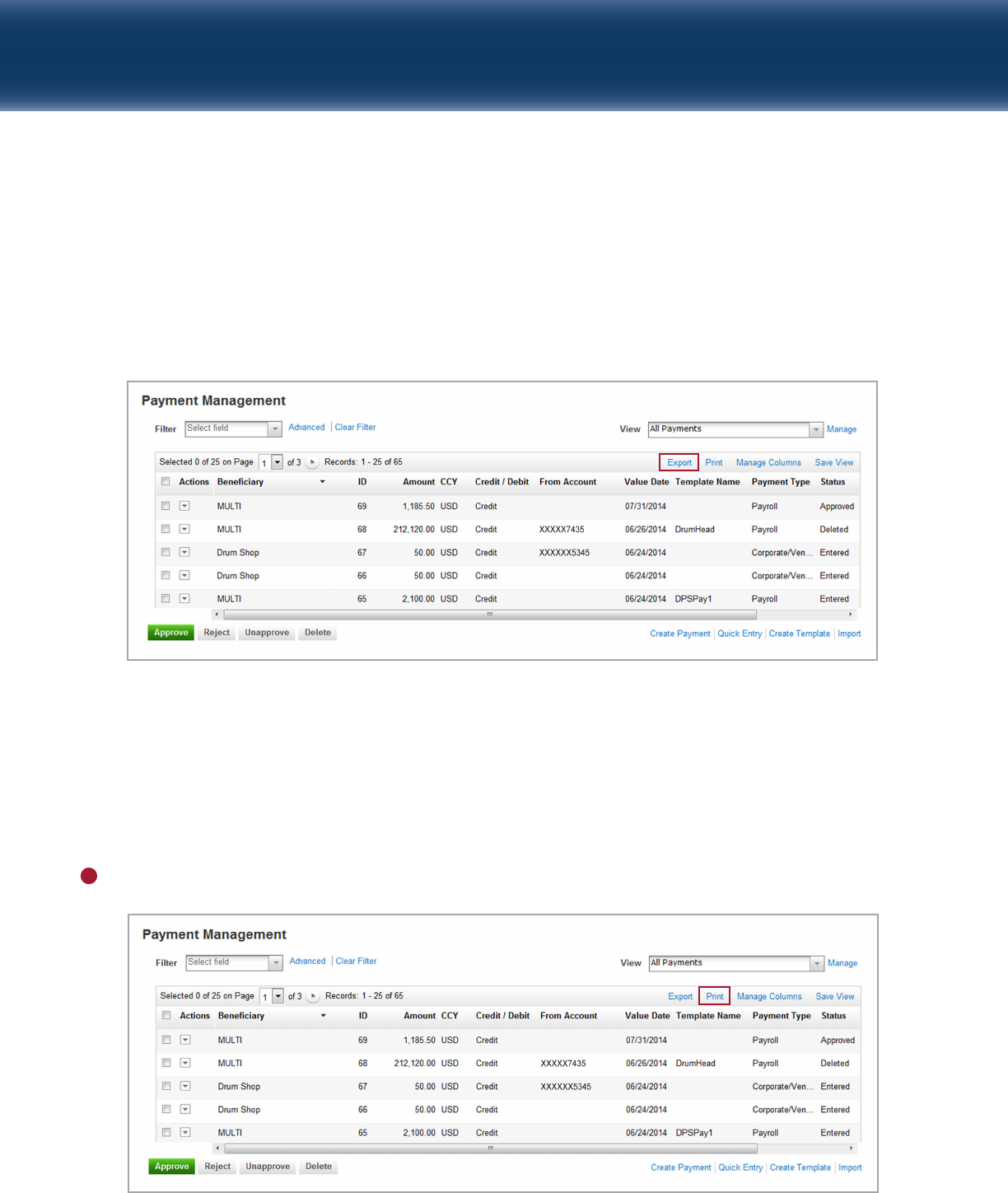

EXPORTING A LIST

A list can be exported as a comma-separated values (.csv) file. This process varies based on the browser

being used. In this guide we will define the process for using Internet Explorer. For other browsers, please

visit Resources

g

eLearning and reference the eLearning modules related to exporting a list.

To export a list, click on the Export link as shown:

When prompted, either Open or Save the file, as appropriate.

PRINTING A LIST

This process varies based on the browser being used. In this guide we will define the process for using

Internet Explorer. For other browsers, please visit Resources

g

eLearning and reference the eLearning

modules related to printing a list.

Click Print. The report window is displayed.

1

Capital One Intellix

®

Payments Using List Functionality in Intellix Payments | 12

Click the Print icon.

2

Set print properties and click Print.

3

Capital One Intellix

®

Payments Working with ACH Payments and Templates | 13

PAYMENT STATUSES, WORKFLOWS AND RELEASE

Standard payment statuses:

Workflow examples:

• ACH: Entered

g

Approved

g

Sent to Bank (appears momentarily)

g

Released

• Domestic wire transfer: Entered

g

Approved

g

Sent to Bank (appears momentarily)

g

Bank Received

(appears momentarily)

g

Bank Confirmed

•

International wire transfer: Entered g Needs Rate g Sent to Bank (appears momentarily) g Bank

Received

(appears momentarily)

g

Bank Confirmed

• Book transfer: Entered

g

Approved

g

Sent to Bank (appears momentarily)

g

Bank Received

(appears momentarily)

g

Bank Confirmed

Release schedule for future payments: Approved payments are released to the bank for processing on the

process date for that payment type. The exact timing of each release cycle is shown on the table below with

example approval and paid dates.

Working with Payments and Templates

Status Definition

Entered Entered without errors, ready for approval. Can be modified or deleted.

Approved Approval workflow complete. Not available for modification or deletion.

Ready for extraction to back office.

Needs Rate Payment requires a real-time exchange rate. Not eligible for modification

(International Wires only) or deletion. Once rate is applied, status changes to “Bank Confirmed.”

Released (ACH only) Released to the bank for processing. Not available for workflow, deletion,

or modification.

Bank Confirmed Payment has been paid by the bank. Not eligible for modification or

(Wires and Transfers) deletion.

Payment Type Date Approved Date/Time Released (a.k.a., Process Date) Date Paid (Value Date)

ACH (for same Tuesday Tuesday at the next regular extraction time Tuesday

day payment) (9 AM and Noon, all times Eastern)

ACH (for next Tuesday Tuesday at the next regular extraction time Wednesday

day payment) (9 AM, Noon, 2 PM, 5 PM, 7:30 PM, and

9 PM all times Eastern)

ACH (for payment Tuesday One Business Day PRIOR to the Value Date Future Value Date

2 or more days at 9 AM Eastern Specified

in the future)

Domestic Wire Tuesday Immediately Tuesday

(same day)

(continued)

Final status upon completion: ACH Payments will show in “Released” status, wires and transfers will show as

“Bank Confirmed.”

Additional statuses:

Capital One Intellix

®

Payments Working with ACH Payments and Templates | 14

Status Definition

Incomplete Saved in an incomplete status, for later completion. Can be modified

or deleted.

Needs Repair Needs repair, usually due to an error in a file import validation.

Incomplete Approval Currently in approval workflow. Not available for modification or deletion.

Approver Rejected Rejected by approver at the client. Can be modified or deleted.

(Can be rejected by the system if the cutoff time passed for the

specified Value Date.)

Bank Rejected Rejected by the bank, generally due to insufficient funds, a closed account

or other issues within a Wire or Transfer. Not available for workflow or

deletion.

Deleted Deleted. Not available for workflow or modification.

Sent to Bank Only displays for approx 1 minute as the cut begins but has not completed

processing.

Rejected Rejected by the system, generally for a NACHA import issue. Not available

for workflow, deletion, or modification.

Bank Received Denotes initial acknowledgement that the payment has been received

by the bank. Not eligible for modification or deletion.

Payment Type Date Approved Date/Time Released (a.k.a., Process Date) Date Paid (Value Date)

Domestic Wire Tuesday Process Date Specified, 7 AM Eastern Process Date Specified

(future date)

International Wire Tuesday Process Date Specified, 7 AM Eastern Process Date +

(except MX/CA) 2 business days

International Wire Tuesday Process Date Specified, 7 AM Eastern Process Date +

to Mexico/Canada 1 business day

Book Transfer (same day) Tuesday Immediately Tuesday

Book Transfer (future date) Tuesday Process Date Specified, 7 AM Eastern Process Date Specified

(continued from prior page)

Capital One Intellix

®

Payments Working with ACH Payments and Templates | 15

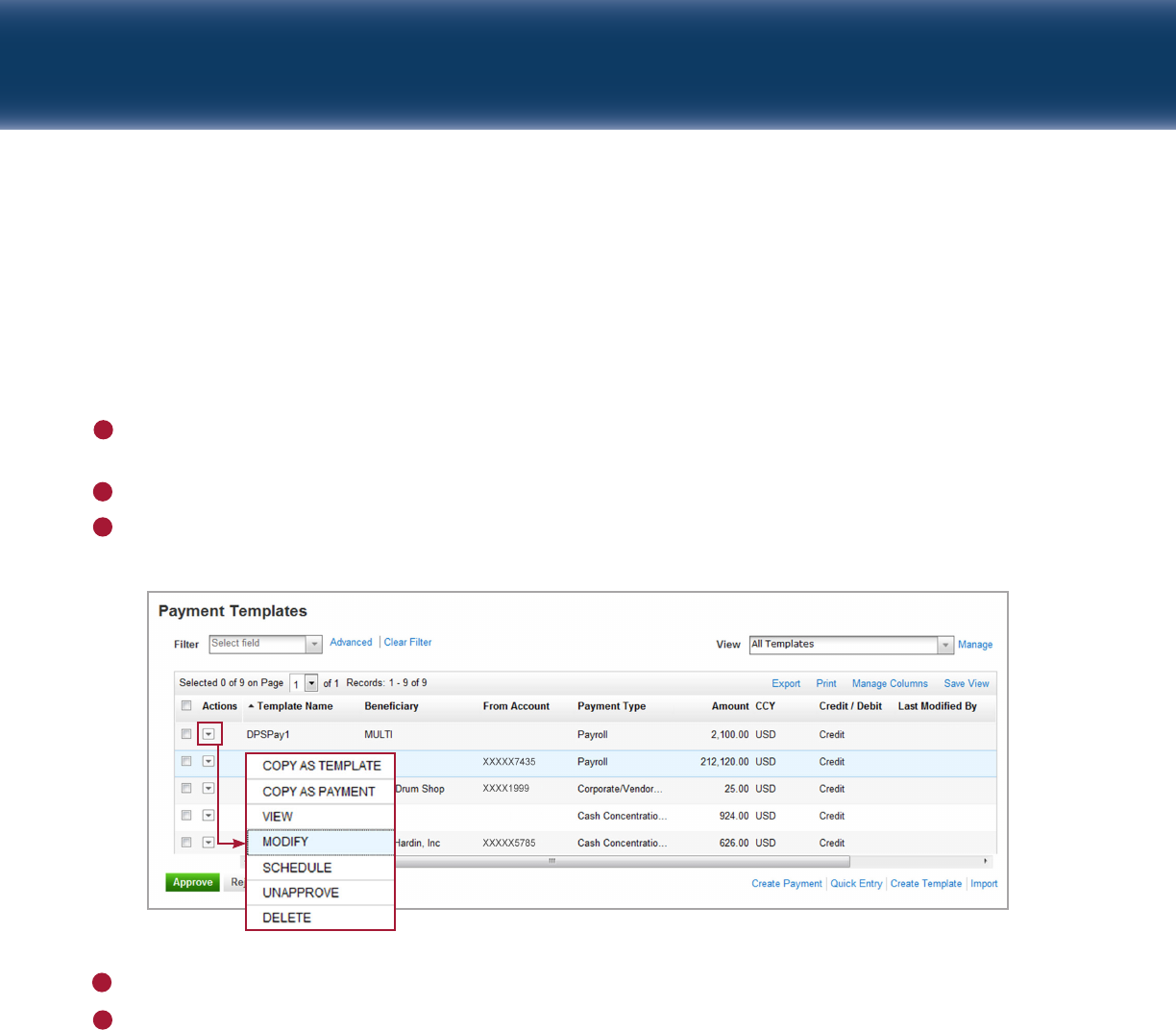

MODIFYING A PAYMENT OR TEMPLATE

Both payments and templates may be modified after entry, for example to change or add beneficiaries,

or to change the amount of a payment. Payments in “Approved” status must be “Unapproved” prior to

modification. Approved templates do not need to be “unapproved” prior to modification.

To modify a payment or template:

From the Services g Payments g Templates menu, select Maintain (to modify a payment, select Payment

Management from the Services g Payments g Manage & Initiate Payments menu).

Locate the item to be modified in the Payment Templates/Payment Management list.

Select the Modify option from the Actions drop-down as shown below, or select the item using the checkbox

and click the Modify button.

1

2

3

Make changes to the template or payment as appropriate.

Click

Submit

(or, if the item is not complete, you can click

Save Draft

to save your existing work).

Depending on your organization’s approval policy, the status of the payment or template will change to a

Modified status or to an Approved status. If the payment or template is in a Modified status, then it needs

to be approved as a second step. Refer to page 21 for more information on Approvals.

4

5

Capital One Intellix

®

Payments Working with ACH Payments and Templates | 16

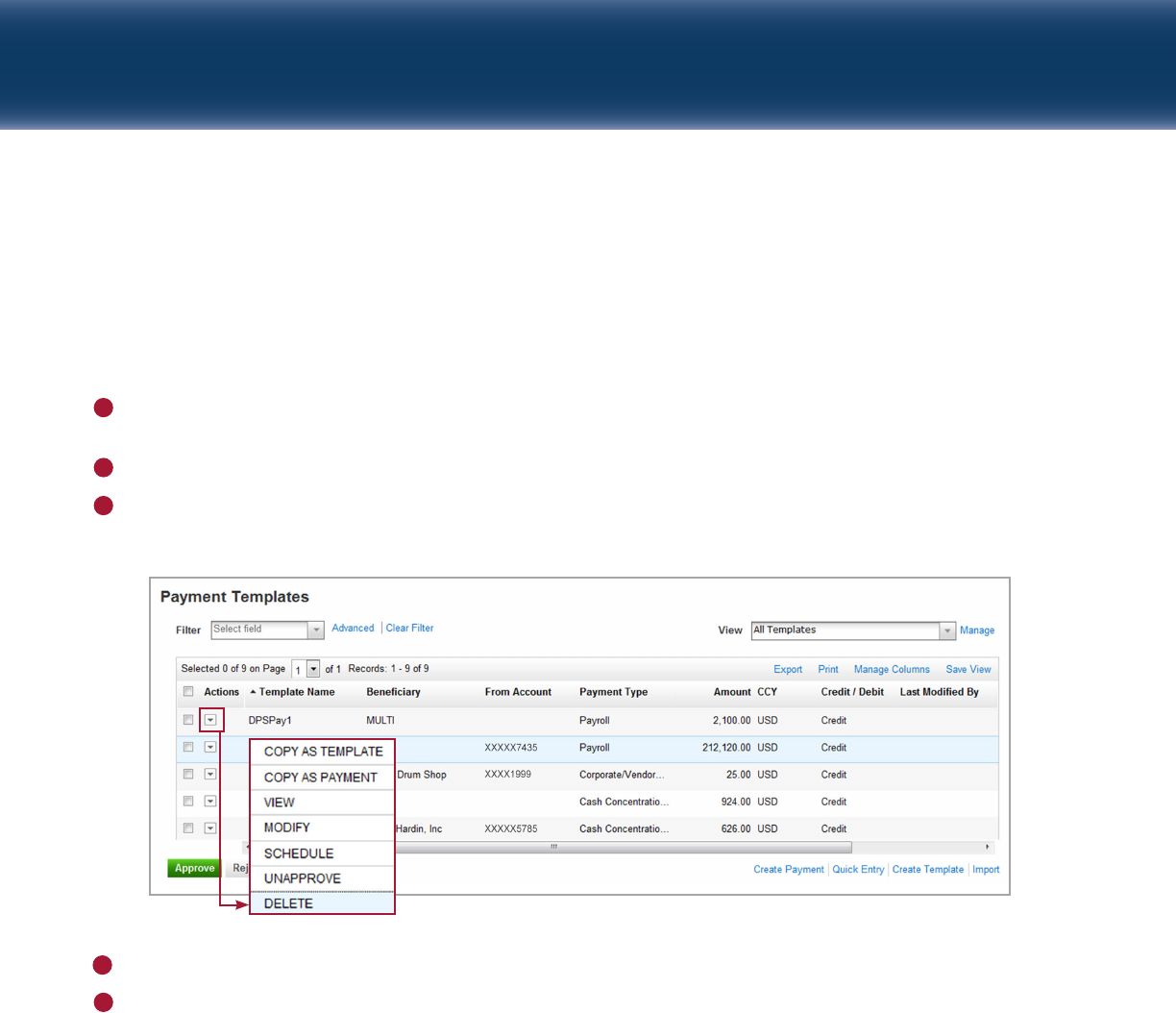

DELETING A PAYMENT OR TEMPLATE

Payments and templates may be deleted if necessary. If a payment has been approved, it must be

“unapproved” prior to deletion. Approved templates do not need to be “unapproved” prior to deletion.

To delete a payment or template:

From the

Services g Payments

menu, navigate to Templates

g

Maintain Templates or Manage & Initiate

Payments

g

Payment Management.

Locate the appropriate item in the list.

Select the

Delete

option from the

Actions

drop-down, as shown below, or select the payment or template

using the checkbox and click the

Delete

button.

The confirmation window displays. Click

Yes

to proceed.

Click the “

X

” to close the window and return to the previous screen.

4

1

2

3

5

Capital One Intellix

®

Payments Working with ACH Payments and Templates | 17

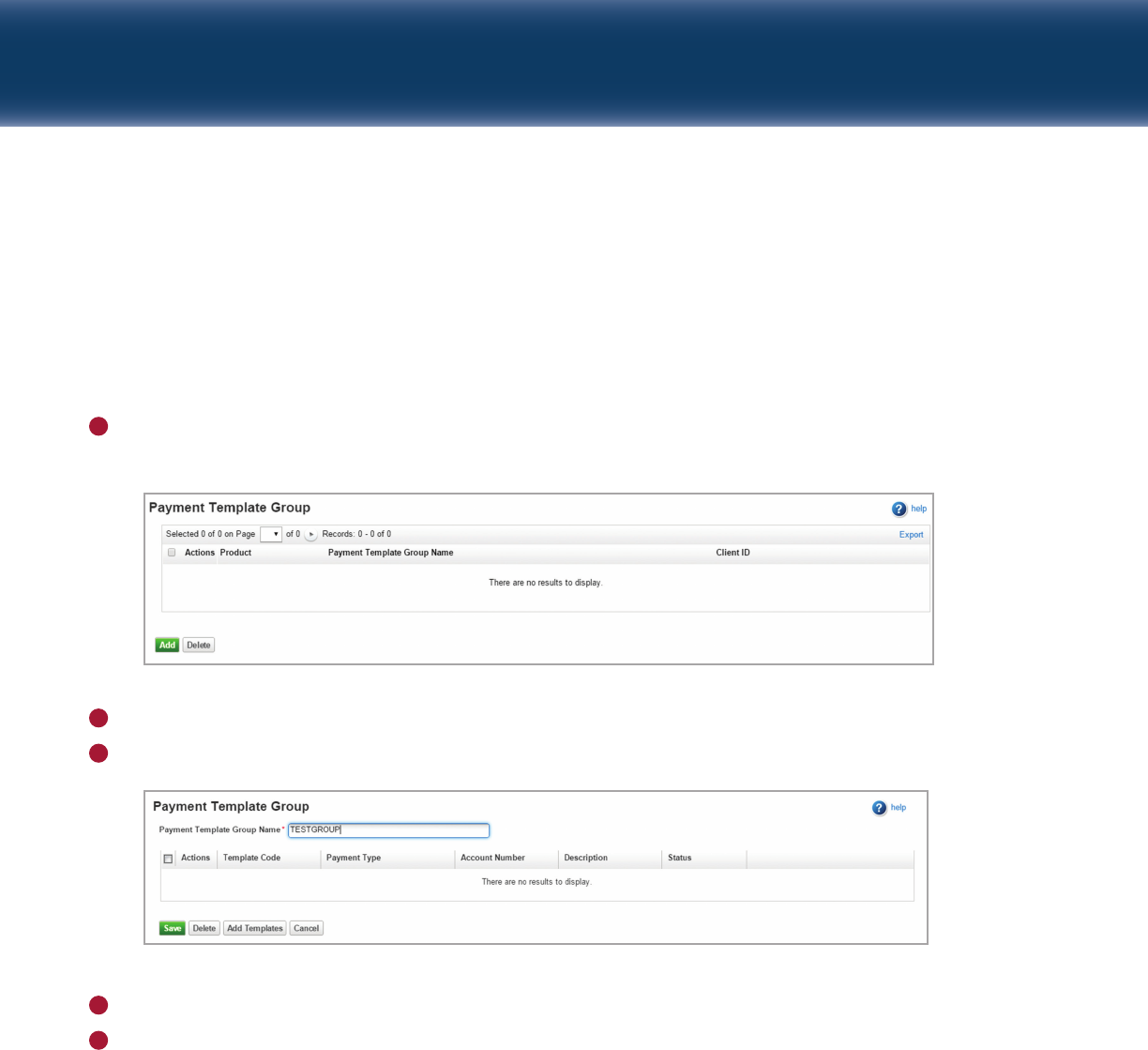

CREATING A PAYMENT TEMPLATE GROUP

A payment template group is a set of one or more templates that can be used to make payments using

Quick Entry. The templates used to create the group must have only one beneficiary each, and the group

may not include templates for tax payments.

To create a payment template group:

Select Template Group from the

Services g Payments g Templates

menu. The system displays the

Payment Template Group screen.

1

Click Add.

Enter a template group name in the Template Name Group field.

2

3

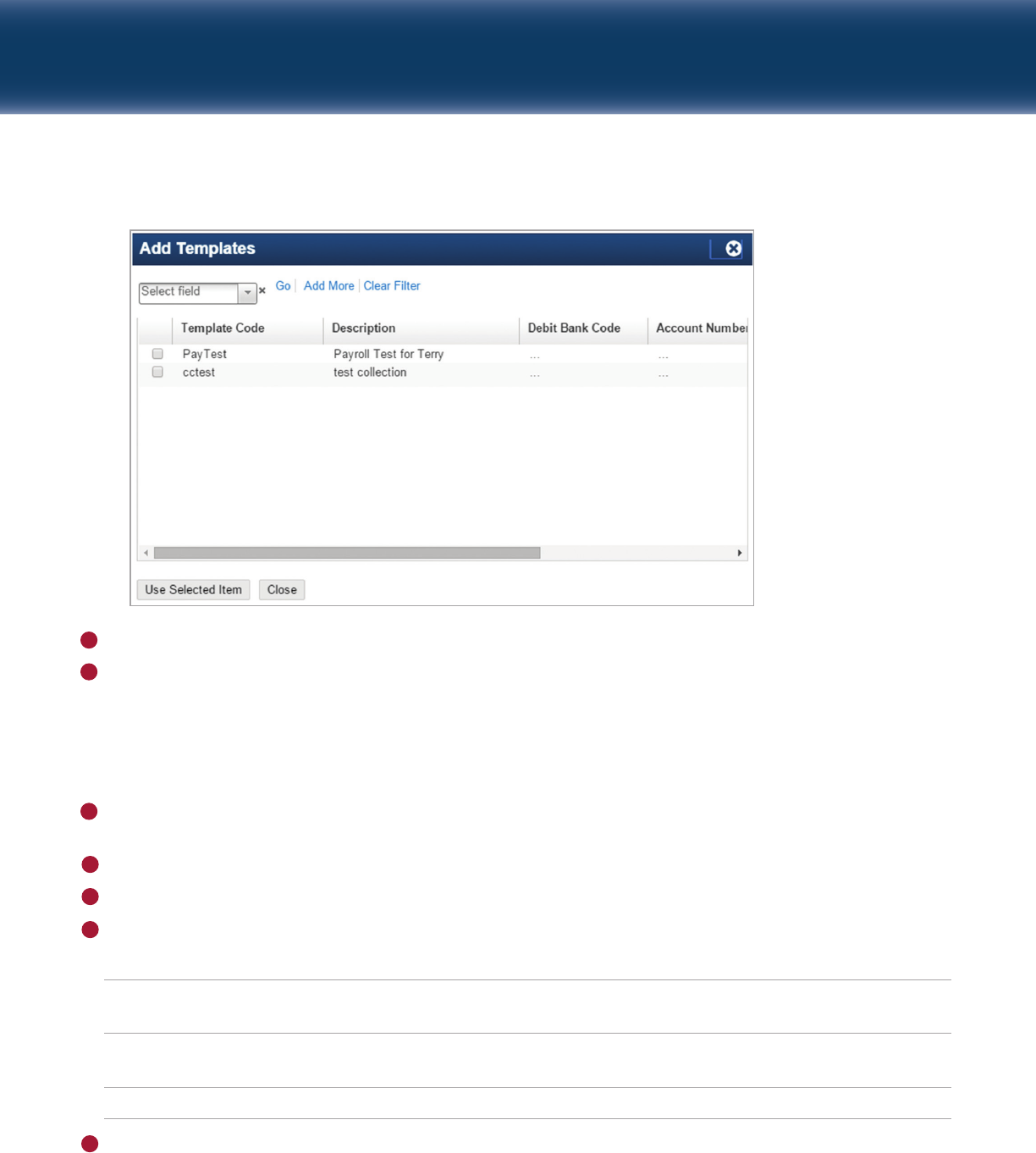

Click Add Templates.

Select the templates to add to the group.

4

5

Capital One Intellix

®

Payments Working with ACH Payments and Templates | 18

MODIFYING A PAYMENT TEMPLATE GROUP

Click Use Selected Item.

Click Save.

6

7

To modify a template group:

Select Template Group from the

Services g Payments g Templates

menu. The system displays the Payment

Template Group screen.

Select a Template Group from the list.

Select a Payment Template from the list.

Perform one of the following actions:

If you want to... Then...

Delete a single template from the group Select a template from the list and select Delete from

the Actions drop-down list.

Delete multiple templates Select the templates fom the list and click Delete at the

bottom of the screen.

Add templates to the group Click Add Templates at the bottom of the screen.

Click Save.

5

1

2

3

4

Capital One Intellix

®

Payments Working with ACH Payments and Templates | 19

USING QUICK ENTRY

Quick Entry

can be used to generate payments from multiple templates; however, each template must have

no more than one beneficiary. The

Quick Entry

link can be accessed from either the Payment Management

or Payment Templates screen. Remember, if your template contains more than one beneficiary, it is not

eligible for

Quick Entry

. When using

Quick Entry

, you can only change the

Value Date

and

Amount

.

To create a payment using

Quick Entry

:

From the

Services g Payments g Manage & Initiate Payments

menu, select

Quick Entry

.

1

3 Complete the information on the screen:

A. Select the template or template group you wish to use (remember, only templates with ONE

beneficiary will be displayed in the search window).

B. Select the Value Date.

C. Edit the amount, if desired.

D. Add additional templates by clicking the Add Entry link, or payment template group by clicking the

Add Payment Template Group link.

2

Capital One Intellix

®

Payments Working with ACH Payments and Templates | 20

Click

Submit Entries

.

Upon submission, the payment will be validated and you will see a confirmation or error pop-up on your

screen. Click the

Manage Payments

button to exit and return to the Payment Management screen, click

Create Another Payment

button if you wish to create another new transaction, or click the

Print Details

button to print a report of this payment.

What happens when you click Submit depends on your organization’s setup and the permissions of the

individual submitting the item.

See page 15 for a detailed explanation of the approval process.

3

Capital One Intellix

®

Payments Approving Payments and Templates | 21

Approving Payments and Templates

For organizations with a Dual Approval policy, when a payment or template is created or modified, it must

be approved as a second step by someone with appropriate approval permissions. And, some organizations

require that the approval be done by someone other than the creator of the payment or template. Until the

payment or template is approved, it will remain in Entered or Modified status.

NOTE: Some organizations have a Single Approval policy. In this case, when a payment or template is

created or modified by someone with appropriate approval permissions, it will be approved at the same

time.

APPROVING A PAYMENT OR A TEMPLATE

Alerts

may be created by the approver (or by an administrator on his/her behalf) to notify them that new

payments or templates are awaiting approval. Approvers can also use the

Payments Requiring Approval

view

within the

Payment Management

or

Payment Templates

lists to filter for these items. See Working With

Lists

g

Managing Views to learn how to use Views.

Approvers should review each transaction for accuracy and completeness before approval.

To approve a pending payment or template:

Access the

Payment Management

or

Payment Templates

list from the

Services g Payments

menu.

A. For Payments, access the list through Services

g

Payments

g

Manage & Initiate Payments

g

Payment

Management.

B. For Templates, access the list through Services

g

Payments

g

Templates

g

Maintain Templates.

1

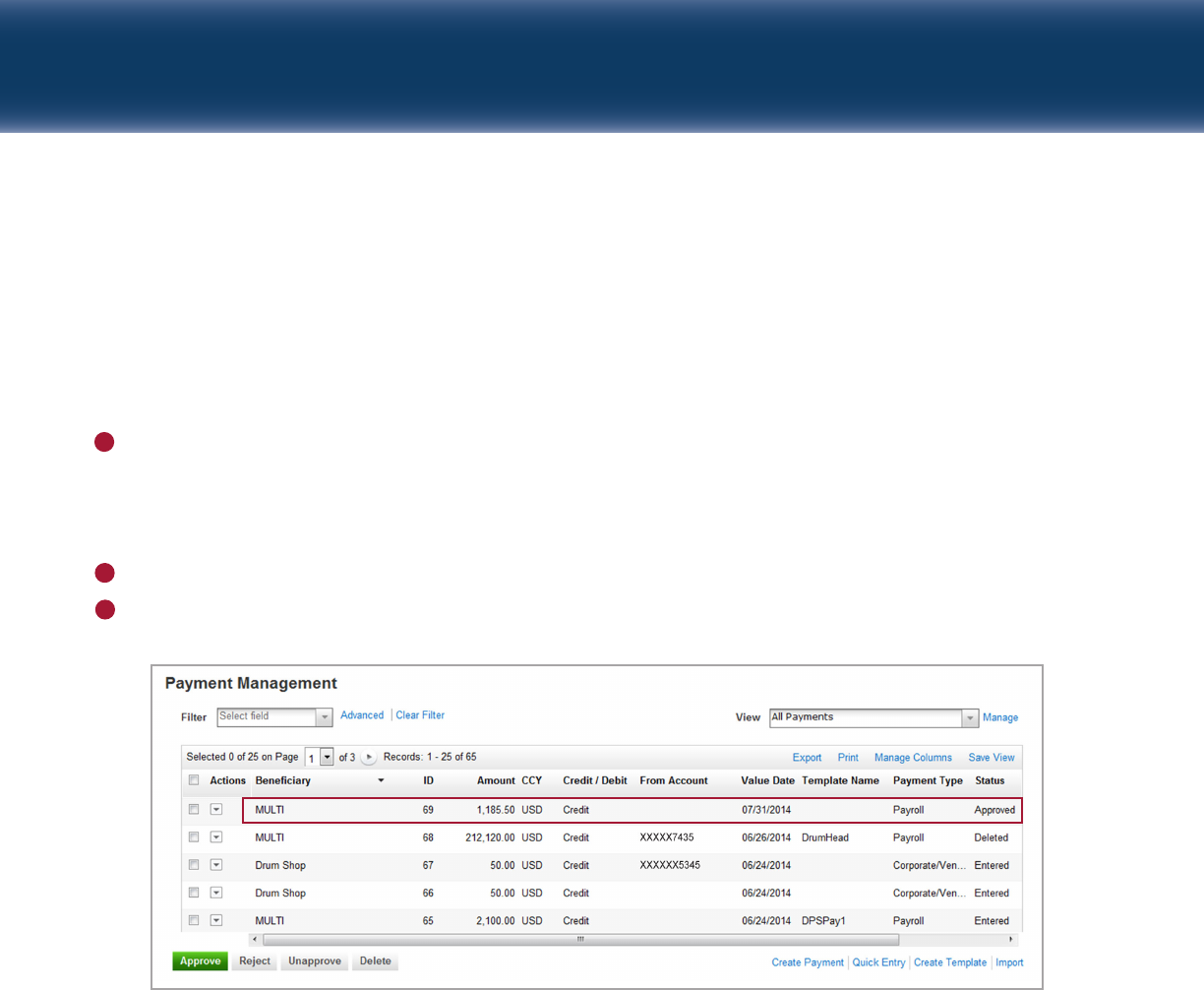

A pop-up window will display if the approval was successful. Click the “

X

” to close the window and

return to the

Payment Management

or

Payment Templates

screen.

The status will change to

Approved

. Payments will automatically be released and templates will now be

available for use.

Capital One Intellix

®

Payments Approving Payments and Templates | 22

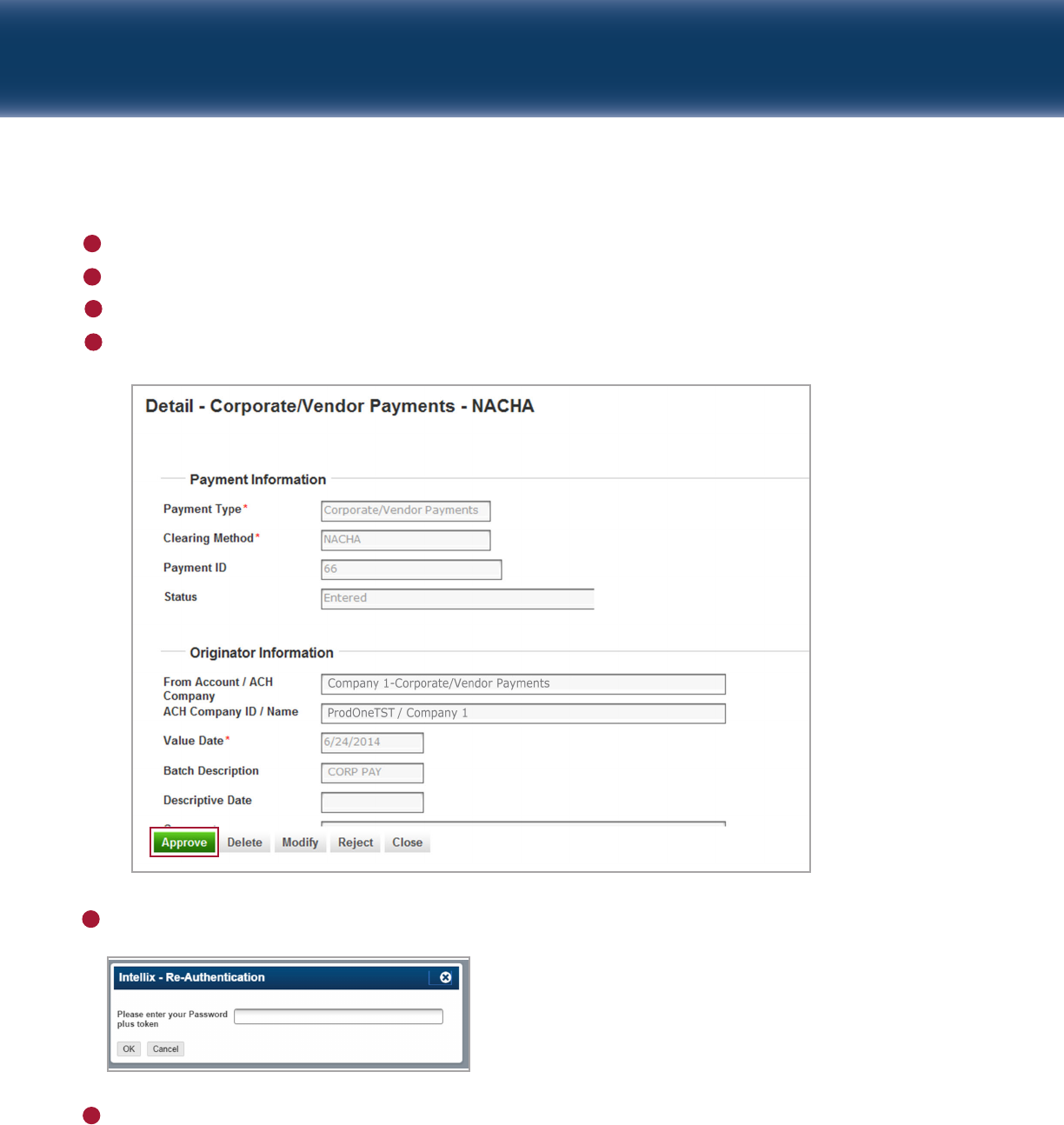

Locate the payment or template in the list.

Click on the item to open it.

Review the item for accuracy and completeness.

If the item is acceptable, click the

Approve

button at the bottom of the screen.

2

3

4

5

If prompted, enter your Password and Tokencode to complete the approval.

6

7

Capital One Intellix

®

Payments Approving Payments and Templates | 23

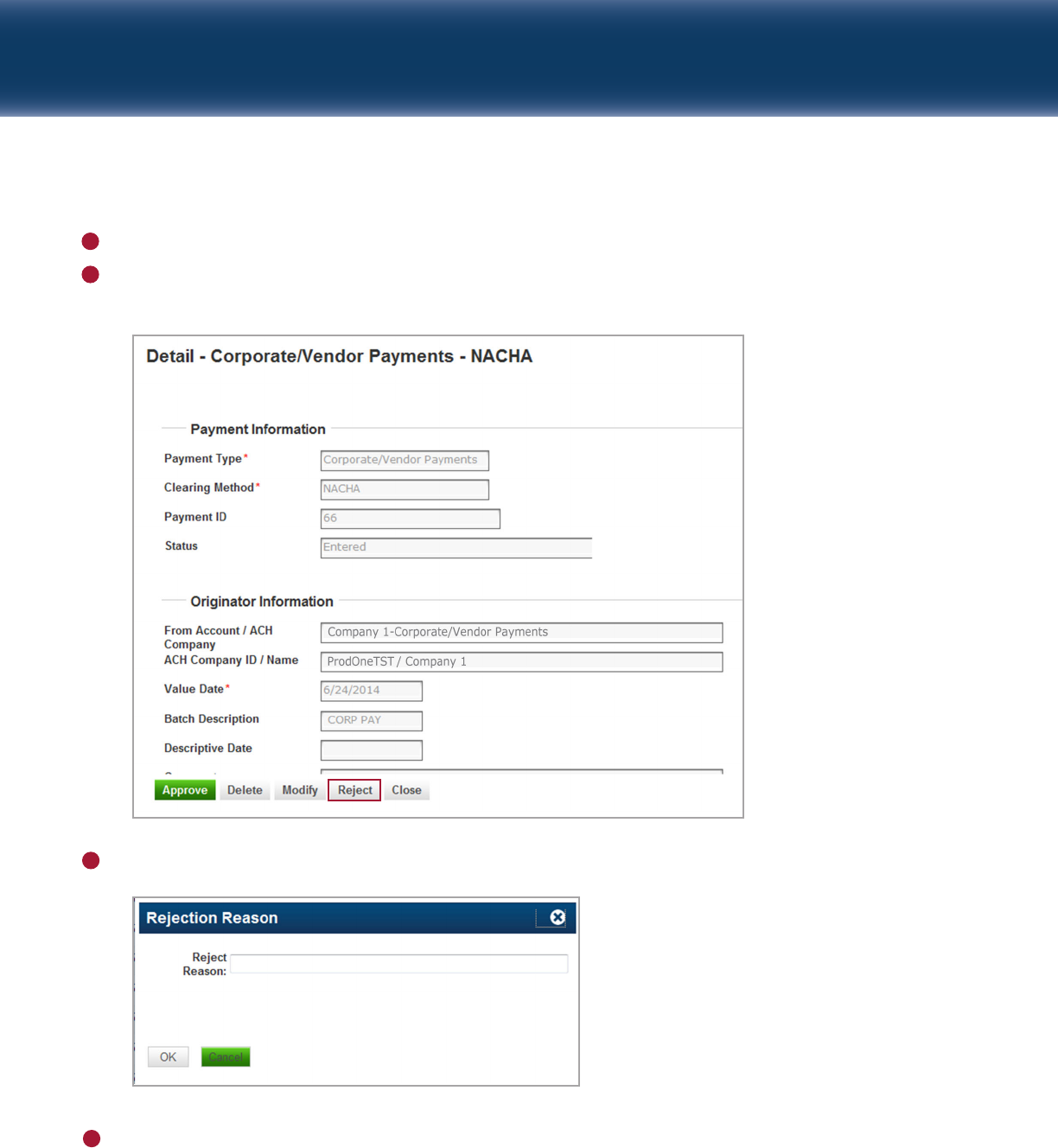

REJECTING A PAYMENT OR TEMPLATE

If a payment or template contains an error, an

Approver

can reject it so that it can be corrected. If the

approver rejects a payment or template, it will change to an

Approver Rejected

status.

NOTE:

For those that

create payments and templates, an

Approver Rejected Alert

is available. See

Alert Settings

for detail.

To reject a pending payment or template:

Access the

Payment Management

or

Payment Templates

list from the

Services g Payments

menu.

A. For Payments, access the list through Services

g

Payments

g

Manage & Initiate Payments

g

Payment

Management.

B. For Templates, access the list through Services

g

Payments

g

Templates

g

Maintain Templates.

Locate the payment or template in the list.

Click on the payment or template record to open the item.

1

2

3

Capital One Intellix

®

Payments Approving Payments and Templates | 24

Review the item for accuracy and completeness.

If the item is incomplete or contains errors, click the

Reject

button at the bottom of the screen. The

Rejection Reason

window displays.

4

5

Enter a

Rejection Reason

.

6

Click

OK

. The status will change to

Approver Rejected

and the payment will be held.

7

Capital One Intellix

®

Payments Approving Payments and Templates | 25

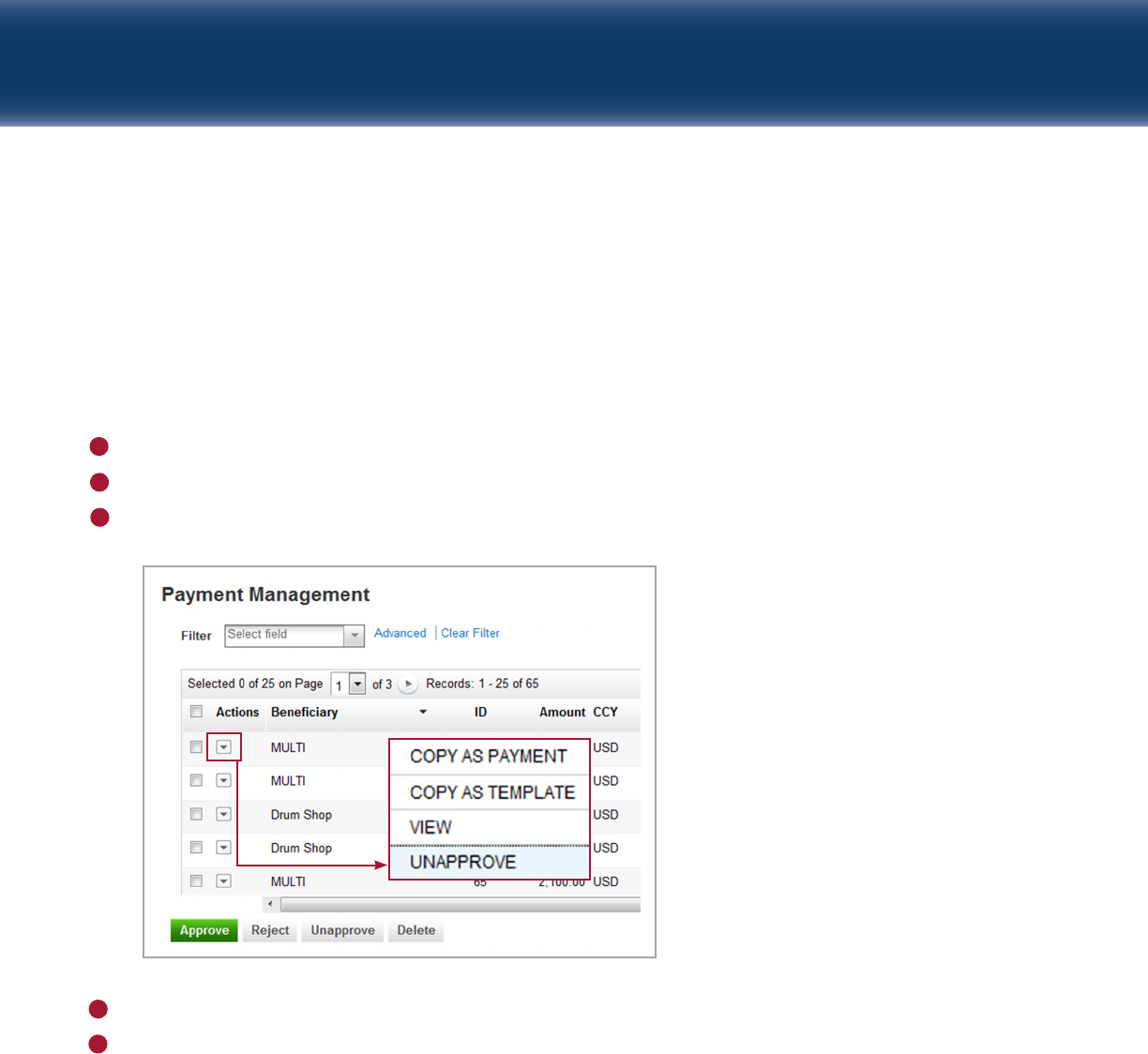

UNAPPROVING AN APPROVED PAYMENT

Approved payments may not be altered. In order to modify or delete an approved payment, it must first be

“unapproved.” An authorized approver must perform this task. Once the payment has been released to the

bank, it can no longer be unapproved. If you are unable to unapprove a payment, it has already been

released to the bank for processing.

To unapprove a payment:

Access the

Payment Management

list from the

Services g Payments

g

Manage & Initiate Payments menu.

Locate the payment.

Select the

Unapprove

option from the

Actions

drop-down, as shown below.

1

2

3

Click the “

X

” to close the window and return to the Payment Management screen.

Modify

or

Delete

the item as necessary. See

Modifying a Payment

or

Deleting a Payment

for detailed

instructions.

4

5

Capital One Intellix

®

Payments Approving Payments and Templates | 26

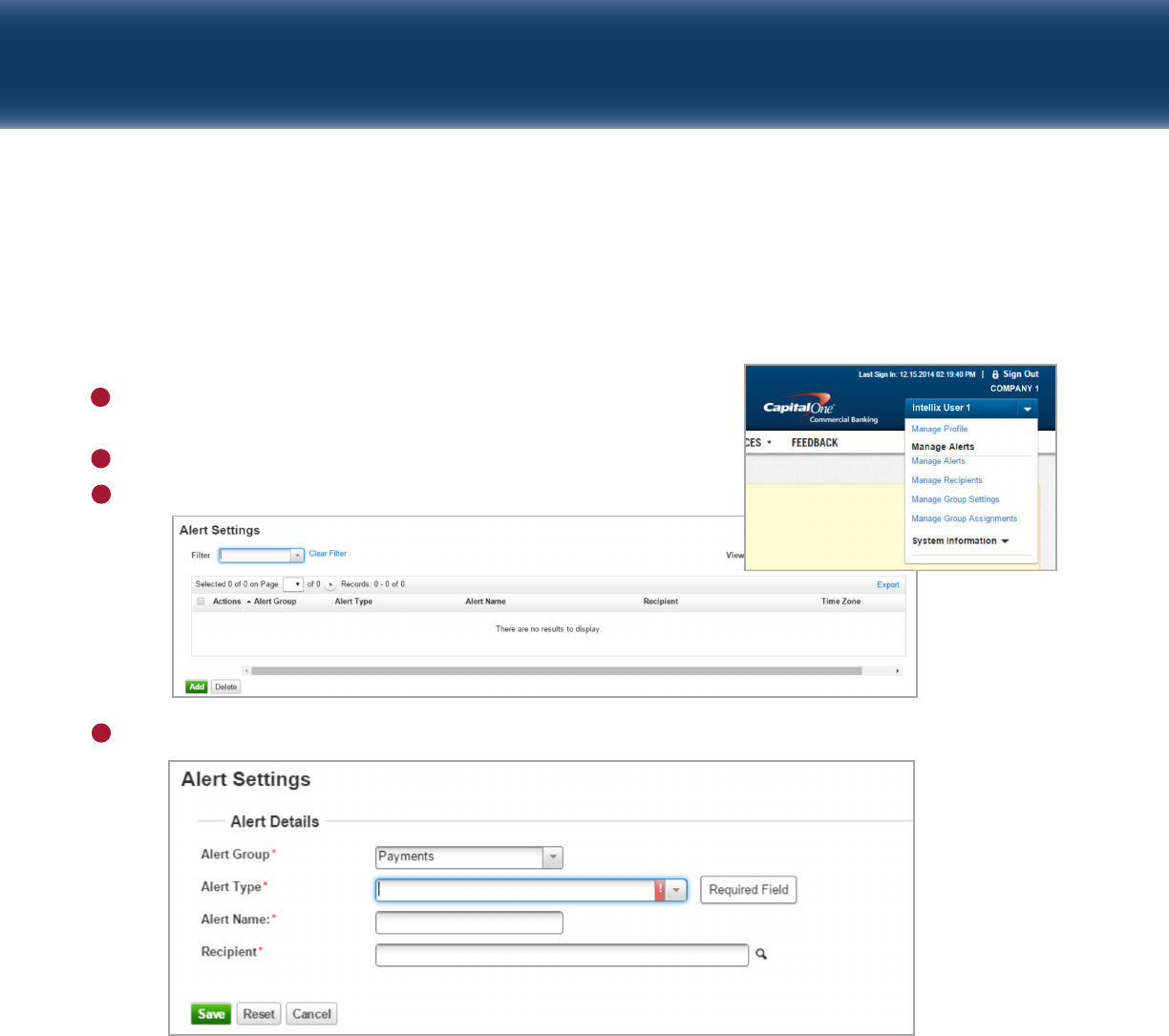

ALERT SETTINGS

Based on your permissions, you may have the ability to set alerts to notify yourself when a payment

is rejected, or if a payment is ready for approval. Alerts are created using the profile menu in the upper

right-hand corner of the Intellix screen. To create an alert:

Click on the drop-down menu next to your name. Most users

will only see the Manage Profile and Manage Alerts links.

Select Manage Alerts.

Click Add.

Complete the following Alert Details:

• Alert Group: Select Payments or Information Reporting (see below).

• Alert Type (select one of the following):

A. Approver Rejected Payments: This type of alert sends you an email if a payment you submitted was

rejected in the approval process. This allows you to quickly fix any problems that caused the

payment to be rejected.

B. Payment(s) Automatically Generated: This type of alert sends you an email when a payment has been

automatically generated by the system, such as a scheduled payment.

C. Payments Awaiting Approval: This type of alert sends you an email when a payment has been

submitted for a type of payment for which you are responsible for approval.

D. Payments Rejected Today: This alert sends an email when a payment is rejected during the current

business day. This alert is only applicable to Wire and Book Transfers.

1

2

3

4

E. Payments Needing Rate: This type of alert sends an email to the individual authorized to apply an

exchange rate to an International Wire Transfer. This person will be required to get and approve the

rate by close of business in order to release the transfer.

F. Payment Processed: This type of alert sends an email when a Wire Transfer or Book Transfer is

processed by the bank. Individual settings allow for alerts when the bank receives, confirms, or

rejects the payment.

NOTE: If you wish to set up an alert for Wire Transfers and other payments received to your accounts,

you can utilize the Transaction Notification alert, found under the Information Reporting Alert Group.

For Wire Transfers, specify transaction type 195 on the alert setup page.

• Alert Name: Create a name for this alert.

• Recipient: Enter or select your email address. If you are an administrator you may enter or select any

email address or group in the organization.

Click Save.

5

Capital One Intellix

®

Payments Approving Payments and Templates | 27

Capital One Intellix

®

Payments Reports | 28

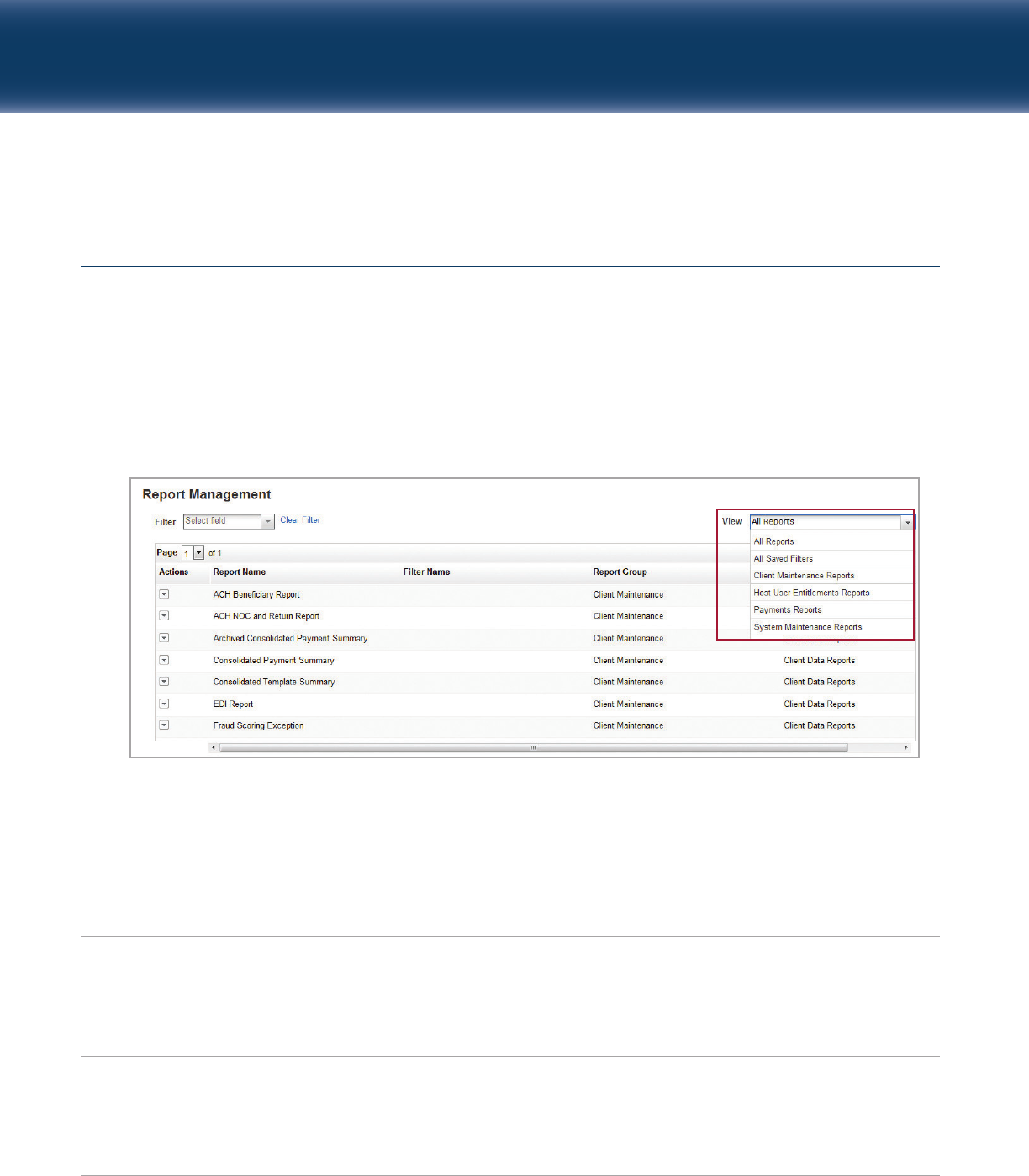

Payment Reports

VIEWING A REPORT

From the

Services g Payments

menu, select

Reports

. The Report Management window will appear, listing

all payment reports to which you have access. Click on a report to display, or click the

Actions

drop-down

and select

View

.

You can also filter reports using the

View

menu.

REPORT DEFINITIONS

The table below defines the standard payment reports available within Intellix Payments. Your access to

different reports is based on your organization’s entitlements and your permissions. As a result, you may

not have access to some of the reports outlined in this section.

Report Name Description

ACH Beneficiary Report

Details the beneficiary information for incoming bulk payments. It is

generally used by nursing homes for payments received from government

agencies. E.g., for lump-sum incoming payment, this report will provide

detail on the breakdown of payments for each beneficiary so the funds

can be applied correctly.

ACH EDI Agenda Report

Displays transaction and remittance detail on incoming ACH Credits/

Deposits to a client’s account. This report helps reconcile deposits to

invoices issued as it includes remittance detail sent through the ACH

network. Remittance detail can include numerous invoice numbers,

pricing discount amounts, product codes, customer codes and more.

Capital One Intellix

®

Payments Reports | 29

Report Name Description

ACH Return and Notice of

Displays returned ACH items when the account could not be debited/

Change (NOC) Report

credited or when incorrect account information identified with the

recipient’s account. This report includes the originating transaction

information, as well as the corrected information (if known) and the

return/change reason code. ACH return reasons include insufficient

funds, account closed, unable to locate account, account frozen and

more. ACH Notice of Change reasons include incorrect account number,

routing number, receiving company name and transaction type code.

ACH Company Information The ACH Company Information report displays bank-maintained ACH

company information and the payment types entitled to each ACH

company.

Users will only see ACH company information to which they have access.

Report data includes payment types, child support agencies and tax

authorities.

ACH Company The ACH Company report displays a list of all ACH companies that are in

the system.

ACH Payment Audit Trail The ACH Payment Audit Trail report lists all ACH payment and batches

with transaction details as well as any auditing information associated

with the batch or transaction.

Users will only see payment batches to which they have access.

ACH Payment Detail The ACH Payment Detail report lists all payment batches and their

transactions in detail.

Users will only see payment batches to which they have access. An

archived version of this report also exists.

ACH Template Detail This report lists all templates and their detail transactions.

Users will only see templates to which they have access.

ACH File Import Status The ACH File Import Status report lists all files imported to create

payment batches and notes the import status of each transaction. It is

specific to the File Import action available from within the Payments and

Template List View and applies to full file imports.

Users will only see payment batches to which they have access.

ACH Payment Detail Export The ACH Payment Detail Export report lists all payment batches in a

fixed-width padded format. The report can be exported to multiple

columns in Excel where each field will be broken into a cell. The header

is also exportable to Excel.

Users will only see payment batches to which they have access. An

archived version of this report also exists.

ACH Payment Detail Import The ACH Payment Detail Import Status report lists all detail imports into

payment batches and notes the import status of each transaction.

Capital One Intellix

®

Payments Reports | 30

Report Name Description

ACH Payment Summary Totals The ACH Payment Summary Totals report lists all payment batches in

summary format with a drill down to the payment detail.

Users will only see payment batches to which they have access. An

archived version of this report also exists.

ACH Template Audit Trail The Template Audit Trail report displays a list of templates and their

detail transactions.

ACH Template Detail Export Lists all templates in a fixed-width padded format. This report can be

exported to multiple columns in Excel where each field will be broken

into a cell. The header is also exportable to Excel.

Users will only see templates to which they have access.

ACH Template Detail Import The ACH Template Detail Import Status report lists all detail imports into

payment batches and success, failure, and rejects per transaction.

Users will only see templates to which they have access.

ACH Template Summary Totals The ACH Template Summary Totals report displays all templates in

summary format with a drill down to the template detail.

Users will only see templates to which they have access.

Wires/Transfers Payment Lists all Wire and Transfer payments with transaction details and auditing

Audit Trail information.

Archived Consolidated Archive of all payments (ACH, Wires and Transfers) over 90 days old in

Payment Summary summary format with a drill down to detail.

Beneficiary Import Summary Lists all beneficiaries imported into the Beneficiary Address Book in

summary format with a drill down to detail.

Consolidated Payment Summary Lists all payments (ACH, Wires and Transfers) in summary format with a

drill down to detail.

File Import Summary Summary list of all files imported into Intellix.

Wires/Transfers Payment Data – Lists all payments in a fixed-width padded format. This report can be

Export Format exported to multiple columns in Excel where each field will be broken

into a cell. The header is also exportable to Excel.

Wires/Transfers Archived Archive of all payments over 90 days old in summary format with a drill

Payment Summary down to the payment detail.

Wires/Transfers Future-Dated Lists all Wire and Transfer payments with future value dates

Payments

Wires/Transfers Payment Detail Lists all Wire and Transfer payments in detail.

Wires/Transfers Payment Lists all Wire and Transfer payments in summary format with a drill down

Summary to the payment detail.

Report Name Description

Wires/Transfers Payments Lists all payments awaiting approval.

Pending Approval

Consolidated Template Lists all templates (ACH, Wires and Transfers) in summary format with a

Summary drill down to detail.

Wires/Transfers Template Detail Lists all Wire and Transfer templates in detail.

Wires/Transfers Template Lists all Wire/Transfer templates in summary format with a drill down to

Summary detail.

Exchange Rates Displays the indicative rates for the current day.

Capital One Intellix

®

Payments Reports | 31

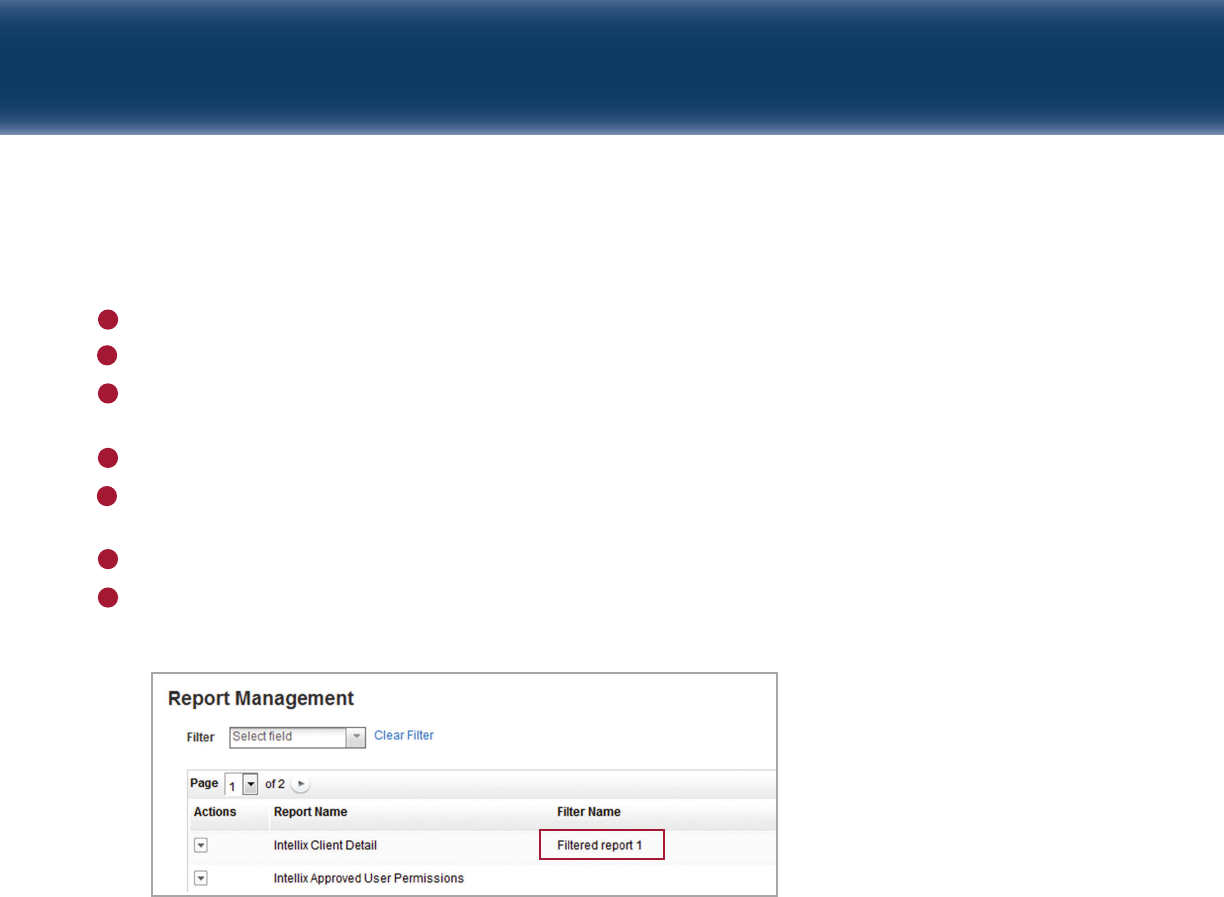

FILTERING A REPORT

Some reports support filtering to return a custom report. Filters may be saved so that the custom report can

be run on demand with a single click.

To create a report filter:

From

Services g Payments g Reports & Other Utilities

menu, select Payment

Reports

.

Click the

Actions

drop-down next to the report you wish to filter, and click

Filter

.

1

2

Select the appropriate filter options and click

View Results

. The filtered report will display.

Optionally, you can select the filter options and click

Save Filter

. You will be prompted to name and save

the filtered report.

3

4

Capital One Intellix

®

Payments Reports | 32

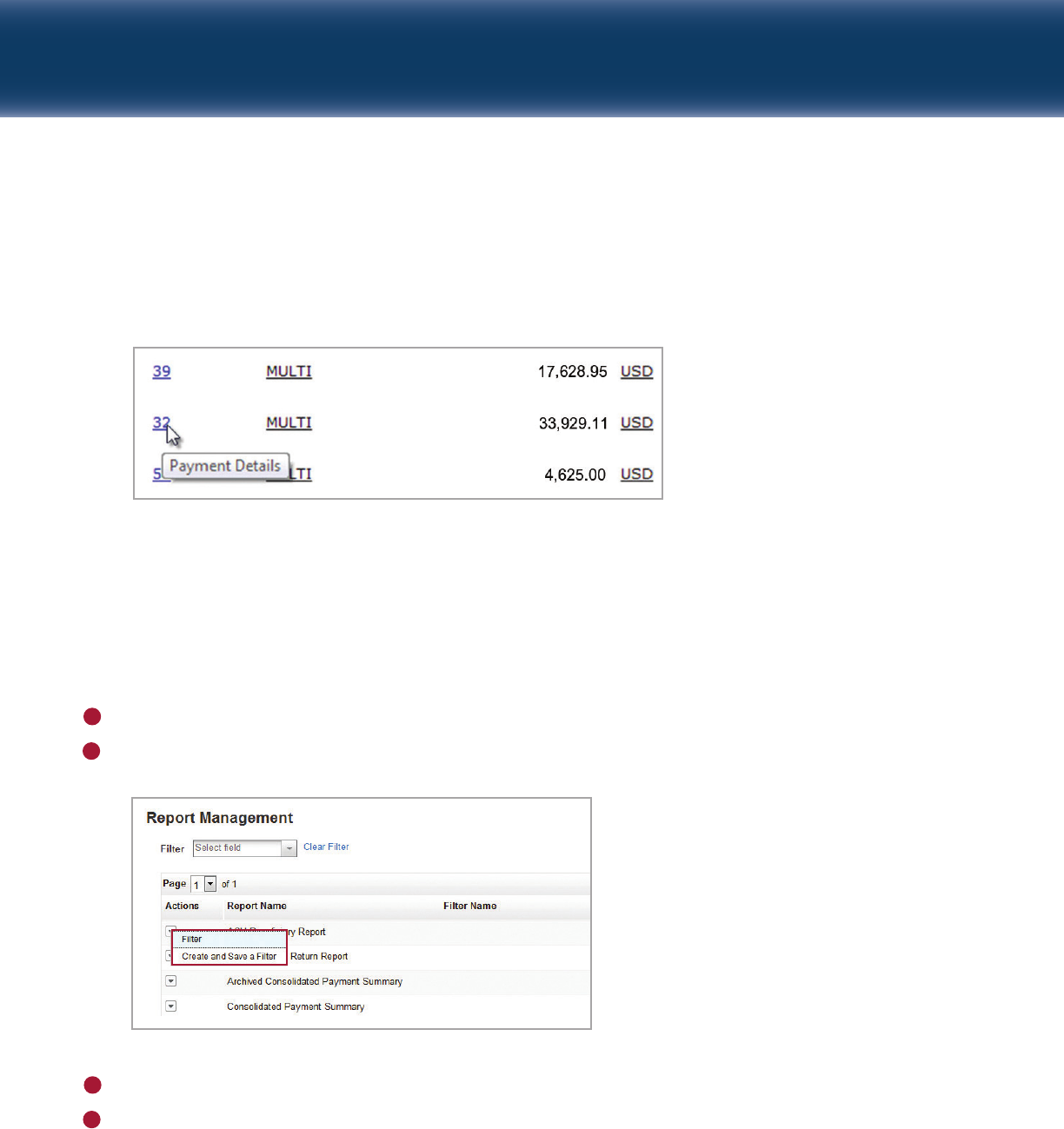

VIEWING ADDITIONAL DETAIL WITHIN A REPORT

Where available, you will be able to view additional detail within a report. Click the hyperlink next to the

record in the report to view detail.

Capital One Intellix

®

Payments Reports | 33

To save a report filter:

From

Services g Payments g Reports & Other Utilities

menu, select

Payment Reports

.

Click the

Actions

drop-down next to the report you wish to filter, and click

Create and Save a Filter

.

Enter a name and description for your filtered report. This is how the filtered report will be represented

in the Report Management list.

Select

Sort

options if desired.

Click the

Shared

checkbox if you wish to make this filtered report available to everyone with access to the

underlying report. Otherwise this filtered report will only be visible to you.

Select the appropriate filter options and click

Save

. A confirmation window displays.

Click

View Report

to view the filtered report. Otherwise click the

“X”

to return to the Report Management

list. The filtered report displays.

1

2

3

4

5

6

7

Capital One Intellix

®

Payments Reports | 34

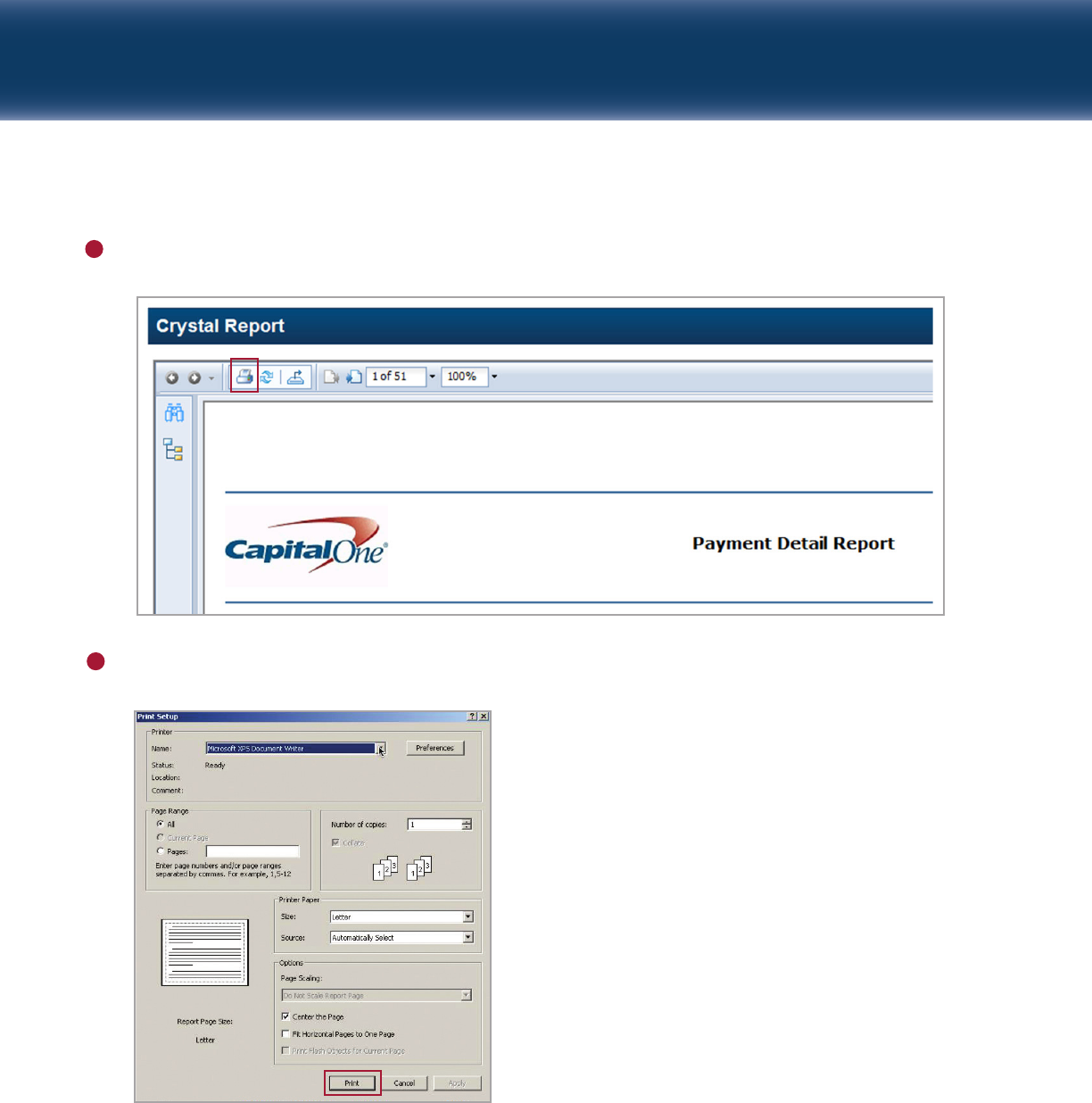

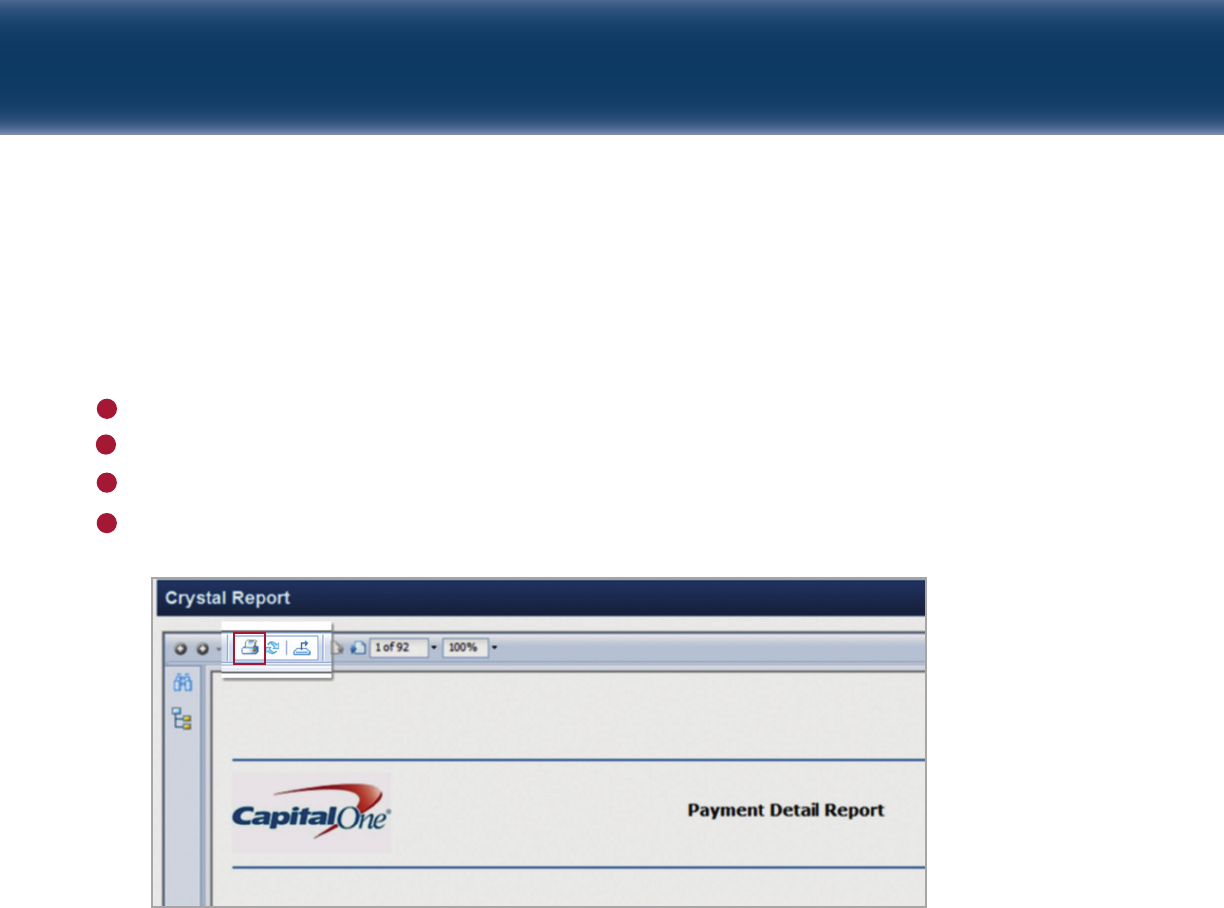

PRINTING A REPORT

This process varies based on the browser being used. In this guide we will define the process for using

Internet Explorer. For other browsers, please visit Resources

g

eLearning and reference the eLearning

modules related to this process.

Open the

Report

.

Click the

Print

button.

Select the page range you wish to print, and change any print settings as necessary.

Click

Print

.

1

2

3

4

Capital One Intellix

®

Payments Reports | 35

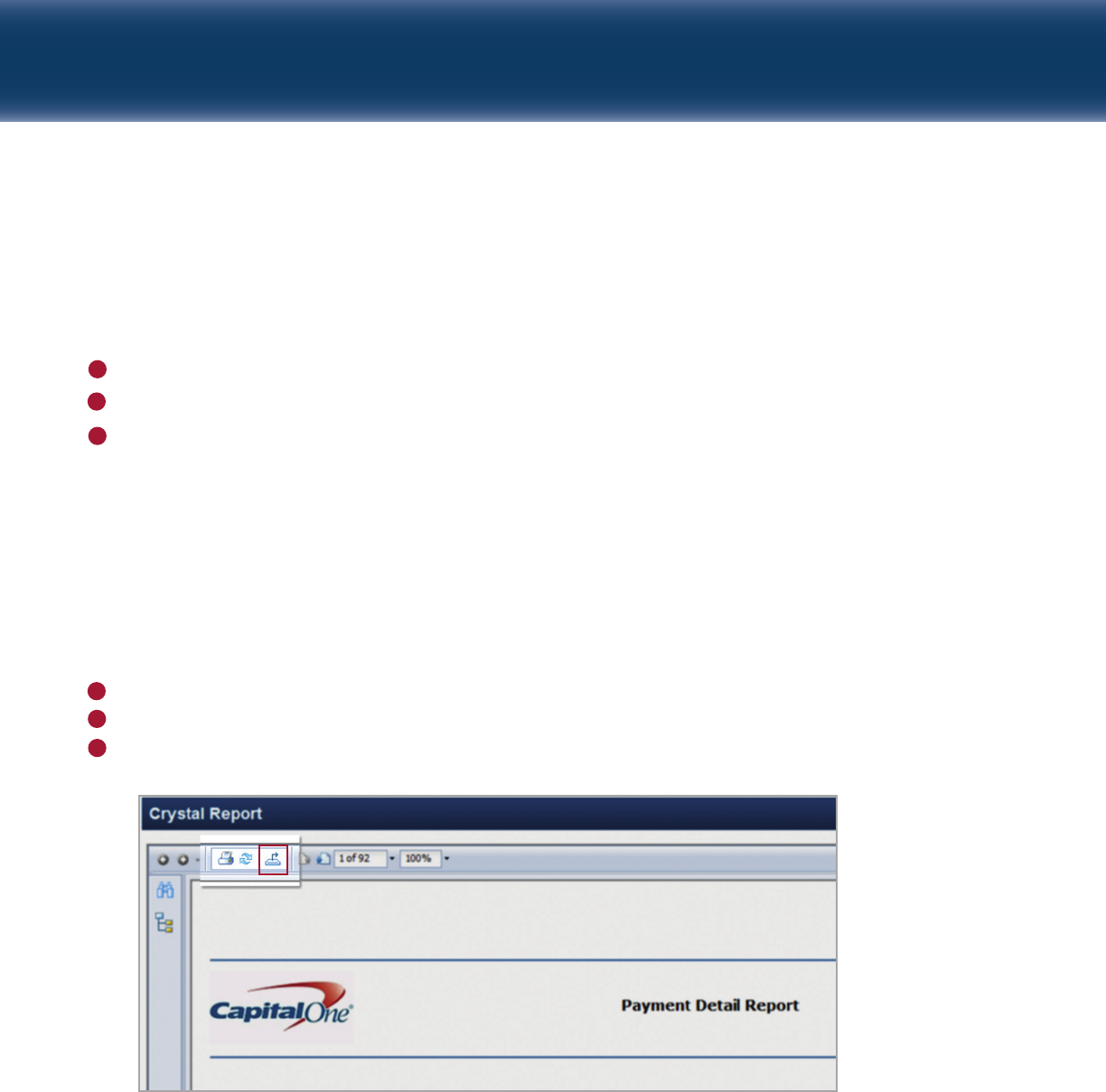

EXPORTING A REPORT

This process varies based on the browser being used. In this guide we will define the process for using

Internet Explorer. For other browsers, please visit Resources

g

eLearning and reference the eLearning

modules related to this process.

Open the

Report

.

Click the

Export

button.

Select the file format for the exported data:

• PDF: Exports data to Portable Document Format, which can be viewed with a PDF application such

as Adobe Reader.

• Microsoft Excel: Exports data into .xls format easily read by Excel version 97-2003 and above.

• Microsoft Excel – Data only: Exports data into Excel unformatted.

• Rich Text Format (RTF): Exports data and retains any formatting.

• Separated Values (CSV): Exports data in common, plain-text format where field values are separated

by a comma or other single character.

• XML: Exports data in Extensible Markup Language.

Select the range of pages desired.

Click

Export

.

When prompted, click the appropriate button to open or save the file.

1

2

3

4

5

6

6.26.17